Strategy’s $59B Bitcoin Bet Aims to Eclipse All Public Equities

WASHINGTON, D.C. — Strategy, formerly MicroStrategy, is not just riding the Bitcoin wave — it’s aiming to reshape the global equity landscape. Co-founder Michael Saylor and his team believe their $59 billion Bitcoin position puts them on a path to become the largest publicly traded company in the world.

The company’s strategic direction, massive capital raising capability, and aggressive Bitcoin accumulation are now central to a bold forecast: a $10 trillion market cap — and a $13 million Bitcoin.

“We’re Not Playing to Compete. We’re Playing to Win.”

In a new Financial Times documentary, Michael Saylor’s $40 Billion Bitcoin Bet, Strategy analyst Jeff Walton claims the company could outperform all listed equities, powered by its deep Bitcoin reserves.

“Strategy holds more of the best assets and the most pristine collateral on the entire planet than any other company, by multiples,” Walton said.

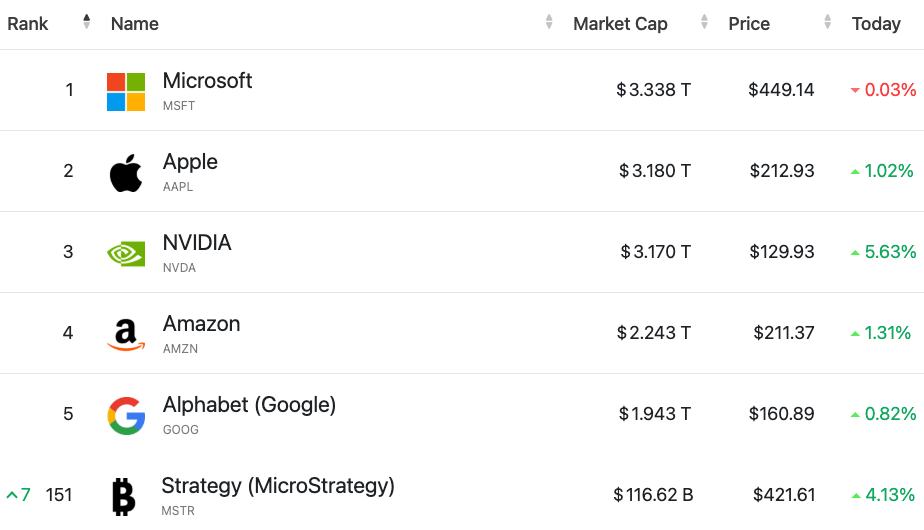

Currently, Strategy owns 568,840 BTC, with a market value of approximately $59 billion, making it the largest corporate holder of Bitcoin in the world. Its current market cap stands at $117 billion, placing it 151st globally — but Saylor insists that’s only the beginning.

$12 Billion Raised in 50 Days: “That’s Insane”

What sets Strategy apart isn’t just its Bitcoin holdings — it’s the speed and scale at which it raises capital.

In late 2024, the firm raised $12 billion in just 50 days.

“It’s incredibly hard to raise $100 million,” said Walton.

“They did that 120 times — in under two months.”

That capital went directly into Bitcoin, reinforcing Strategy’s singular focus on converting fiat into crypto at scale.

Saylor’s Long Game: $13 Million per Bitcoin by 2045

In the same documentary, Saylor outlines a multidecade vision:

“I think that Strategy can grow from a $100 billion company to $10 trillion. My forecast for Bitcoin is $1 million in 10 years, $13 million by 2045.”

That outlook would place Strategy ahead of current titans like Microsoft, whose market cap is $3.3 trillion.

Resilient Even If Bitcoin Crashes 90%

Despite the bullish tone, Saylor remains prepared for the worst. He acknowledged that a deep drawdown in Bitcoin — even as steep as 90% lasting for four or five years — wouldn’t collapse the firm.

“It wouldn’t be great for equity holders. But the capital structure is built to survive it,” he stated.

That layered financial structure is one reason why some analysts see Strategy as uniquely equipped for long-term crypto volatility.

Share This