US Could Approve Multiple Solana Staking ETFs Within Two Weeks, Analyst Says

Analysts Expect Rapid SEC Decisions

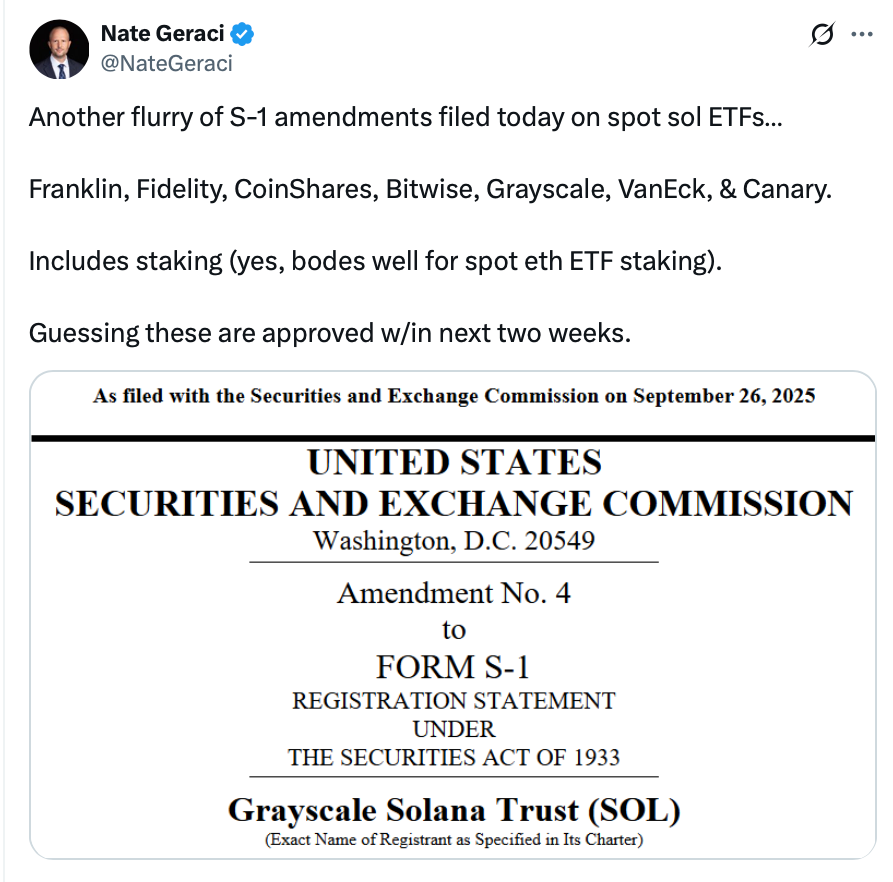

Several Solana exchange-traded fund (ETF) applications featuring staking could receive U.S. approval by mid-October, according to ETF analyst Nate Geraci.

Geraci, president of NovaDius Wealth Management, wrote on X Friday that he was “guessing these are approved [within the] next two weeks,” citing newly amended regulatory filings.

The filings come from major asset managers, including Franklin Templeton, Fidelity Investments, CoinShares, Bitwise Asset Management, Grayscale Investments, VanEck, and Canary Capital, all of whom submitted updated S-1 disclosures to the U.S. Securities and Exchange Commission (SEC). These documents outline a firm’s financials, risks, and intended securities offerings.

Solana’s Institutional Moment

The momentum follows the recent launch of the REX-Osprey Solana Staking ETF, which began trading on the Cboe BZX Exchange just over two months ago. The fund recorded $33 million in trading volume and $12 million in inflows on its first day.

Institutional interest appears to be growing. Pantera Capital recently called Solana (SOL) “next in line for its institutional moment,” noting its relative under-allocation compared to Bitcoin (BTC) and Ether (ETH).

October Could Be a Turning Point

Geraci argued that October may be pivotal for crypto markets. He pointed to events such as the first Hyperliquid (HYPE) ETF filing and the SEC’s recent approval of generic listing standards for crypto ETFs.

“Get ready for October,” Geraci said.

Meanwhile, Bitwise CIO Hunter Horsley highlighted that Europe’s Bitwise Solana staking ETP attracted $60 million in inflows over five trading days, evidence of accelerating demand for Solana-linked products.

Still, some analysts caution that a broader altcoin rally may not emerge until regulators approve more ETFs offering exposure further down the risk spectrum.

Implications for Ethereum ETFs

Geraci also noted that the inclusion of staking in Solana ETF filings “bodes well for spot ETH ETF staking.”

Industry experts agree. Markus Thielen, head of research at 10x Research, told Cointelegraph that staking features for Ethereum ETFs could increase yields and “dramatically reshape the market.”

Despite multiple filings, the SEC has yet to permit staking for Ether ETFs. Asset managers are still waiting for approval that could expand institutional participation in Ethereum’s ecosystem.

Share This