Bitcoin and Altcoins Test Key Resistance Levels as Bulls Seek Momentum

Crypto Traders Eye Bullish Breakouts Amid Market Headwinds

As the week begins, Bitcoin (BTC) is mounting a fresh charge above $85,000, signaling renewed bullish ambition—yet key resistance levels across the market raise questions about whether this is a sustainable rally or just another false start.

Meanwhile, altcoins like ETH, XRP, SOL, and DOGE are also grappling with resistance levels, creating a tense standoff between bulls and bears in the wake of increased institutional selling pressure.

Bitcoin Surges Past Trendline—But Will $89K Stall the Rally?

Bitcoin surged past a long-term descending trendline on April 12, a level closely watched by technical traders. Bulls managed to hold above this breakout into April 13, suggesting early strength.

The 20-day EMA at $82,979 has flattened, and the Relative Strength Index (RSI) sits near neutral territory—signs that bearish pressure may be cooling off.

“Bitcoin may climb to $89,000, but that’s likely where strong resistance kicks in,” analysts noted.

If rejected at $89,000, BTC could range between $73,777 and $89,000 for the coming days. A failure to hold above the 20-day EMA may trigger a drop toward $78,500 and even deeper toward critical support at $73,777.

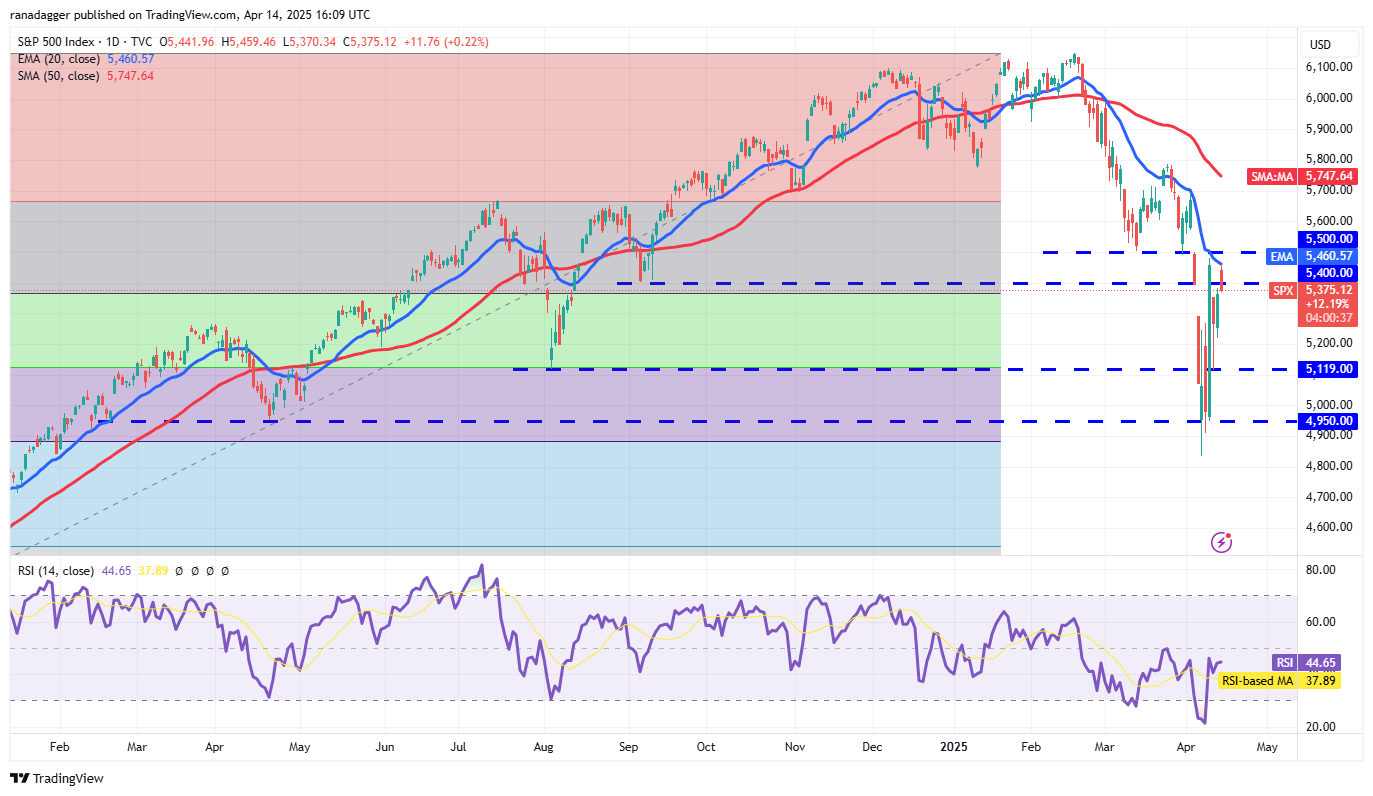

S&P 500 and Dollar Index: Macro Conditions Cloud the Outlook

The S&P 500 (SPX) endured a volatile week, but bullish buying at lower levels hints at investor confidence. Analysts suggest the index could trade between 5,119 and 5,500 until a clearer direction emerges. A breakout above 5,500 might fuel a surge toward 5,800.

In contrast, the US Dollar Index (DXY) continues its decline, closing below 99.57 and raising the risk of further losses toward 97.50 or even 95.00. A return above 99.57 could reverse the trend, but for now, dollar weakness could benefit crypto markets.

Altcoin Analysis: Resistance Tests Across the Board

Ether (ETH)

Ether faced rejection at the 20-day EMA ($1,722), with downside risks pointing toward $1,368 support. However, a push above the 50-day SMA ($1,955) could revive bullish momentum toward $2,111.

XRP

XRP dropped from the 50-day SMA ($2.24), suggesting selling pressure. A break below $2.00 could lead to $1.61, but reclaiming the SMA may trigger a move toward the resistance trendline.

Binance Coin (BNB)

BNB is stuck at the downtrend line, but bulls aren’t backing off. A breakout could lift the pair to $645, while a rejection might extend the current triangular consolidation.

Solana (SOL)

SOL is fighting to hold above the 50-day SMA ($130). If it succeeds, the price could rally toward the $147–$153 resistance zone, with the potential to hit $180 on a breakout.

Dogecoin (DOGE)

DOGE is rebounding but facing resistance from its moving averages. A break above them could target $0.20, potentially forming a double-bottom pattern with a target near $0.26.

Cardano (ADA)

ADA is finding resistance at the 20-day EMA ($0.65). Key support lies at $0.50, while a move above the 50-day SMA ($0.71) may trigger a rally to $1.03.

UNUS SED LEO (LEO)

LEO trades between $9.90 and $8.79, with buyers attempting to break above the 20-day EMA ($9.39). A successful breakout completes a bullish triangle with a target of $12.04, while failure could lead to $8.30.

Institutional Pressure vs. Retail Optimism

While retail traders are showing renewed optimism, institutions remain cautious. MicroStrategy recently added 3,459 BTC worth $285.5 million, signaling long-term faith in Bitcoin. Still, CoinShares reports $795 million in outflows from crypto investment products in the past week, with $7.2 billion withdrawn since February—nearly erasing all gains this year.

This divergence hints at a potential short-term tug-of-war between bullish sentiment and cautious capital.

Final Word: Crypto Markets at a Crossroads

The crypto market is at a technical and emotional inflection point. Key indicators show reduced selling pressure, but formidable resistance levels and macro uncertainty loom large. Whether this rally solidifies or stalls may depend on upcoming economic signals and trader conviction.

Share This