How to Send Money Abroad Using Cryptocurrency

In today’s interconnected world, cryptocurrency offers a transformative way to send money overseas. With faster transactions, lower costs, and enhanced security, crypto is revolutionizing how people transfer money to family and friends abroad. Here’s a deep dive into the process and its benefits.

Key Advantages of Crypto for International Transfers

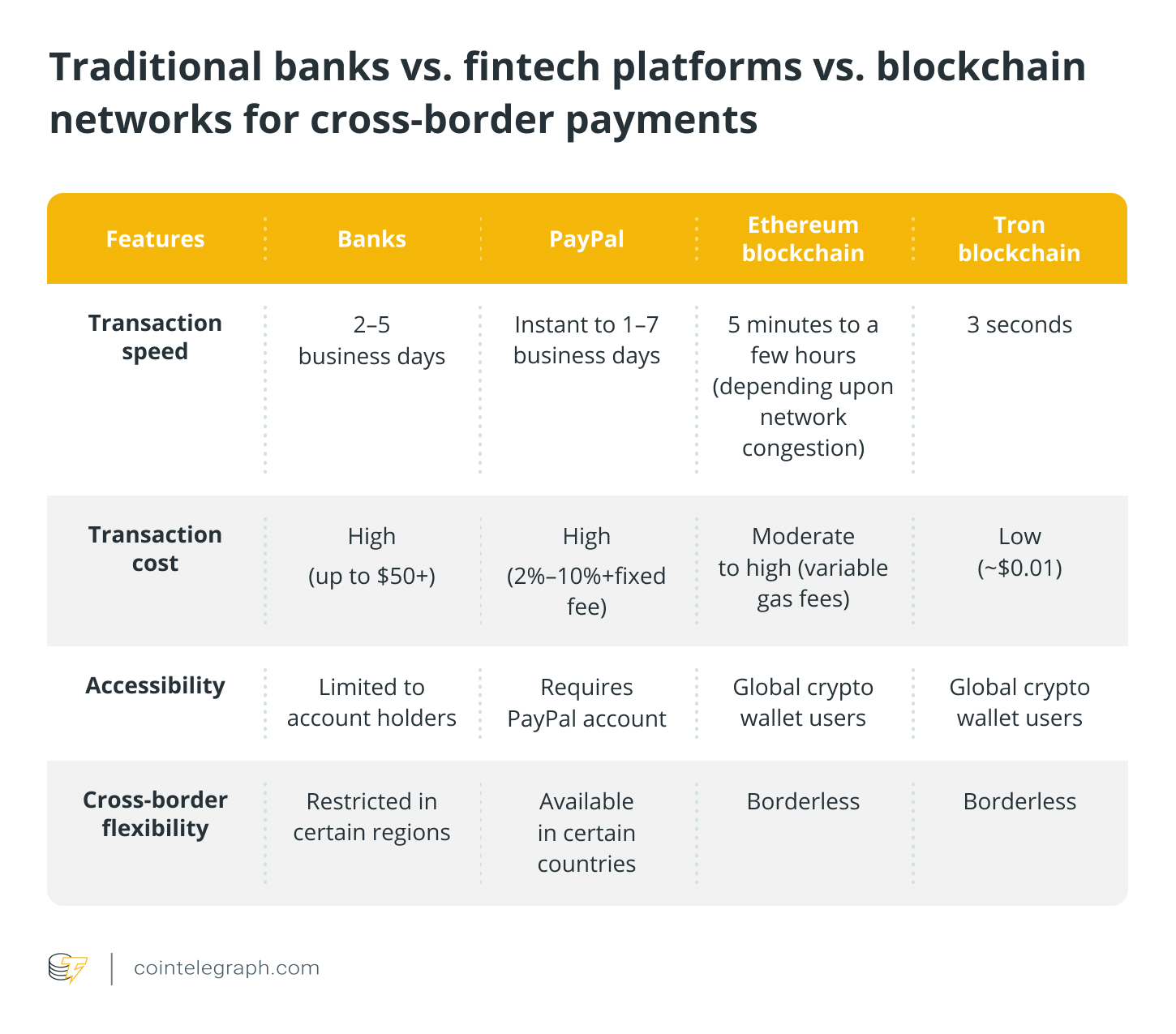

Lower Costs: Cryptocurrencies bypass traditional bank fees, which can range from 2%–4% of the transfer amount. Transactions cost just a fraction of this.

Speed: Transfers are near-instant, with some blockchains processing transactions in seconds, compared to days with traditional banking systems.

Accessibility: Crypto offers a lifeline in regions with limited banking infrastructure or during crises like economic instability or conflicts.

No Intermediaries: Blockchain technology eliminates the need for banks, ensuring seamless transfers even on holidays.

How to Send Money Using Cryptocurrency

Step 1: Set Up a Crypto Wallet

Choose a secure wallet—either custodial for ease of use or non-custodial for full control over your funds. Enable two-factor authentication (2FA) for added security.

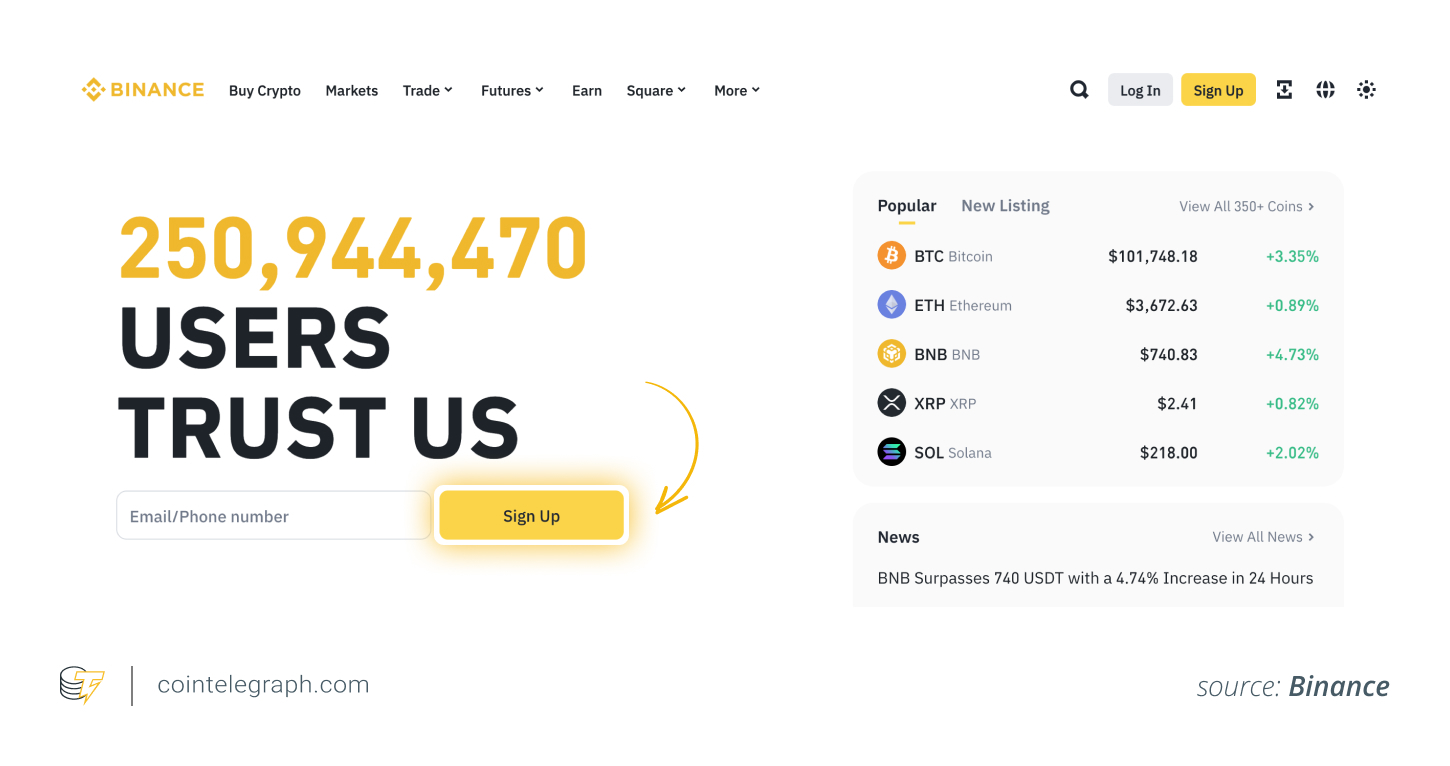

Step 2: Purchase Cryptocurrency

Use a reputable exchange like Binance or Coinbase to convert fiat into cryptocurrency. Consider stablecoins like USDt for minimizing volatility.

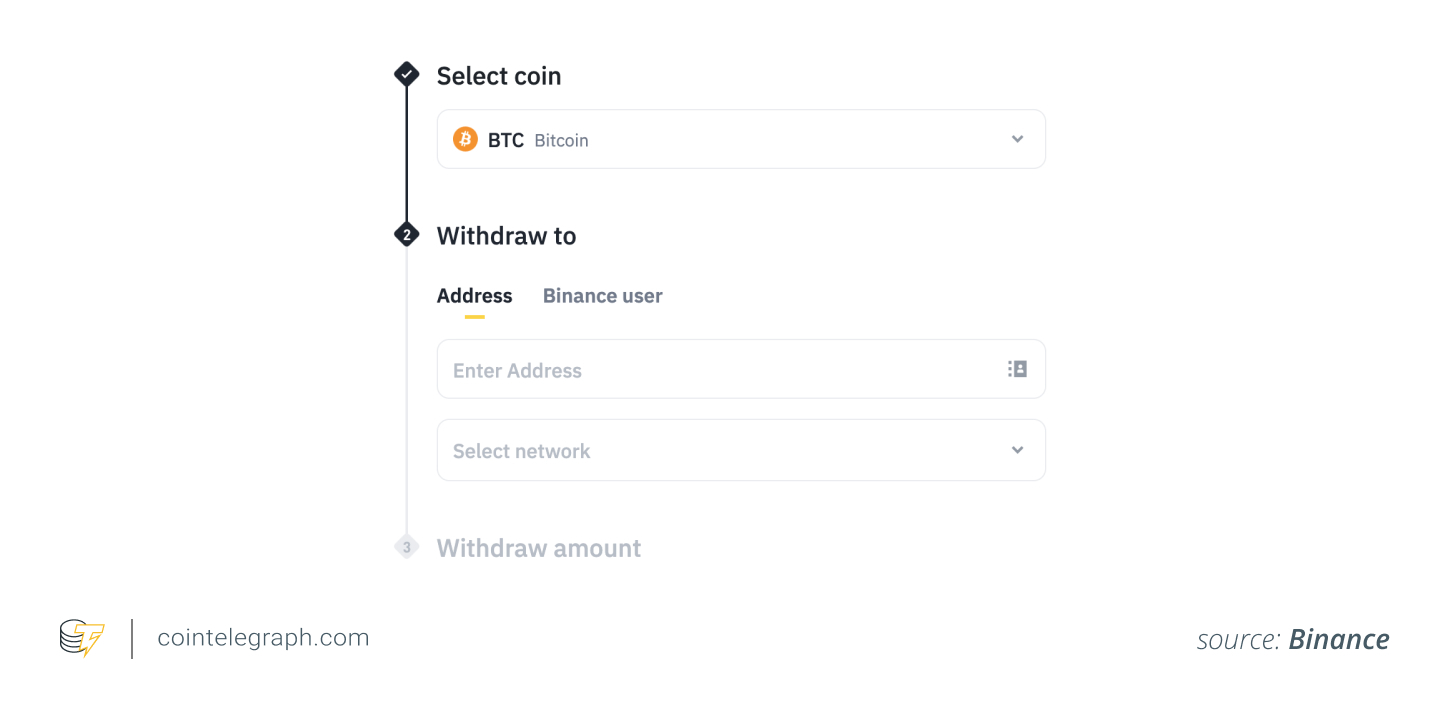

Step 3: Obtain Recipient’s Wallet Address

Confirm the recipient’s wallet address to avoid irreversible errors. QR codes can simplify the process.

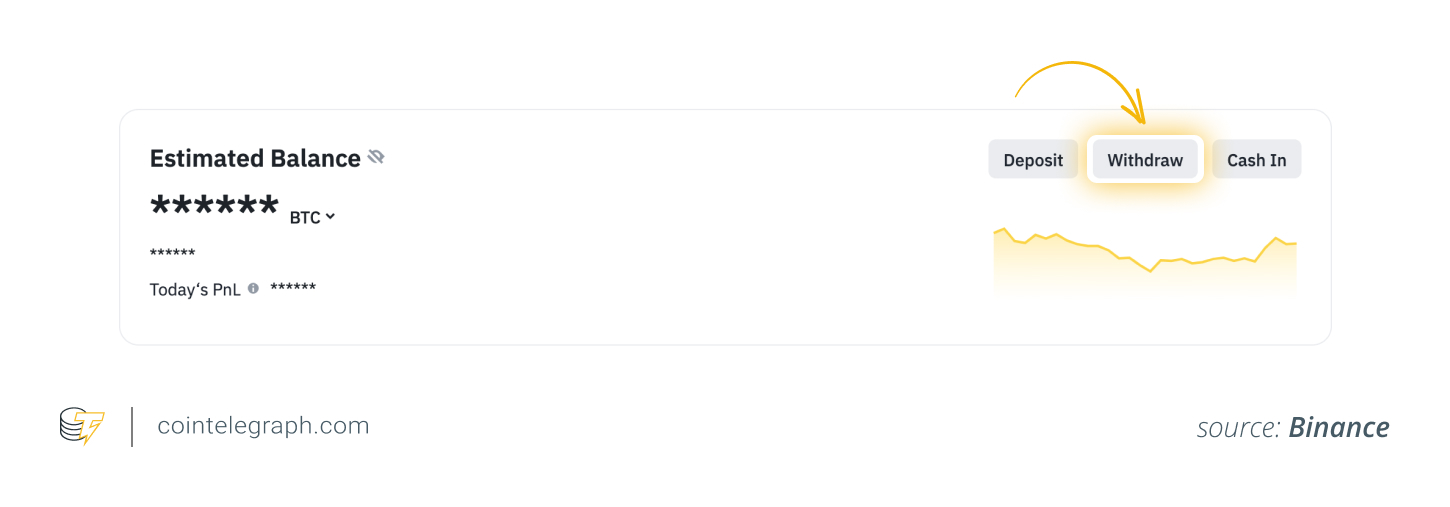

Step 4: Complete the Transaction

Enter the recipient’s wallet address, the amount, and pay the network fee. Opt for higher fees if you need faster processing.

Step 5: Notify the Recipient

Share the transaction details and ID with the recipient for easy tracking.

Platforms for Crypto Transfers

Crypto Exchanges: Platforms like Binance and Coinbase allow easy buying, selling, and transferring of crypto.

Peer-to-Peer (P2P) Platforms: Decentralized systems like Binance P2P facilitate direct transactions.

Mobile Apps: Apps like Strike and Cash App streamline crypto remittances with user-friendly interfaces.

Real-World Use Cases

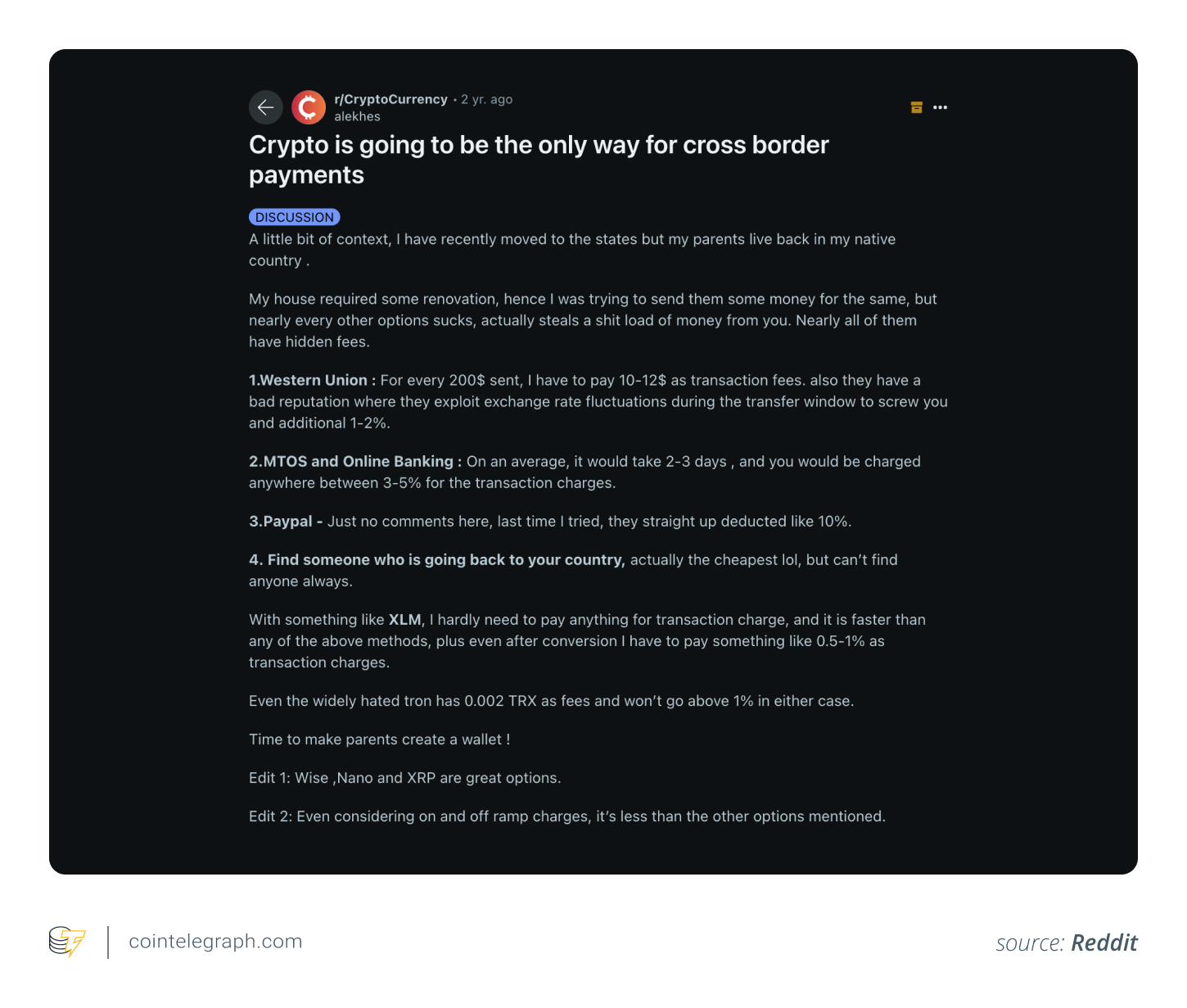

Overcoming High Fees

A Reddit user highlighted how they saved significantly using crypto to send money abroad. Traditional methods like Western Union charged up to 10% in fees, while crypto transfers cost less than a penny and were processed in seconds.

Emergencies and Crises

In conflict zones like Ukraine, cryptocurrencies have become vital for receiving emergency funds when banking systems fail.

Avoiding Exchange Rate Losses

Cryptocurrencies eliminate the need for currency conversion, saving time and protecting against unfavorable exchange rates.

Benefits of Using Cryptocurrency for Remittances

Cost-Effective: Minimal transaction fees compared to traditional methods.

Fast Processing: Transactions complete in minutes, even during high network activity.

Global Access: No need for bank accounts or physical infrastructure.

Transparency and Security: Blockchain ensures tamper-proof records of all transactions.

Tips for Secure and Efficient Transfers

Double-Check Wallet Addresses: Avoid irreversible errors by verifying the recipient’s address.

Use Reputable Platforms: Stick to trusted platforms like Binance for safe transactions.

Understand Fees: Different blockchains charge varying fees; choose one that balances cost and speed.

Enable Security Features: Use strong passwords and 2FA to secure your account.

Overcoming Challenges

Network Delays: Prioritize transactions by paying higher fees during peak activity.

Volatility: Use stablecoins like USDt to avoid fluctuating values.

Regulatory Compliance: Stay informed about local regulations to ensure seamless transfers.

Are Crypto Transfers Taxable?

Tax implications vary by country:

United States: Crypto is taxed as property, and gains may incur capital gains tax.

United Kingdom: Transactions above the annual exemption limit are taxable.

Japan: Gains are classified as miscellaneous income.

Singapore and UAE: No personal income tax, making these crypto-friendly nations.

Always maintain detailed records and consult tax professionals to stay compliant.

Conclusion

Cryptocurrency is reshaping cross-border remittances with unparalleled speed, lower costs, and global accessibility. Whether you’re sending funds to loved ones, managing emergencies, or navigating limited financial systems, crypto offers a compelling alternative to traditional methods. With proper precautions and knowledge, it’s a secure and efficient way to connect financially across borders.

Share This