Caitlin Long Criticizes Fed’s Stablecoin Policy, Accusing It of Favoring Big Banks

Caitlin Long, founder and CEO of Custodia Bank, has expressed her strong dissatisfaction with the U.S. Federal Reserve’s stance on stablecoins, accusing the central bank of maintaining policies that disproportionately benefit large financial institutions. Despite recent moves to ease crypto regulations, Long points out that the Fed is still restricting banks from direct engagement with cryptocurrencies.

Fed’s Continued Anti-Crypto Stance Blocks Bank Participation in Crypto Markets

In a thread posted on April 27 via X, Long criticized the Fed for not rescinding a crucial policy, issued in coordination with the Biden administration on January 27, 2023. While the Fed had relaxed certain crypto-related regulations, it kept in place guidelines that prevent banks from engaging directly with cryptocurrencies or issuing stablecoins on permissionless blockchains.

“The Fed has maintained a regulatory preference for permissioned stablecoins (i.e., big-bank versions),” Long emphasized. She argued that this policy effectively gives traditional banks a competitive advantage in the stablecoin market, enabling them to develop private stablecoins while smaller players are left waiting for Congress to finalize stablecoin legislation.

The Fed’s Actions and Their Impact on Banks

Long also pointed out that the Fed’s stance prevents banks from participating as principals in crypto markets. This means banks are not allowed to market-make in prominent cryptocurrencies like Bitcoin, Ether, or Solana. Additionally, she noted the significant operational challenges for banks trying to offer crypto custody services, particularly around covering gas fees for on-chain transactions—a practice common among crypto custodians, but prohibited under current Fed rules.

As a result, Long believes that the Fed is putting “sand in the wheels” of banks attempting to engage with crypto markets, all while advancing the cause of permissioned stablecoins backed by major financial institutions.

Caitlin Long Urges Congress to Act

In her thread, Long urged Congress to pass the federal stablecoin bill, which could override the Fed’s position. “Congress should hurry up,” Long wrote, emphasizing the importance of legislative action in breaking the current deadlock.

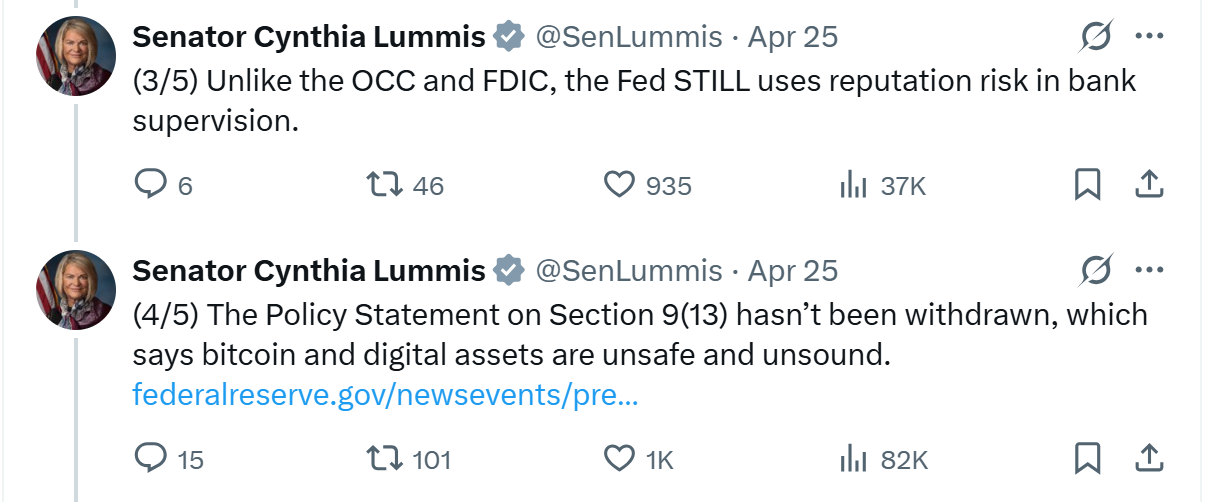

Senator Lummis Criticizes Fed’s “Lip Service”

Senator Cynthia Lummis, a well-known supporter of digital assets, echoed Long’s criticisms, calling the Fed’s move “lip service”. She specifically referenced the Fed’s policy in Section 9(13), which has not been withdrawn. This section continues to label Bitcoin and other digital assets as “unsafe and unsound,” a view that contradicts the growing acceptance of crypto in the financial sector.

Industry Reactions: Mixed Signals on the Fed’s Crypto Shift

While Caitlin Long and Senator Lummis voiced concerns over the Fed’s policies, other figures in the crypto world have taken a more optimistic view. Michael Saylor, CEO of Strategy, praised the Fed’s actions in a post on April 25, stating that the central bank’s recent announcements signal that banks are now free to begin supporting Bitcoin.

Despite the mixed reactions, the ongoing debate underscores the tension between traditional finance and the rapidly evolving world of digital assets. As crypto legislation remains in limbo, the U.S. Federal Reserve’s policies will continue to shape the future of stablecoins and bank participation in the crypto space.

Share This