XRP Faces Critical $2.75 Test as October Recovery Hangs on ETF Momentum

Technical Levels and ETF Approvals Could Decide XRP’s Next Move

XRP is once again at a crossroads. After sliding 14% in the past two weeks, the token opened October near $2.77 and now faces a pivotal battle at the $2.75 support level. Analysts warn that losing this threshold could open the door to a retreat toward $2.00, while holding above it could set the stage for a powerful rally.

According to technical charts, the $2.75 zone forms the lower boundary of a symmetrical triangle pattern. A break above the descending trendline near $2.86—which coincides with the 100-day simple moving average (SMA)—could trigger a 30% climb toward the bullish target of $3.62.

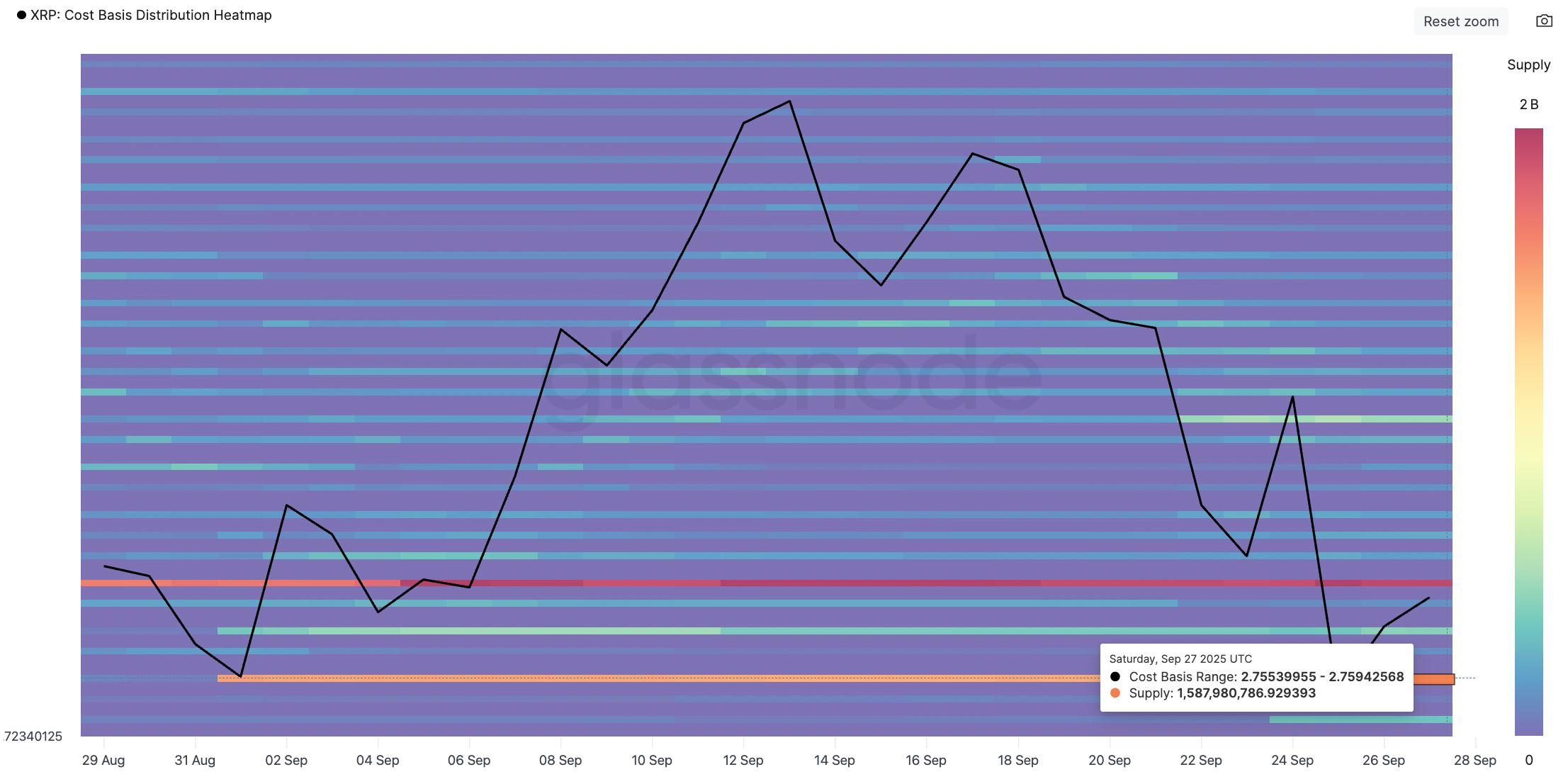

Market Structure Reinforces the $2.75 Level

On-chain data shows 1.58 billion XRP were acquired around the $2.75 mark, underlining its importance as a demand cluster.

But not all signals are supportive. A supply wall remains firmly in place at $2.81, making it a key barrier to watch. Failure to break through could prolong consolidation or even accelerate declines.

Some analysts remain optimistic. Hardy, a market watcher, called XRP’s chart a “solid bullish consolidation” so long as it holds the $2.72–$2.75 range. Another analyst, XForceGlobal, suggested that the longer XRP consolidates near this level, the more explosive the eventual breakout could be—raising long-term targets in the $20–$30 range.

History Says October Is Unkind, but Q4 Often Brings Fireworks

XRP’s track record in October is less encouraging. Since 2013, the token has closed October in the red seven out of twelve times, with an average monthly return of −4.58%.

By contrast, the October–December quarter has historically delivered the strongest results, averaging 51% gains. XRP surged 240% in Q4 2024 and 20% in Q4 2023, while the 2017 bull run saw an explosive 1,064% rally in just three months.

Even during down years, such as 2018 (−39.1%) and 2022 (−29.2%), Q4 marked outsized moves compared to earlier months. This pattern has given rise to the term “Uptober” among traders hoping history will repeat in 2025.

ETF Deadlines Could Ignite October Rally

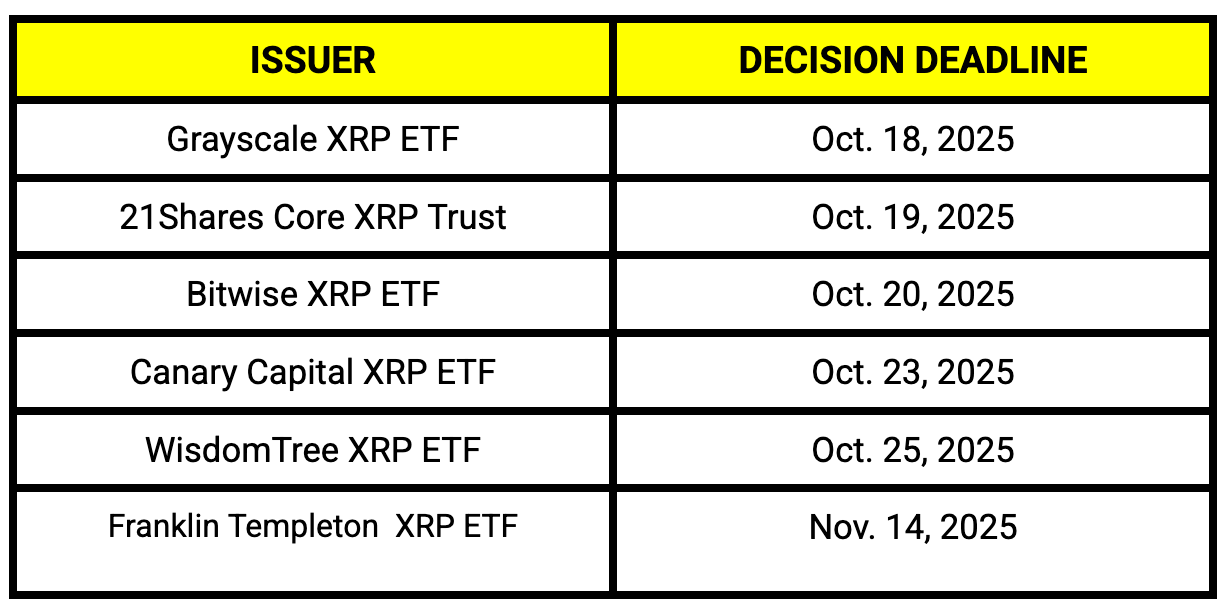

Fueling optimism are looming ETF decisions.

-

Grayscale’s XRP ETF decision is due Oct. 18.

-

Other key deadlines fall between Oct. 19–25.

-

Franklin Templeton’s filing has been pushed to Nov. 14.

-

REX/Osprey’s XRPR ETF debuted Sept. 18, notching nearly $38 million in first-day trading volume.

Analysts estimate that approval could unlock $4–$8 billion in inflows within the first year, boosted by SEC clarity after Ripple’s partial court victory. But some warn that the market may have already priced in much of this optimism, setting up the risk of a “sell the news” event.

Outlook

With technical levels tightening, October’s poor seasonal record, and the ETF clock ticking, XRP sits at a defining moment. Whether the token holds $2.75 or breaks lower will dictate if October extends its reputation as a difficult month—or marks the start of another powerful Q4 rally.

Share This