Insider Wallets Cash in $20M on Solana’s Focai Memecoin Launch

The recent launch of Focai (FOCAI), a memecoin on Solana’s Pump.fun platform, has sparked controversy after 15 suspected insider wallets turned a modest $14,600 investment into over $20 million, raising critical questions about transparency and fairness in the crypto market.

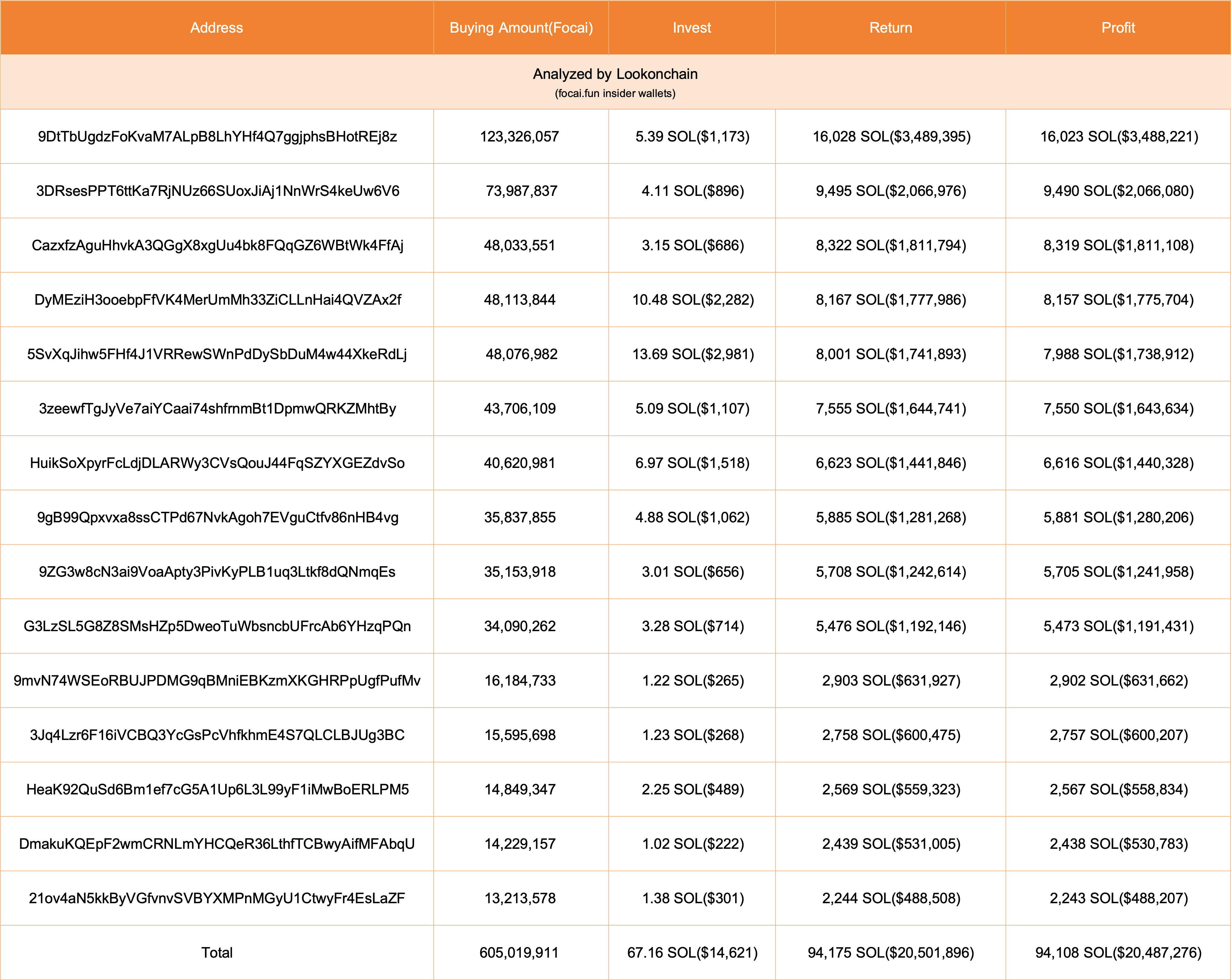

A $20 Million Profit: The Breakdown

Blockchain analytics firm Lookonchain reported that these insider wallets collectively acquired 60.5% of FOCAI’s total token supply before cashing out. Their trades resulted in a staggering 136,000-fold return on their initial investment. The wallets sold their FOCAI holdings for 94,175 SOL (approximately $20.5 million), solidifying their outsized gains.

One wallet, identified as “9DtTb,” emerged as the biggest winner, purchasing 123.32 million FOCAI tokens for just 5.39 SOL ($1,168). Within three hours, the wallet sold its entire holdings for 16,070 SOL ($3.47 million), realizing a jaw-dropping 2,973x profit.

Criticism Over Centralized Token Holdings

The concentration of over 60% of FOCAI’s supply in just 15 wallets has drawn sharp criticism from blockchain analysts. Such practices undermine decentralization, a foundational principle of cryptocurrency, and highlight the risks posed by uneven token distributions.

FOCAI’s Market Performance

FOCAI’s market capitalization peaked at $46 million before dropping by nearly 14% to $39.6 million, according to Pump.fun data. While the memecoin’s rise attracted significant attention, it also underscores the volatility and speculative nature of these assets.

The Harsh Reality of Memecoin Trading

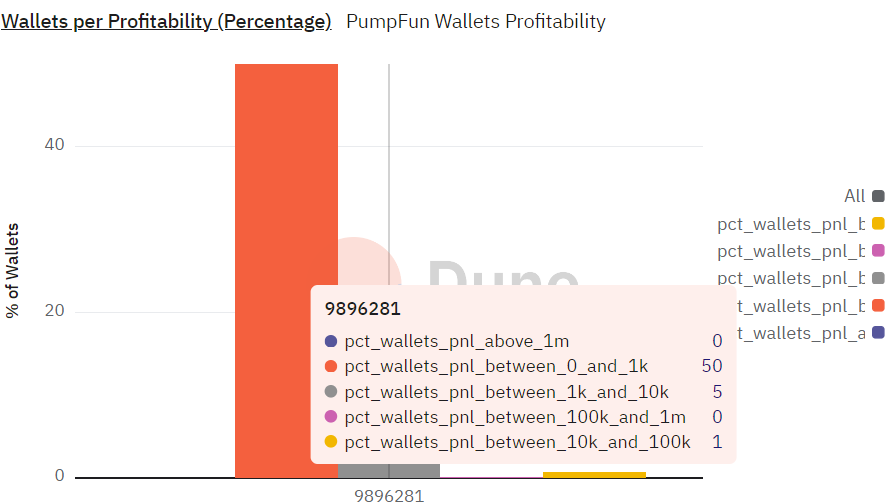

While memecoins like FOCAI have delivered astronomical returns for a select few, most traders face losses. Data from Pump.fun reveals that over 99% of traders on the platform are unprofitable:

- Out of 9.8 million wallets, only 50 wallets generated up to $1,000 in profits.

- A mere five wallets achieved profits between $1,000 and $10,000, and only one wallet exceeded $10,000.

A Growing Concern for Fairness in Crypto

This incident reflects the broader challenges in the crypto ecosystem, where insider trading and uneven token distribution can disproportionately benefit a small group at the expense of the majority. As memecoins continue to attract speculative interest, it remains critical to prioritize fairness, transparency, and decentralization.

Conclusion

The Focai incident is a reminder of the potential risks in memecoin trading and the need for stronger safeguards to ensure equitable participation. For traders, navigating this high-risk, high-reward landscape requires vigilance and an understanding of the inherent market dynamics.

Share This