Ethereum Eyes $4.1K as Altcoin Season Indicators Flash Green

Technical signals point to an incoming rally in Ether and altcoins—but $123B in investor capital remains at risk.

Ethereum Breaks Key Technical Threshold, Signals Potential Market Shift

Ethereum (ETH) has once again crossed a crucial technical level that has historically preceded major market rallies—and triggered altcoin booms. As of late May 2025, Ether has reclaimed the mid-line of the Gaussian Channel (approximately $2,600) on its two-week chart, a level that has been a springboard for explosive growth in previous market cycles.

In 2020–2021, ETH surged from $400 to over $4,800 after breaking this same mid-line. A similar pattern repeated in 2023, with Ether jumping from under $1,500 to nearly $4,000 in less than a year.

Now trading above this level once again, ETH is facing resistance at the $3,200 mark—the Gaussian Channel’s upper band. A clean break could open the door to retesting its previous cycle high near $4,100 by July.

Altcoin Market Could Explode if Patterns Repeat

The optimism around Ethereum is also spilling into broader market expectations. According to market analyst Moustache, past ETH rallies above this Gaussian mid-line have corresponded with massive growth in the altcoin market, excluding Ethereum.

After ETH’s breakout in July 2020, the altcoin market cap surged over 1,400% within a year.

Following the November 2023 breakout, altcoins again posted more than 200% gains in the subsequent 12 months.

These historic performances have traders and analysts closely watching for a potential 2025 “altseason”—a period where altcoins outperform Bitcoin in price movement.

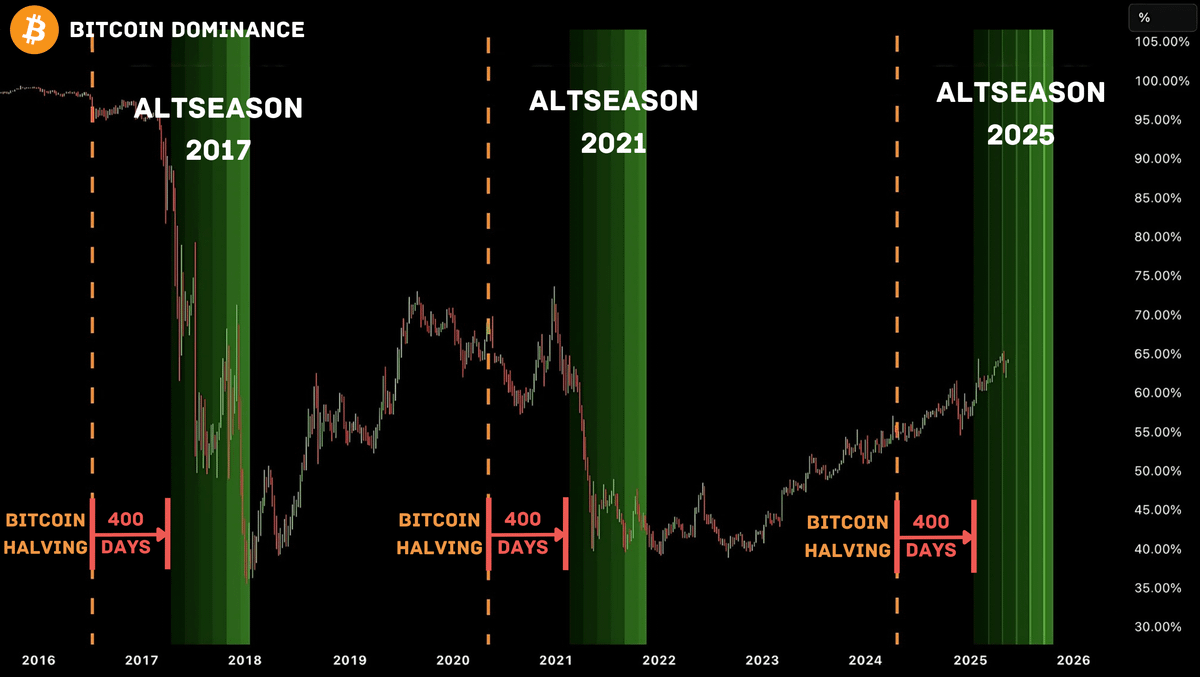

Bitcoin Halving Adds Fuel to the Fire

Another key macro signal bolstering the altseason narrative is the post-Bitcoin halving behavior. In both 2017 and 2021, Bitcoin’s market dominance dropped sharply about 400 days after its halving event, creating space for altcoins to soar.

Following the April 2024 halving, that same 400-day window will hit within the next 100 days—heightening expectations of a repeat pattern.

Analyst Wimar X suggests the altcoin market cap could rise toward $15 trillion if historical dominance trends play out again.

$123 Billion in Ethereum Could Flip to Loss

Despite the bullish setup, Ethereum isn’t in the clear just yet. On-chain data from Glassnode reveals a vulnerability in its current support zone.

A significant $123 billion worth of ETH was purchased between $2,300 and $2,500. A dip below this level could flip a massive portion of holders into unrealized losses, sparking potential panic selling.

This makes ETH’s climb toward $4,100 not just a technical test, but a psychological one as well.

Share This