MicroStrategy’s Bitcoin Debt Strategy: Visionary Genius or Risky Gamble?

Michael Saylor, co-founder of MicroStrategy, continues to make waves with an aggressive Bitcoin acquisition strategy that has polarized observers. While critics label it reckless, supporters hail it as a bold and visionary move that could reshape corporate finance.

As the largest corporate Bitcoin holder globally, with 447,470 BTC in its arsenal, MicroStrategy’s approach has far-reaching implications—not only for its own financial health but for the Bitcoin ecosystem at large.

The Bitcoin Debt Loop

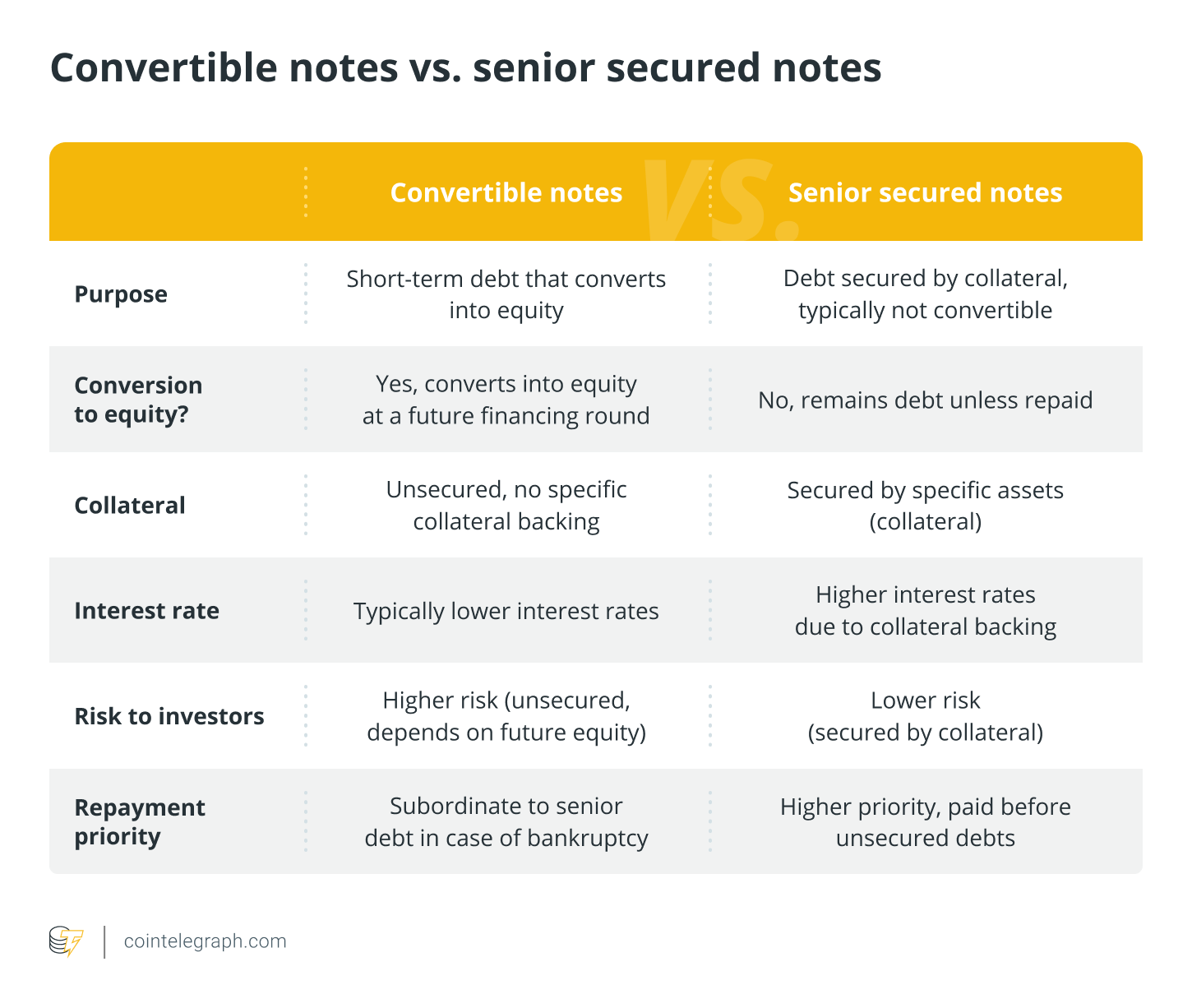

MicroStrategy’s journey into Bitcoin began in August 2020, with an initial purchase of $250 million worth of BTC using corporate cash. Since then, the company has turned to debt issuance to fund further acquisitions, leveraging instruments like convertible notes and senior secured notes.

- Convertible Notes: These low-interest debt instruments, convertible into equity, helped MicroStrategy raise $650 million in December 2020.

- Senior Secured Notes: In June 2021, the company issued $500 million in secured notes backed by company assets, offering higher interest rates.

Most recently, on December 24, 2024, MicroStrategy proposed increasing its common stock from 330 million to 10.33 billion shares, allowing the company to raise capital as needed. This aligns with its 21/21 Plan, which aims to raise $42 billion over three years to fund additional Bitcoin purchases and explore ventures like a crypto bank or Bitcoin-based financial products.

Criticism and Concerns

Not everyone shares Saylor’s optimism. Critics, including finance experts like David Krause, warn that MicroStrategy’s reliance on a volatile asset like Bitcoin could expose the company to significant risks, including:

- Market Volatility: A sharp drop in Bitcoin’s price could erode shareholder equity and strain the company’s ability to meet debt obligations.

- Stock Dilution: Issuing new shares to raise capital could dilute existing shareholders’ equity.

- Financial Distress: If Bitcoin’s price collapses, MicroStrategy’s heavy debt could lead to financial instability or even bankruptcy.

Some have likened the company’s strategy to a Ponzi scheme, dependent on rising Bitcoin prices to sustain its debt-financed purchases. Financial analyst Jacob King remarked, “The cycle only works if BTC keeps rising. If BTC stalls or crashes, the loop collapses.”

Saylor’s Defense

In response to criticism, Michael Saylor has compared MicroStrategy’s strategy to Manhattan real estate practices.

“Every time real estate goes up in value, developers issue more debt to build more real estate. It’s been going on for 350 years in New York City. I would call it an economy,” Saylor explained.

Saylor and other proponents argue that the approach is not fraudulent but rather a calculated bet on Bitcoin’s long-term value as an inflation-resistant asset. Gracy Chen, CEO of Bitget, noted, “This strategy is more akin to exploiting perceived weaknesses in modern monetary theory to gain from asset appreciation.”

The Results Speak for Themselves

Since MicroStrategy’s first Bitcoin purchase in 2020, the company’s stock price has soared by 2,200%, closing at $331.70 on January 8, 2025. Over the same period, Bitcoin’s price rose by 735%. This success has earned MicroStrategy a spot in the Nasdaq-100 index and bolstered its crypto portfolio.

Despite concerns about stock dilution, supporters believe Bitcoin’s long-term growth potential could outweigh these risks. Additionally, MicroStrategy’s convertible debt structure provides some cushion against liquidity crises, reducing the risk of forced Bitcoin liquidation during bear markets.

A Broader Industry Impact

MicroStrategy’s strategy has had ripple effects across the crypto industry, inspiring other companies to explore Bitcoin as a treasury asset. However, its success—or failure—could set a precedent for future corporate adoption of digital assets.

According to Alexander Panasenko, head of product management at VixiChain:

“When you hold a huge amount of an inflation-proof asset like Bitcoin, you can make money from lending or borrowing it. But if this strategy fails, it casts a shadow over the entire industry.”

Key Takeaways

- Bold Bet on Bitcoin: MicroStrategy has amassed 447,470 BTC through a mix of corporate cash, debt issuance, and stock sales.

- Potential Risks: Critics cite concerns over market volatility, stock dilution, and financial instability.

- Strong Performance: Since adopting its Bitcoin strategy, MicroStrategy’s stock price has surged by 2,200%, far outpacing Bitcoin’s growth.

- Industry Influence: The company’s approach has inspired imitators, driving broader adoption of Bitcoin as a corporate asset.

The Bottom Line

MicroStrategy’s Bitcoin strategy is a high-stakes gamble that hinges on the cryptocurrency’s long-term appreciation. While the company’s success so far has silenced some critics, the absence of a clear exit strategy remains a point of contention.

As Michael Saylor puts it, “I have no reason to sell the winner.” Whether his approach proves to be a stroke of genius or a cautionary tale, MicroStrategy has cemented its place as a trailblazer in the evolving landscape of digital assets.

Share This