El Salvador Moves $678M in Bitcoin to 14 Wallets Amid Quantum Security Concerns

Government Takes Precautionary Step with Bitcoin Reserves

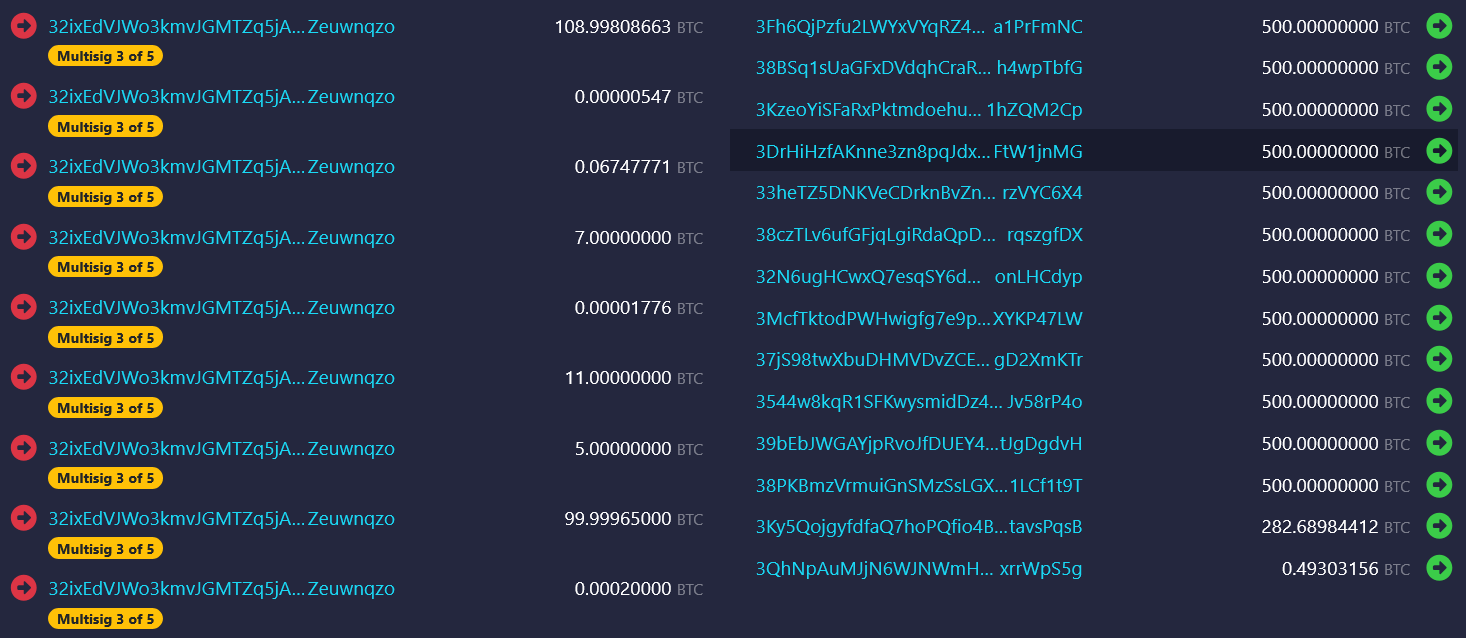

El Salvador has moved its 6,274 Bitcoin—worth $678 million—into 14 separate wallet addresses, a step aimed at mitigating potential risks from future quantum computing attacks, according to the country’s Bitcoin Office.

The government explained that splitting funds into smaller pools reduces the potential fallout if quantum computers ever reach the capability to crack elliptic curve cryptography (ECC), the security system underpinning Bitcoin. Each new address holds up to 500 BTC.

Why the Split Matters

Once Bitcoin funds are spent from an address, public keys become exposed, making them theoretically vulnerable to future quantum decryption. While today’s quantum machines are far from reaching that level, the government’s move was described as a “precautionary measure.”

Industry Voices on Quantum Threats

According to Project Eleven, a quantum research firm, more than 6 million Bitcoin—worth about $650 billion—could be exposed if quantum computers ever achieve the ability to break ECC encryption.

Still, experts argue the threat remains distant. To date, no quantum computer has managed to crack even a 3-bit key, far below Bitcoin’s 256-bit private key standard.

Michael Saylor, founder of MicroStrategy, dismissed current fears as hype, adding that if the quantum threat ever becomes real, Bitcoin’s core developers and hardware manufacturers could deploy protocol upgrades similar to those used by Microsoft, Google, or the U.S. government.

From One Address to Fourteen

El Salvador previously stored its entire Bitcoin reserve in a single address. Blockchain records now show the funds dispersed across 14 wallets, each holding a capped balance to minimize systemic risk.

IMF Tensions Still Linger

This development comes as El Salvador continues to face scrutiny over its Bitcoin strategy. The International Monetary Fund (IMF) reported in July that the country has not made new Bitcoin purchases since February, despite public claims to the contrary by the Bitcoin Office.

El Salvador also secured a $1.4 billion funding package from the IMF in December 2024, a deal reportedly tied to reducing its Bitcoin initiatives. Disputes over the exact terms remain unresolved.

Share This