Tether USDT’s Market Cap Dip Tied to Seasonal Holiday Lull, Not Bearish Turn

A recent multibillion-dollar decline in Tether’s USDT market capitalization and trading volumes has sparked speculation about potential bearish trends in the cryptocurrency market. However, experts from crypto financial services platform Matrixport suggest the drop is likely due to a seasonal holiday slowdown and not indicative of long-term market shifts.

USDT Sees 2.8% Market Cap Drop

Data from CoinGecko reveals that Tether’s USDT market cap has fallen by 2.8% since peaking at $141 billion on Dec. 19, 2024. Similarly, daily trading volumes plummeted by 64%, dropping from $154 billion in mid-December to $55 billion by Jan. 6, 2025.

Matrixport, however, downplayed these trends, emphasizing that they align with the typical holiday lull rather than signaling a bearish market shift.

Holiday Slowdown or Market Correction?

Matrixport highlighted that stablecoin trading volumes are a reliable indicator of market health. Increased stablecoin activity typically reflects more fiat entering the crypto ecosystem, which supports bullish momentum.

“When these trends reverse, it often signals a consolidation phase for Bitcoin and the broader crypto market,” Matrixport stated in a Jan. 6 post on X. Despite the recent decline, Matrixport believes it’s “premature to turn bearish”, attributing the slowdown to holiday illiquidity.

The firm added, “With the new year underway, it won’t be long before we see whether the market’s bullish momentum resumes.”

Crypto Market Awaits Post-Holiday Recovery

Matrixport’s optimism echoes broader market sentiment. CryptoQuant analyst Axel Adler noted on Jan. 4 that Bitcoin (BTC) requires increased trading volume for a sustained bullish impulse, which is expected to emerge as the market rebounds post-holiday season.

Community Pushback Against Tether FUD

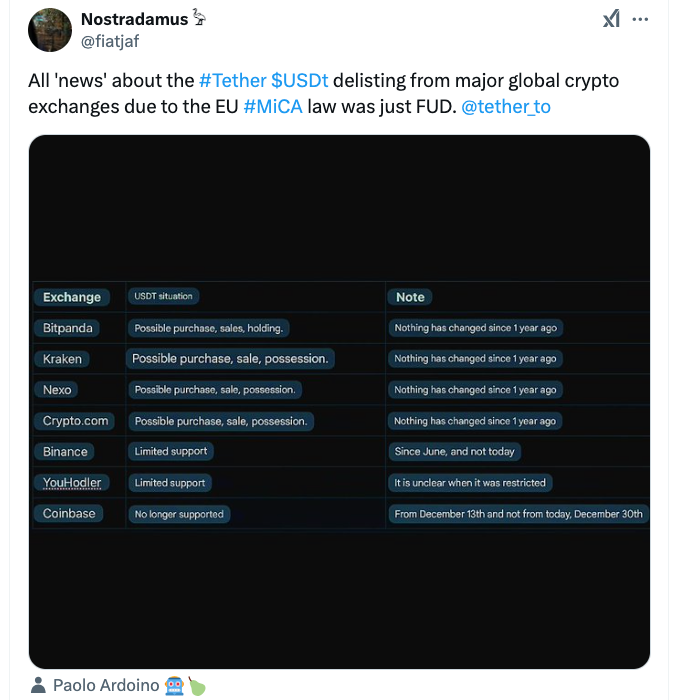

Amid Tether’s market cap drop, rumors have circulated linking the decline to the European Union’s Markets in Crypto-Assets (MiCA) Regulation. Some reports falsely suggested that USDT delisting from European exchanges was mandated by a Dec. 30, 2024, deadline.

Contrary to these claims:

- Major exchanges like Binance confirmed that USDT remains supported.

- The European Securities and Markets Authority (ESMA) has not provided any guidance regarding USDT’s status under MiCA.

Industry observers on X (formerly Twitter) criticized the misinformation, labeling it as “FUD” (fear, uncertainty, and doubt). “All ‘news’ about Tether USDT delisting from major global crypto exchanges due to the EU MiCA law was just FUD,” one commenter noted.

Conclusion: A Temporary Dip

While USDT’s market cap and trading volumes have dipped, analysts attribute this trend to seasonal holiday effects rather than fundamental market weaknesses. With a return to regular trading activity in the new year, bullish momentum may resume, buoyed by increased stablecoin flows and broader market confidence.

Key Takeaway: Tether’s recent decline underscores the importance of evaluating seasonal patterns and avoiding overreactions to unsubstantiated reports. For now, the market awaits post-holiday liquidity to determine the next phase of crypto’s journey.

Share This