Bitcoin Eyes $100K: Can It Break the $95K Barrier as Bulls Regain Momentum?

Bitcoin is once again flirting with historic highs, with the $95,000 resistance level emerging as the next major hurdle. Backed by institutional interest, falling exchange inflows, and bullish technical signals, market watchers are wondering: Is a breakout to six figures imminent?

BTC Price Nears Key Resistance at $95K

Bitcoin’s price surged to $94,700 on April 23, its highest level since early March. The move reignited bullish sentiment across the market, but analysts warn that this $94K–$95K range remains a crucial psychological ceiling.

“The $89K–$90K zone could be next to test bulls, but with BTC’s structure strength, these dips are for buying,” said Swissblock in an April 24 post.

Analysts such as AlphaBTC suggest BTC could consolidate between $93,000 and $95,000 before launching toward the $100,000 liquidity zone.

ETF Demand Roars Back to Life

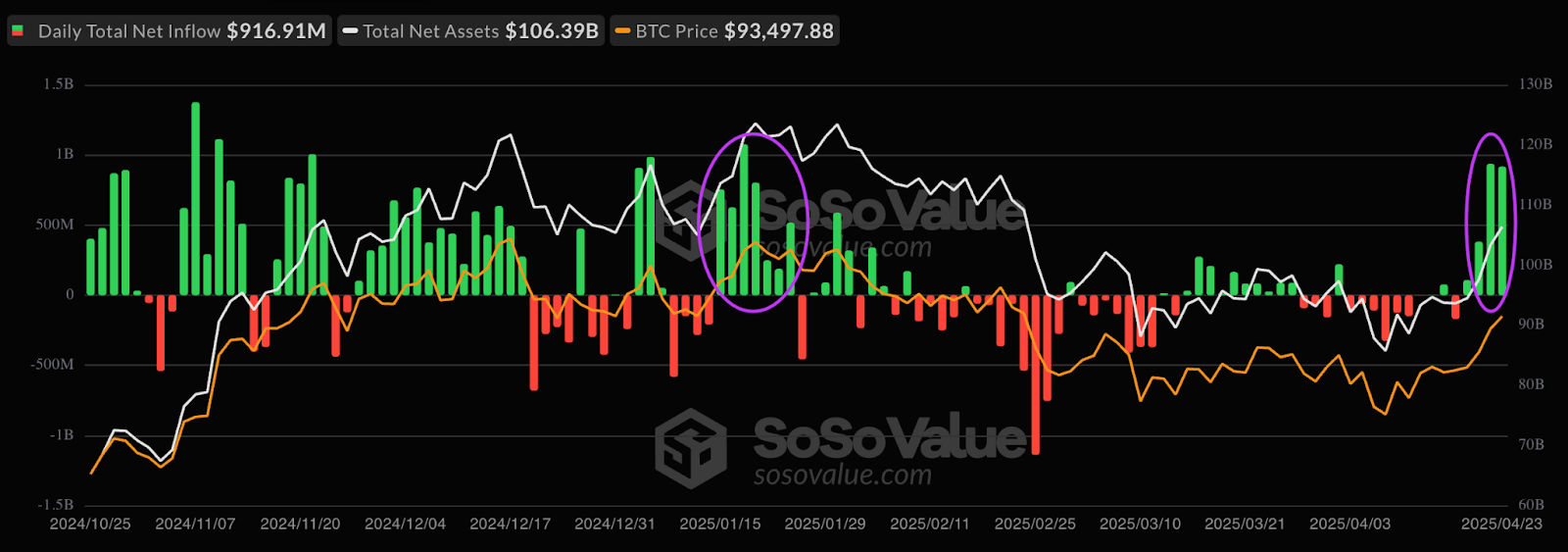

A major bullish driver comes from resurgent demand for spot Bitcoin ETFs, which recorded net inflows of $936 million and $917 million on April 22 and 23, respectively.

According to SoSoValue, these are the largest inflows since January 2025, exceeding 500 times the daily average for the year. This reflects renewed confidence from institutional investors, who are increasingly absorbing the available supply.

Market analyst Jamie Coutts noted that global liquidity is hitting all-time highs, a historic signal for asset rallies.

Exchange Inflows at Their Lowest Since 2016

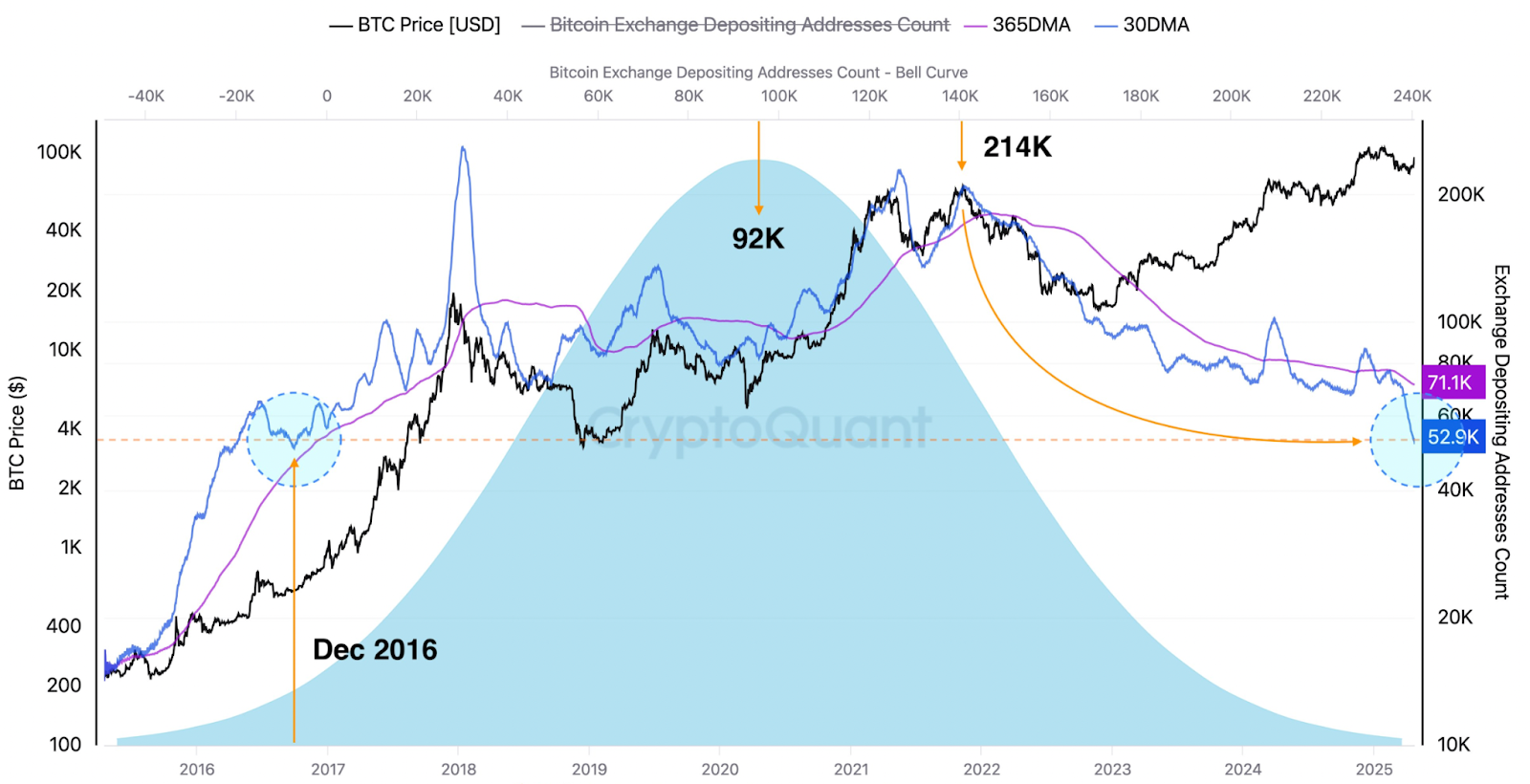

Another bullish metric? Bitcoin inflows to exchanges have dropped dramatically—from a year-to-date high of 97,940 BTC per day in February to just 45,000 BTC as of April 23.

CryptoQuant analyst Axel Adler Jr. explains:

“This represents growing HODL sentiment, significantly reducing sell pressure and creating a foundation for further growth.”

The 30-day average of BTC exchange deposits is now at 52,000 BTC, a level last seen in December 2016, marking a fourfold drop in sell-side activity since 2022.

Negative Funding Rates Hint at Explosive Rally

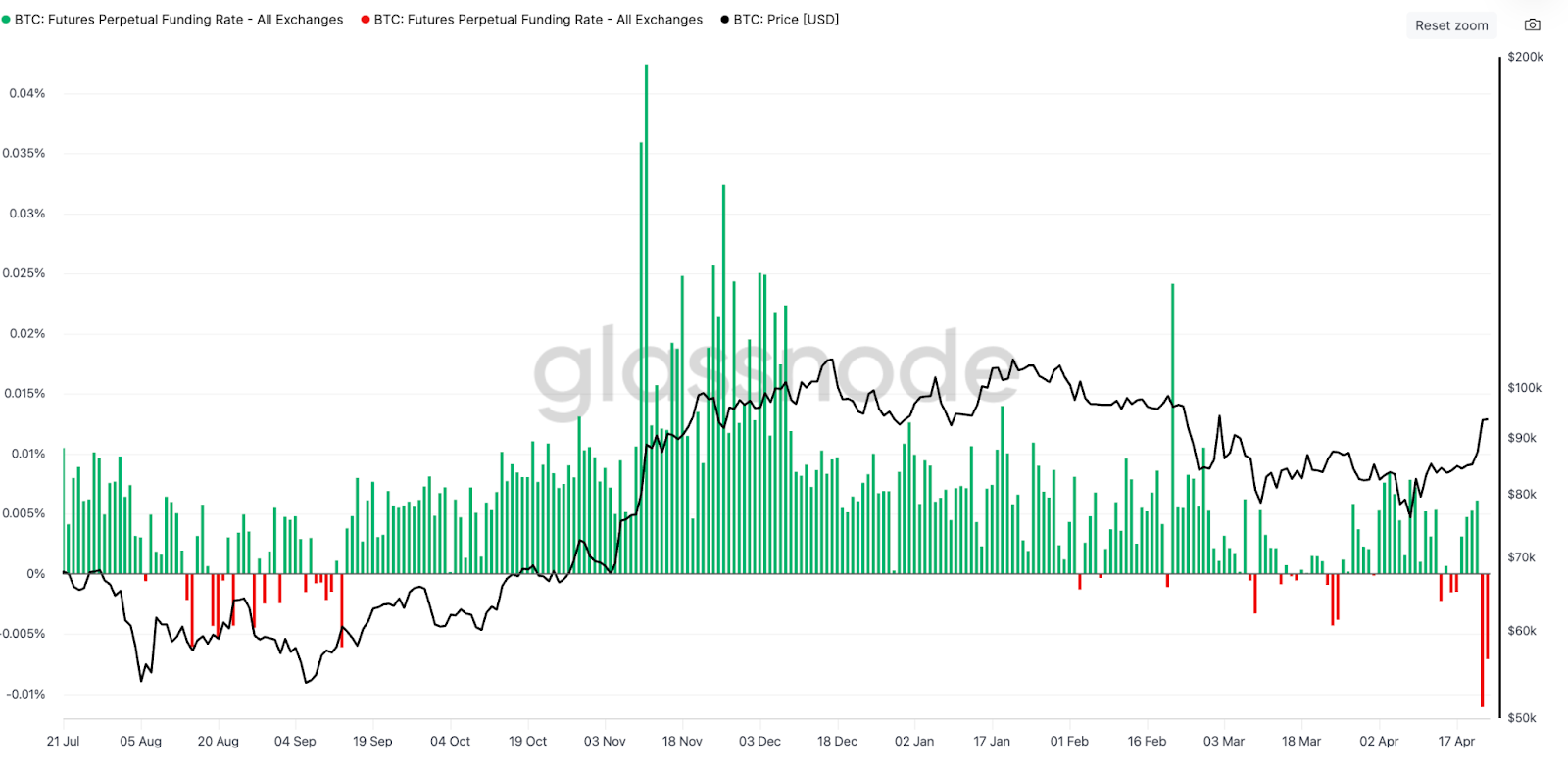

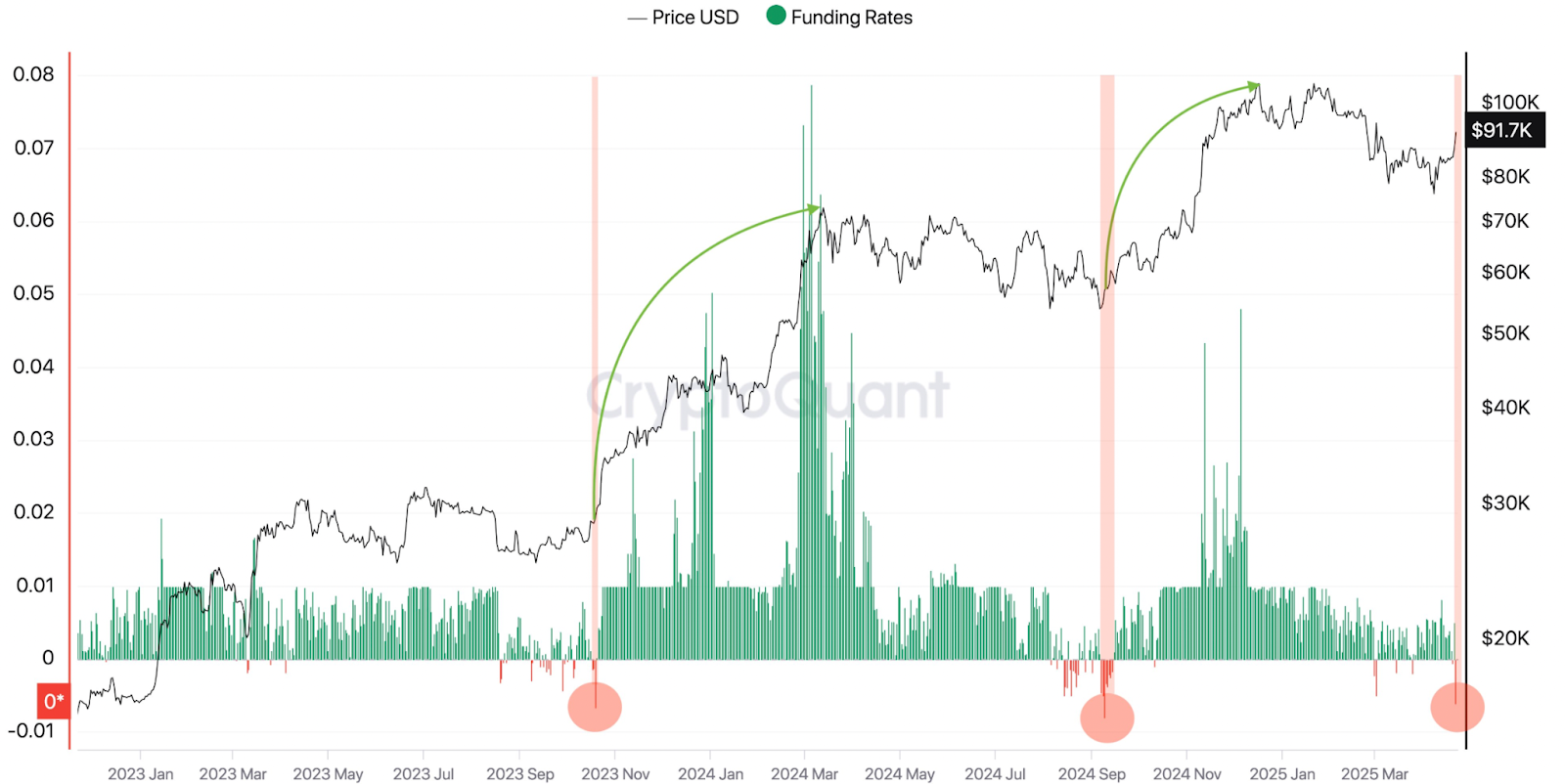

Despite price gains, Bitcoin’s perpetual futures funding rates remain negative, suggesting traders are still leaning bearish—a setup ripe for a short squeeze.

CryptoQuant’s Darkfost flagged that Binance’s funding rates had turned negative at -0.006, even as Bitcoin climbed 11% in two days.

“This rare divergence often precedes massive rallies,” he said, pointing to BTC’s past jumps from $28K to $73K in 2023, and $57K to $108K in 2024.

BTC Surpasses 200-Day SMA, Setting Stage for More Gains

Another crucial indicator is that Bitcoin has risen above its 200-day simple moving average (SMA), currently at $88,690. This has historically preceded massive upswings, like the 80% rally in late 2024 from $66,000 to $108,000.

Should Bitcoin maintain this momentum, resistance levels at $95,000 and $100,000 are in play. A clean break above could send the price soaring toward its all-time high above $109,000 recorded on January 20.

Outlook: Is Six-Figure Bitcoin Around the Corner?

With institutional demand soaring, sell pressure decreasing, and technical signals aligning, Bitcoin seems poised for a historic breakout above $95,000.

However, all eyes remain on the psychological resistance zones and the response of futures traders. If momentum continues, $100,000 Bitcoin might no longer be a question of if—but when.

Share This