How Are Foreign Dividends Taxed in South Africa?

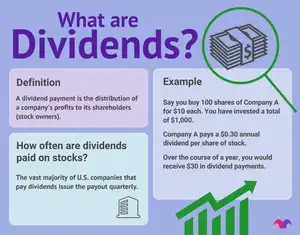

What is a dividend?

A dividend is a monetary or non-monetary reward given by a company to its shareholders. Dividends can be paid in a variety of ways, including cash, stock, or any other form.

What are the types of dividends?

1. Cash Dividend

2. Stock Dividend

3. Scrip Dividend

4. Property Dividend

5. Liquidating Dividend

What is an example of a dividend?

If a company’s board of directors decides to pay a 5% dividend per share every year and its shares are worth $100, the dividend is $5. If dividends are paid out every quarter, each payment is $1.25.

What exactly is a foreign dividend?

The Income Tax Act defines a foreign dividend as an amount paid by a foreign corporation to an individual or another company in respect of a share in that foreign corporation.

Is a foreign dividend taxable in South Africa?

Foreign dividends are subject to tax in South Africa.

How are foreign dividends taxed in South Africa?

Most foreign dividends received by individuals from foreign corporations (shareholding of less than 10% in the foreign company) are taxable under the normal tax system at a maximum effective rate of 20%.

What are the South African tax exemptions for foreign dividends?

According to Section 10B(2) of the Income Tax Act, a foreign dividend is exempt from dividend tax under the following circumstances:

1. If the shareholder owns at least 10% of the entire number of equity shares and voting rights, the shares are considered equity shares.

2. If a shareholder receives a dividend from a foreign company and the foreign dividend is paid or declared by another foreign company based in the same nation as the company whose shares are held.

3. The dividend is paid from the profits of a managed foreign corporation.

4. Dividends paid by dual-listed firms in foreign currency.

Are distributions from foreign trusts taxable in South Africa?

All distributions from a foreign trust to a South African resident, whether as a funder or a beneficiary, are taxed under current South African tax legislation.

Share This