Insider Traders Net $20M from Focai.fun Launch on Solana, Analysts Warn of Red Flags

A shocking case of insider trading has surfaced on the Solana blockchain, where 15 suspected wallets reportedly made $20 million in profits from the launch of FOCAI, an AI-themed cryptocurrency. The revelations, uncovered by Lookonchain, have sparked outrage in the cryptocurrency community and raised serious concerns about the project’s integrity.

Inside the Insider Trades

According to Lookonchain’s investigation:

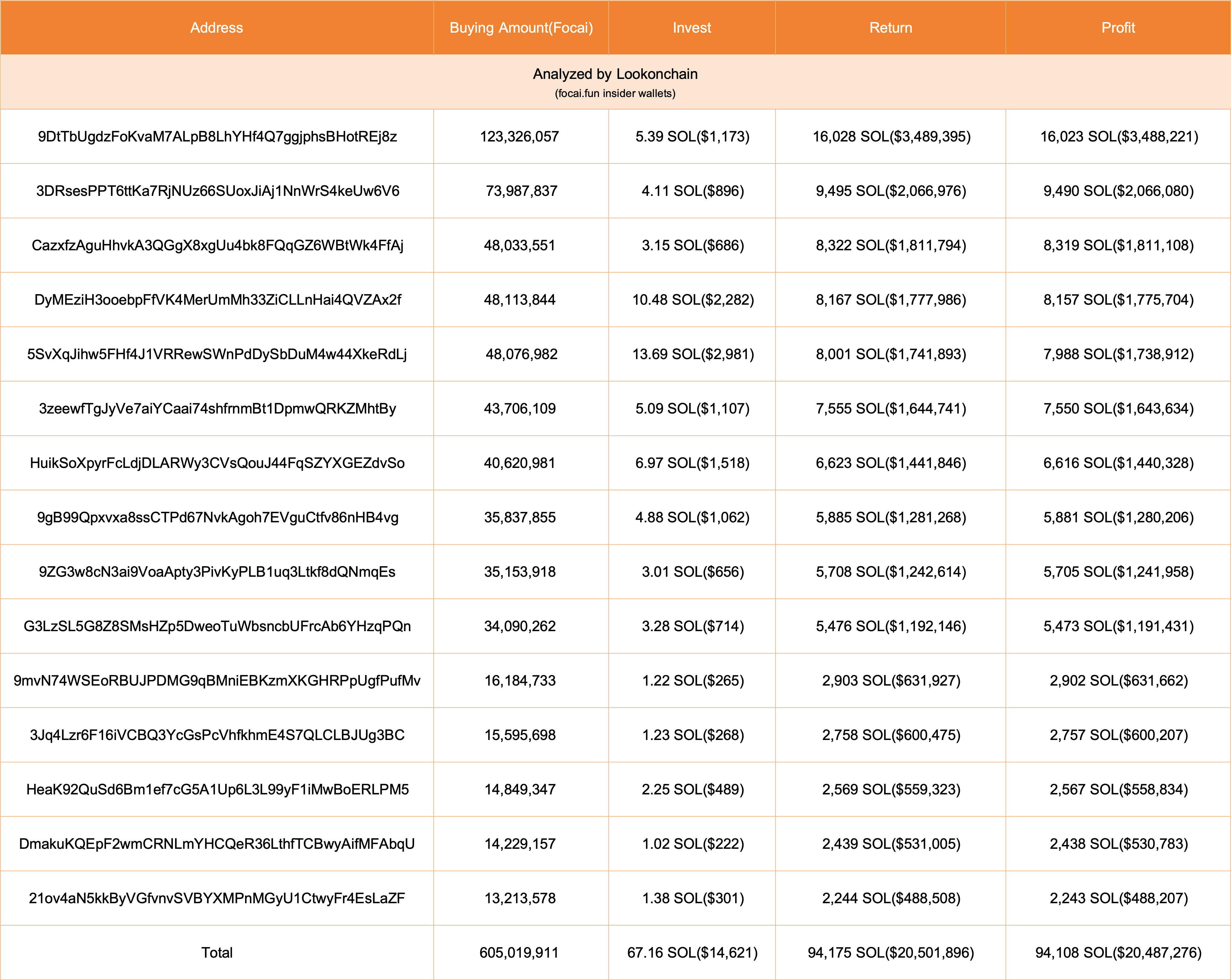

15 wallets spent 67.16 SOL ($14,600) to purchase 605 million FOCAI tokens, representing 60.5% of the token supply.

The tokens were bought on Raydium, a decentralized exchange, and later sold for 94,175 SOL ($20.5 million), yielding an astounding 94,108 SOL ($20.48 million) in profit.

A follow-up by Lookonchain indicated that additional insider wallets linked to the FOCAI team were used to manipulate the market further.

FOCAI’s Explosive Debut

FOCAI made a strong initial impression, reaching a market capitalization of $50 million within 11 minutes of going live. Trading volumes spiked to $48.2 million in under an hour. However, after the insider trading activity, FOCAI’s price plunged to $0.327, with its market cap dropping to $32.7 million.

Analysts Highlight Serious Red Flags

Crypto analyst @olegmetaverse flagged FOCAI as a potential scam, pointing out several warning signs:

- Forked Codebase: FOCAI appears to be a clone of the existing cryptocurrency Eliza, with minimal original contributions.

- Misleading Marketing: Heavy use of buzzwords like “AI” and “blockchain” lacked substantial technical backing.

- Inconsistent Documentation: The project’s incomplete and poorly translated documents suggest a lack of transparency.

- Flawed Tokenomics and Smart Contracts: Analysts found unclear token economics and a lack of proper smart contract implementation, critical components of any legitimate cryptocurrency.

Community Reaction and Broader Implications

The revelations have sent shockwaves across the crypto community, with users on X (formerly Twitter) expressing dismay at the scale of the apparent manipulation. Many have called for stricter oversight of new token launches to protect investors from such exploitative practices.

Conclusion: Lessons for Crypto Investors

The FOCAI insider trading scandal underscores the need for due diligence in the crypto space. While the initial hype around AI and blockchain-themed projects may be enticing, investors should scrutinize project fundamentals, codebases, and transparency to avoid falling victim to scams. As the industry grows, greater accountability and regulatory oversight are vital to ensuring fair practices and safeguarding the trust of participants.

Share This