$19 Trillion Settled on Bitcoin Network in 2024: A Milestone Year for Adoption and Growth

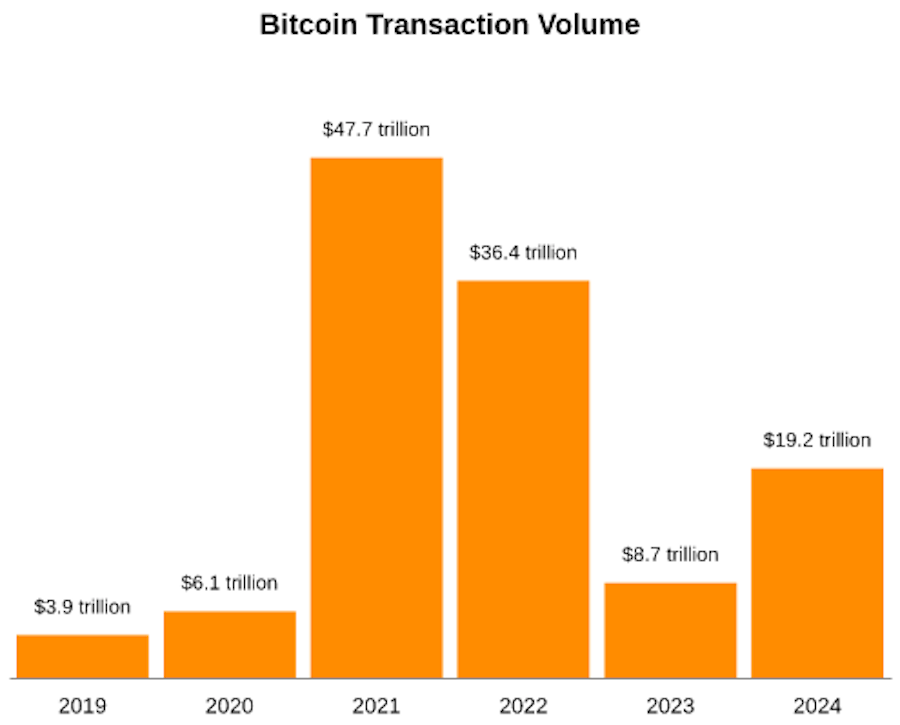

The Bitcoin network achieved a historic milestone in 2024, settling $19 trillion in transactions, more than doubling the $8.7 trillion settled in 2023. This remarkable growth reverses a two-year decline in transaction volumes since the 2021 bull market peak of $47 trillion.

A Year of Major Bitcoin Developments

Pierre Rochard, vice president of research at Riot Platforms, highlighted the achievement, stating:

“The Bitcoin network finalized more than $19 trillion worth of BTC transactions in 2024, decisively proving that Bitcoin is both a store of value and a medium of exchange.”

Bitcoin’s 2024 performance was driven by several pivotal events:

- Introduction of a BTC Exchange-Traded Fund (ETF) in the United States.

- The April 2024 halving event, which reduced the block reward to 3.125 BTC.

- A new all-time high price of approximately $108,000.

Bitcoin Market Capitalization Surpasses Silver

Bitcoin ended 2024 with a market capitalization of $1.9 trillion, overtaking silver’s $1.6 trillion market cap. This milestone underscores Bitcoin’s increasing adoption as a store of value and investment asset.

Bitcoin Hashrate Hits Record Highs

The Bitcoin network’s security also reached unprecedented levels. On January 3, 2024, the network’s hashrate peaked at 1,000 exahashes per second (EH/s), showcasing the immense computing power safeguarding the protocol.

By year-end, the hashrate stabilized around 775 EH/s, according to data from CryptoQuant.

Over 40% of global hashrate was contributed by U.S.-based mining pools, with Foundry USA and MARA Pool collectively accounting for 38.5% of all blocks mined.

Despite the dominance of U.S.-based miners, China-based pools continued to control a majority of the global hashrate. However, determining hashrate dominance remains complex due to the decentralized and pseudonymous nature of Bitcoin mining.

Decentralized Mining Continues to Evolve

Mining pool operators often rely on individual miners globally, further obscured by the use of VPNs to mask IP addresses. This decentralized structure makes Bitcoin mining resilient but challenging to measure geographically.

The Road Ahead for Bitcoin

As Bitcoin enters 2025 with record-breaking transaction volumes and all-time high hashrates, its role as a store of value and medium of exchange becomes increasingly clear. The introduction of ETFs, greater institutional adoption, and heightened global mining activity point to continued growth and innovation in the Bitcoin ecosystem.

Stay tuned for updates as Bitcoin’s evolution reshapes the financial landscape.

Share This