Trump’s Crypto Venture WLFI Struggles as Investments Falter

World Liberty Financial Faces Market Headwinds Amid Political Tensions

World Liberty Financial (WLFI), the crypto venture tied to former U.S. President Donald Trump, made a grand entrance into the digital asset scene last year. But now, just as the Trump administration nears its first 100 days, WLFI’s financial reality is painting a far less glamorous picture.

Launched ahead of Trump’s inauguration, WLFI was met with fanfare — and criticism. Observers quickly flagged potential conflicts of interest, accusing the project of front-running key crypto events, such as the White House Crypto Summit.

Despite Trump’s unique ability to influence the crypto landscape, WLFI’s fortunes have been battered by wider market turbulence, reflecting the ongoing struggles in both crypto and stock markets amid global economic pressures.

The Making of WLFI: A Family Affair

Founded on September 16, WLFI was spearheaded by real estate mogul Steve Witkoff and his son, Zach, alongside crypto investor Chase Herro and social media influencer Zak Folkman.

The Trump family is front and center. Donald Trump acts as Chief Crypto Advocate, while Eric Trump, Donald Trump Jr., and Barron Trump serve as Web3 Ambassadors.

One of the firm’s first major plays was a token sale on October 15, 2024, generating about $300 million. A second round, launched on Trump’s Inauguration Day, raised an additional $250 million. In total, WLFI pulled in $550 million — but investors should note: $WLFI tokens are restricted to accredited investors and cannot currently be traded on exchanges.

WLFI’s Investment Moves: Some Wins, Many Losses

Beyond token sales, WLFI has been actively investing in a variety of digital assets. Its portfolio, valued at about $103 million, is largely composed of stablecoins (USDC), Wrapped Bitcoin (WBTC), and Ethereum (ETH).

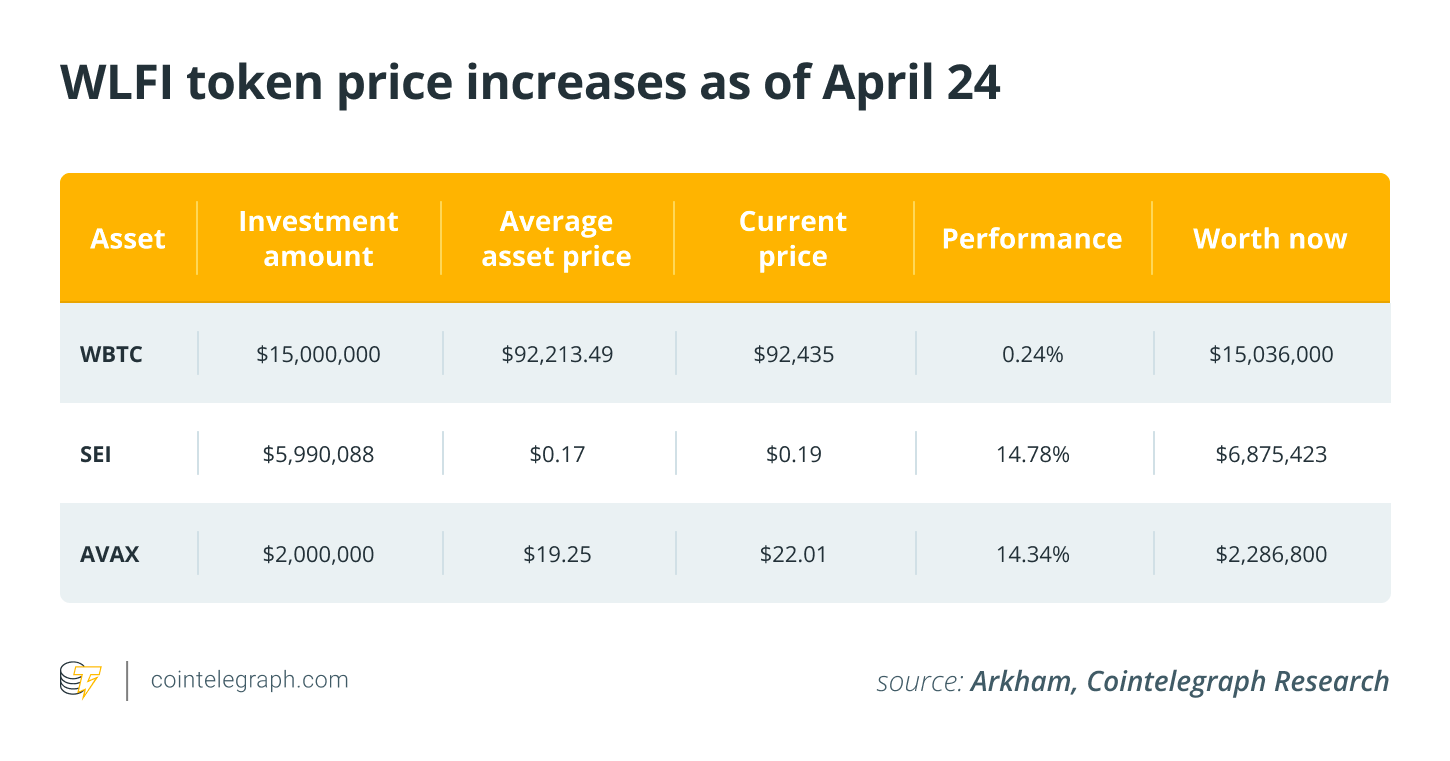

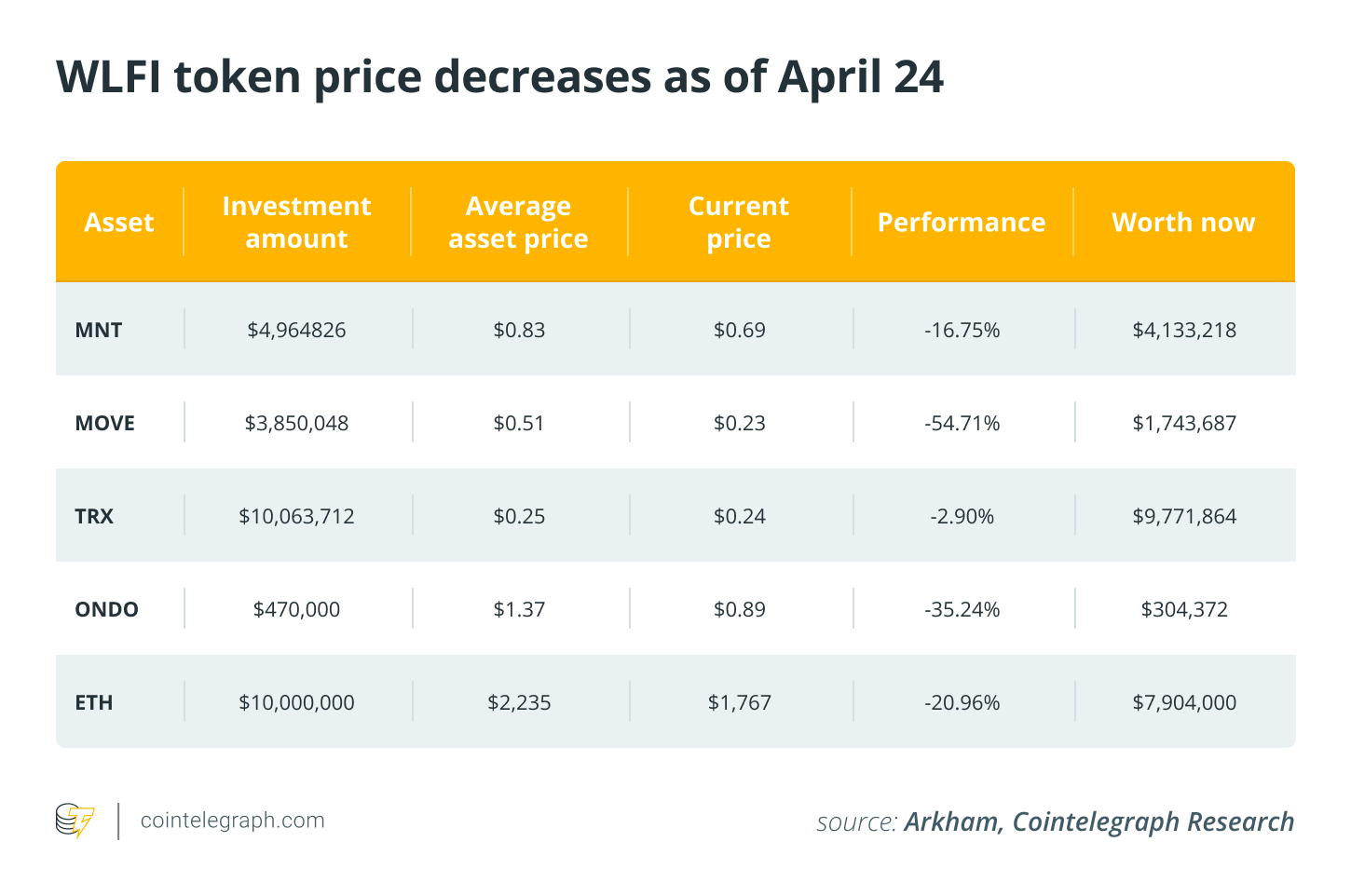

Among WLFI’s better-performing assets are its holdings in WBTC, SEI, and AVAX. However, losses loom large over its stakes in MNT, MOVE, ONDO, and ETH — with its MOVE investment plunging over 50%, resulting in a loss of approximately $2.1 million.

Overall, WLFI is down around $4.28 million when comparing asset acquisition costs to current market values.

A closer look reveals curious timing: WLFI wallets accumulated large amounts of ETH ahead of key moves, only to later transfer these funds to Coinbase Prime — just as Eric Trump was loudly promoting Ether on social media.

Conflict Concerns and the USD1 Stablecoin Scrutiny

WLFI’s involvement in stablecoins has triggered regulatory concerns. Senators from the Banking Committee have publicly urged agencies to investigate potential conflicts of interest, especially concerning WLFI’s new stablecoin, USD1.

Launched in early March, USD1 is already trading on exchanges like Kinesis Money and ChangeNOW. Yet lawmakers worry about the president’s potential to shape regulation in favor of his family’s crypto investments.

Those concerns intensified when, after announcing new tariffs on “Liberation Day,” Trump posted on Truth Social:

“THIS IS A GREAT TIME TO BUY!!”

…prompting fears of insider trading and market manipulation.

Despite the controversy, the Trump administration’s crypto ties are only growing stronger. Enforcement actions against crypto firms are decreasing, and friendly legislation is gaining traction in Congress.

Crypto players also seem unfazed. DWF Labs, a major market maker, announced a $25 million investment in WLFI on April 16, also agreeing to provide liquidity support for USD1.

Conclusion: A Rough Road Ahead for WLFI

World Liberty Financial embodies the high-stakes drama at the intersection of politics, finance, and emerging technologies. While its ambitions are bold, its early performance signals that even political power can’t guarantee crypto success.

With mounting scrutiny and market volatility, the Trump family’s crypto dreams may be facing a tougher road than expected.

Share This