Bitcoin Could Reach $150K After Trump’s New Spending Bill

Analysts Compare Trump’s ‘Big Beautiful Bill’ to 2020’s Post-COVID Surge

As the U.S. prepares to celebrate Independence Day, crypto traders are bracing for another potential Bitcoin rally—this time triggered by President Donald Trump’s newly announced “Big Beautiful Bill.”

The legislation, a major government spending package, is fueling forecasts of a dramatic increase in national debt—and with it, a sharp move in Bitcoin prices. Some analysts say the setup echoes the COVID-19-era spending boom, which pushed BTC up 38% in just weeks following the last major stimulus bill in late 2020.

If history repeats, the math suggests Bitcoin could surge to $150,000 in the weeks following the bill’s signing.

Debt Explosion: $40 Trillion on the Horizon

The warning signs are already flashing.

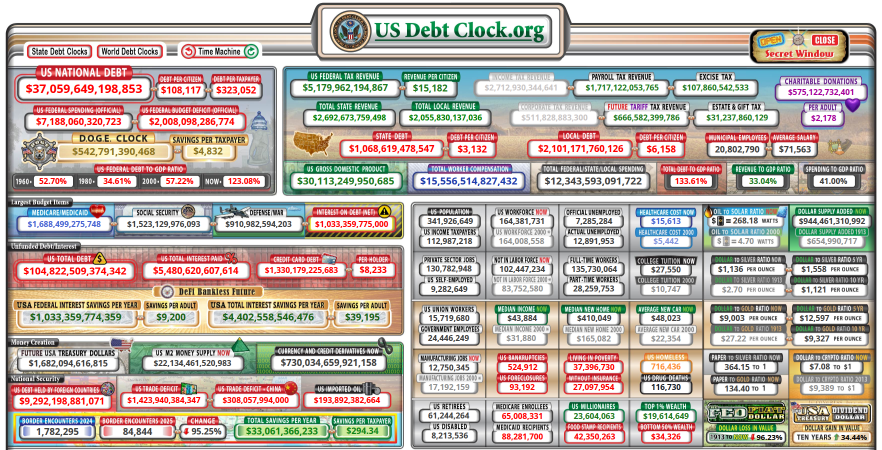

According to The Kobeissi Letter, total U.S. debt is on track to hit $40 trillion by 2025, up from $23.2 trillion at the start of 2020. That’s a $17 trillion jump in just six years—a record pace of borrowing that some financial commentators are calling a “crisis.”

“Never in history has the U.S. borrowed even remotely near the levels we are borrowing now,” Kobeissi wrote in a recent post.

These debt concerns haven’t historically scared Bitcoin investors. In fact, they’ve often acted as rocket fuel.

When Trump signed the $2 trillion COVID relief bill in December 2020, Bitcoin surged 38% in just a few weeks. Traders now say the “Big Beautiful Bill” could offer similar tailwinds.

From Stimulus to Surge: BTC’s Historic Reaction

On-chain analysts and popular crypto influencers like Crypto Rover have pointed out that Bitcoin has repeatedly responded with force to U.S. spending packages. The current bill, while still in process, already carries that same market-altering potential.

Should the past pattern play out again, Bitcoin’s price could rise from its current $108,842 to $150,000—a gain of nearly 40%.

Global Money Supply Reaches $55.4 Trillion

Adding fuel to the fire is the continued rise in global M2 money supply, which reached a new record high of $55.4 trillion this month.

M2, a measure of the amount of liquid money in the world, has long shown a direct relationship with Bitcoin’s performance. While the effects often come with a slight lag, history suggests that rising liquidity typically precedes Bitcoin’s strongest rallies.

Even analysts like Rekt Capital—known for measured takes—acknowledge that M2 increases can continue to impact Bitcoin even after it peaks in a bull market cycle.

What to Watch: Liquidity, Legislation, and Lag

While not every government action produces immediate results, crypto markets are forward-looking. Investors and institutions are now recalibrating their expectations based on Trump’s new fiscal direction.

The combination of soaring debt, expanding money supply, and political momentum behind crypto is forming what some call a perfect storm for Bitcoin’s next move.

But as always, markets come with risk. This is not investment advice—just a sober look at how macroeconomic policy could once again tilt the crypto landscape.

Share This