Bit Digital Buys $53M Facility to Power AI and HPC Pivot as Bitcoin Mining Pressures Mount

Bit Digital Doubles Down on AI and HPC With $53M Facility Acquisition in North Carolina

Bit Digital, a leading Bitcoin mining company, is making a bold move to diversify beyond cryptocurrency mining, with a $53.2 million acquisition of an industrial facility in Madison, North Carolina.

The purchase, made through its Canadian subsidiary Enovum Data Centers Corp., marks a significant step in the company’s transition toward artificial intelligence (AI) and high-performance computing (HPC) workloads.

“This is about future-proofing our business,” said Bit Digital CEO Sam Tabar, highlighting the shift toward AI-driven infrastructure in response to the mounting volatility in crypto markets.

A Strategic $53M Bet on Data Infrastructure

According to regulatory filings submitted to the U.S. Securities and Exchange Commission, Bit Digital placed a $2.25 million initial deposit, with $1.2 million non-refundable. The full acquisition is expected to close by May 15.

The announcement comes shortly after Bit Digital unveiled a new Tier 3 data center in Quebec, Canada—a facility undergoing $40 million in retrofits to meet stringent uptime and reliability standards.

This site will support a 5-megawatt colocation deal with Cerebras Systems, a major player in the AI infrastructure sector.

“The Quebec operation represents continued momentum in our strategy to deliver purpose-built AI infrastructure at scale,” Tabar noted.

Why Bitcoin Miners Are Pivoting to AI and HPC

The crypto mining landscape is shifting rapidly. With Bitcoin halving events reducing block rewards and crypto prices remaining volatile, mining companies are feeling the squeeze.

Recent data shows that public Bitcoin miners sold over 40% of their BTC holdings in March, an alarming sign of pressure across the sector.

As a result, AI and HPC workloads—which require robust data infrastructure and offer higher, more stable revenue streams—are becoming an attractive pivot.

A Struggle for Profitability

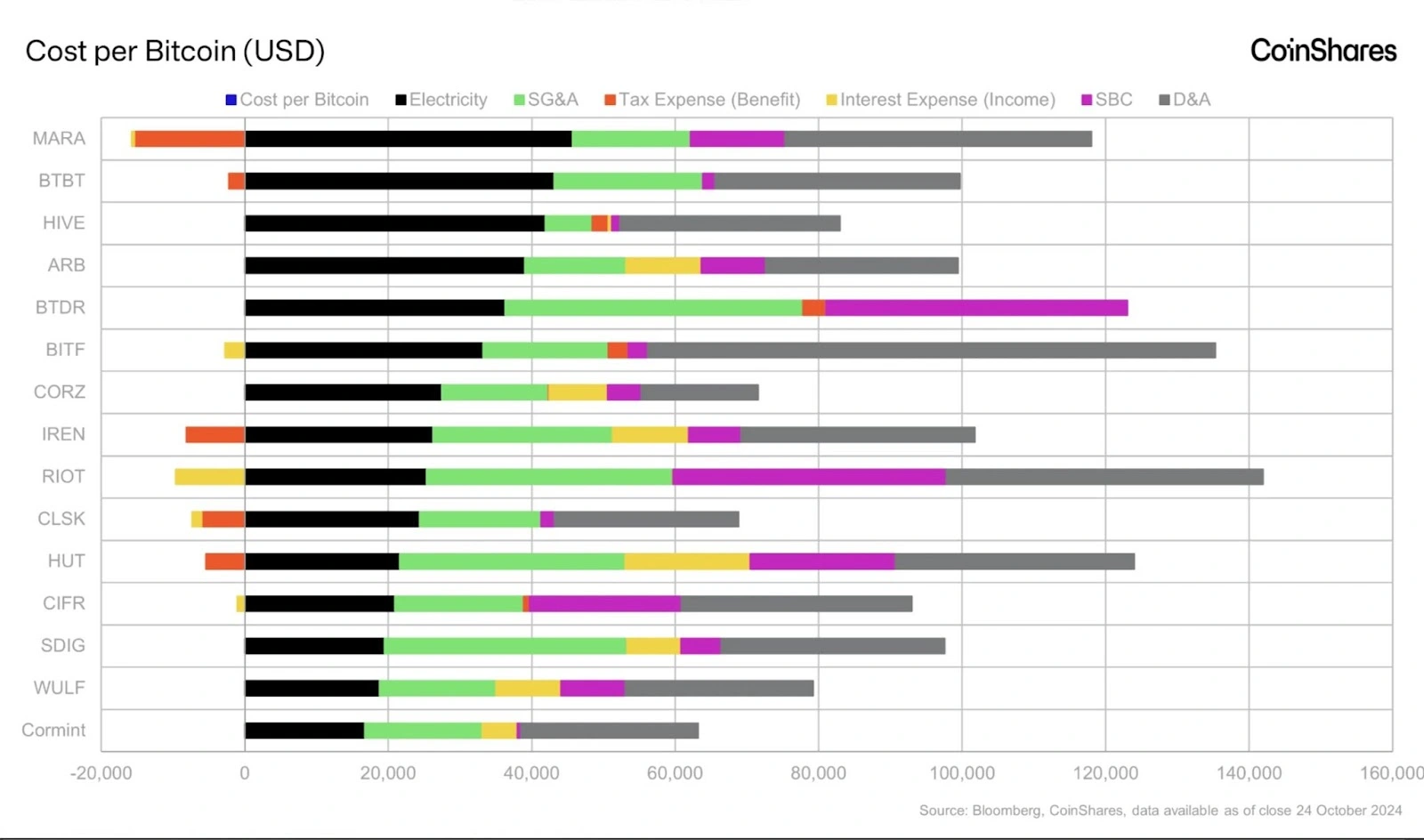

According to an October report from CoinShares, mining firms with higher operational costs are the first to explore non-crypto applications like AI to remain viable.

“The cost per Bitcoin is a critical metric,” the report states.

“Firms that can’t maintain profitability post-halving are most likely to diversify.”

Bit Digital is not alone. Other mining companies such as Hive Digital are also repositioning themselves as AI data center operators, leveraging existing infrastructure for this transition.

Share This