Bitcoin Could Become Untouchable Above $130K, Bitwise CEO Says

Early Sellers Taper Off as Institutions Drive Demand and Supply Tightens

Hunter Horsley Sees Bitcoin Supply Drying Up Beyond $130K

Once Bitcoin breaks above the $130,000 mark, it may become nearly impossible to buy — not because of price alone, but because no one will be willing to sell, says Bitwise CEO Hunter Horsley.

“Once Bitcoin breaks through $130-150K, no one is going to sell their Bitcoin,” Horsley posted Wednesday on X.

His remarks come as Bitcoin (BTC) trades just shy of its all-time high at $108,698, only $3,272 below the May 22 record of $111,970, according to CoinMarketCap. Over the past 30 days, Bitcoin has gained 6.12%.

Who’s Selling Now? Long-Time Holders Taking Profits

Horsley explained that current selling pressure is largely from early adopters, many of whom acquired Bitcoin at deep discounts years ago and are now cashing out near the psychological $100K level.

“Right now at $100K, it seems individuals who hold a lot of Bitcoin that was bought a long time ago at very low prices are selling some,” he said.

However, this selling is not expected to last.

“Once Bitcoin breaks new levels, this will peter off,” Horsley added.

This observation aligns with Glassnode’s recent warning that older investors began offloading holdings as BTC crossed the $100,000 threshold.

Average Long-Term Holder Now Up 215%

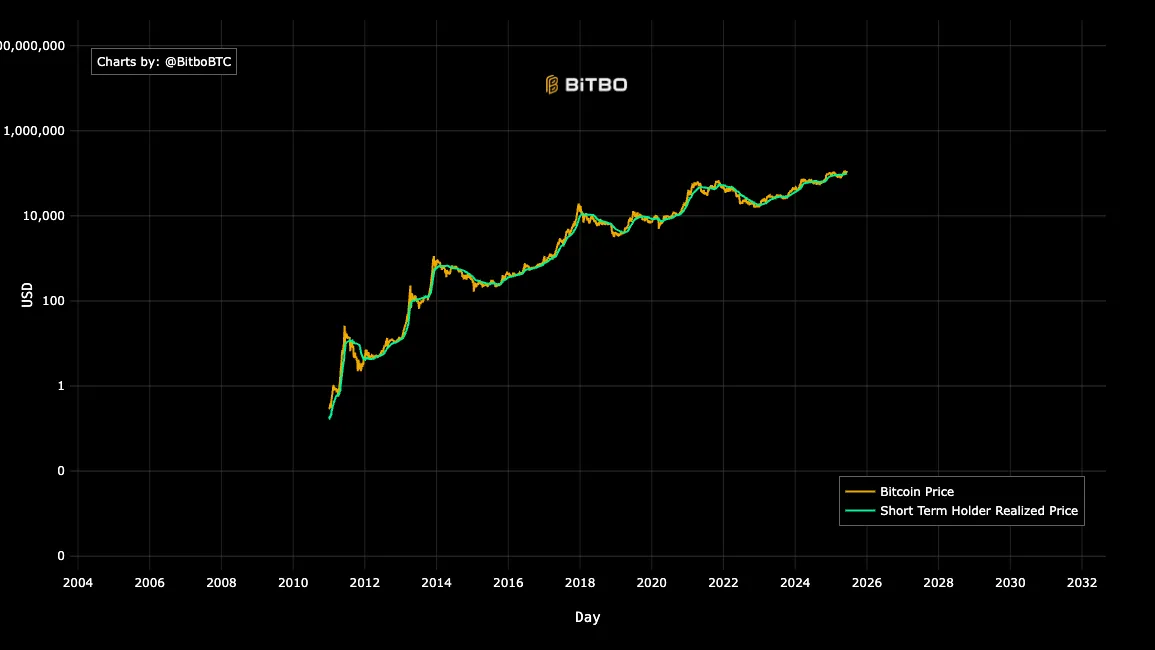

Data from Bitbo shows the average long-term BTC holder — defined as holding for over 155 days — purchased Bitcoin at around $34,414, meaning they’re currently sitting on 215% gains.

In contrast, short-term holders, those who recently entered the market, have an average buy-in of $97,911 — just slightly under the current price — leaving them with modest gains for now.

Holders Will Borrow Instead of Selling

Even with big profits on the table, Horsley believes most Bitcoiners won’t sell. Instead, they’ll leverage their holdings as collateral.

“When people need liquidity, they are going to borrow from an ever-growing set of lenders,” he explained.

This lending infrastructure, according to Horsley, will further accelerate Bitcoin’s price climb.

“There’s simply not going to be enough Bitcoin,” he added.

Market Tightening Already Underway

Evidence of this supply crunch is already showing.

Cointelegraph reports that OTC desks, which facilitate large private transactions, are experiencing reduced supply.

Michael Saylor, co-founder of MicroStrategy, reinforced this view on June 10, stating:

“Only about 450 BTC are available for sale per day from miners — roughly $50 million at current prices.”

Saylor emphasized how thin that supply is:

Share This“If that $50 million is bought, then the price has got to move up. At the current price level, it only takes $50 million to turn the entire driveshaft of the crypto economy in one turn.”