Bitcoin Braces for Volatility: Will $88K Hold Before a Surge to $180K?

Bitcoin markets are heating up as traders prepare for a crucial week packed with high-stakes U.S. economic data and mounting speculation over the next big move. From potential retests of $88,000 to predictions of an explosive rally to $180,000, the next few days could reshape the crypto landscape.

Bitcoin Holds $92K — But Will It Last?

After a strong weekly close just above $93,500, Bitcoin briefly tested support at $92,000. Although the move looked promising, many traders are still bracing for a deeper correction.

Popular trader CrypNuevo remains cautiously optimistic, forecasting a possible surge toward $97,000 before any major downturn. Highlighting the 50-period EMA on the 4-hour chart, CrypNuevo suggests that $91,850 could act as a solid support level.

Meanwhile, trader Roman isn’t convinced. Pointing to the stubborn $94,000 resistance, he warns that Bitcoin could retest $88,000 soon, especially with technical indicators like the stochastic RSI signaling overbought conditions.

“Waiting to see what happens at 88k,” Roman told his X followers, highlighting market indecision between $90K and $92K.

Can Bitcoin do it?

Can Bitcoin Weekly Close above $93500 to start the process of regaining the previous Range?$BTC #Crypto #Bitcoin https://t.co/r5reRJ0HFy pic.twitter.com/5ga0gcSqX4

— Rekt Capital (@rektcapital) April 27, 2025

U.S. Economic Data Could Shake Bitcoin’s Course

A packed economic calendar adds even more tension. Key releases this week include:

-

Q1 GDP figures

-

Nonfarm payroll data

-

April 30 release of the PCE (Personal Consumption Expenditures) index

The Federal Reserve’s preferred inflation gauge, PCE, is especially crucial. With markets already whipsawing from U.S. trade tariffs, any surprises in the data could trigger sharp moves across crypto, stocks, and commodities.

Trading firm The Kobeissi Letter notes that the S&P 500 has swung 2% or more on 23% of trading days this year — one of the most volatile stretches since 2022.

“This has been one of the most volatile years in history,” Kobeissi states, emphasizing the ongoing unpredictability.

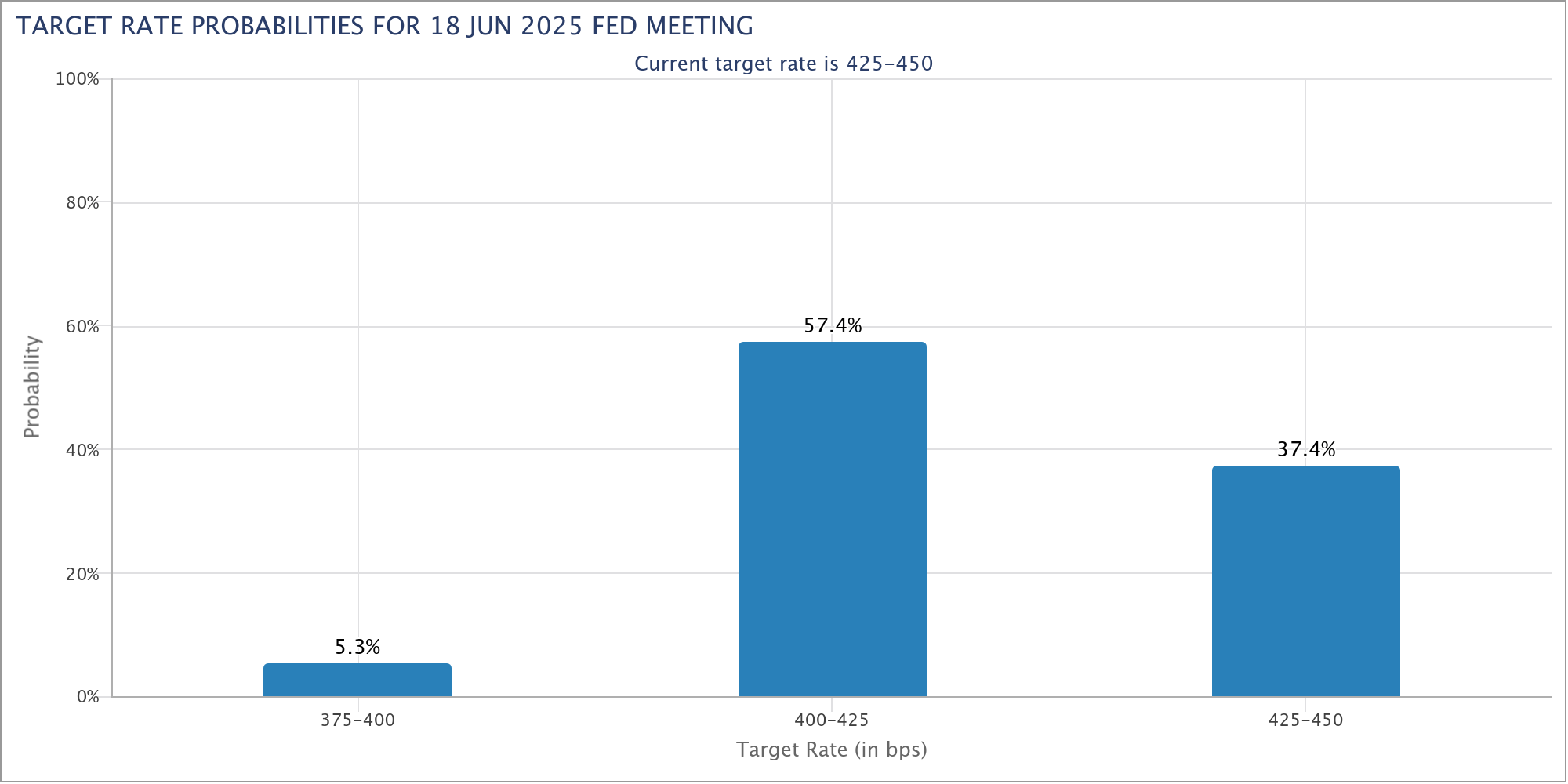

While the Fed holds rates steady for now, rate cuts could come as early as June, according to CME Group’s FedWatch Tool.

Bold Predictions: Bitcoin at $180K Within 18 Months?

Hedge fund founder Dan Tapiero has doubled down on a bold call: Bitcoin reaching $180,000 before summer 2026.

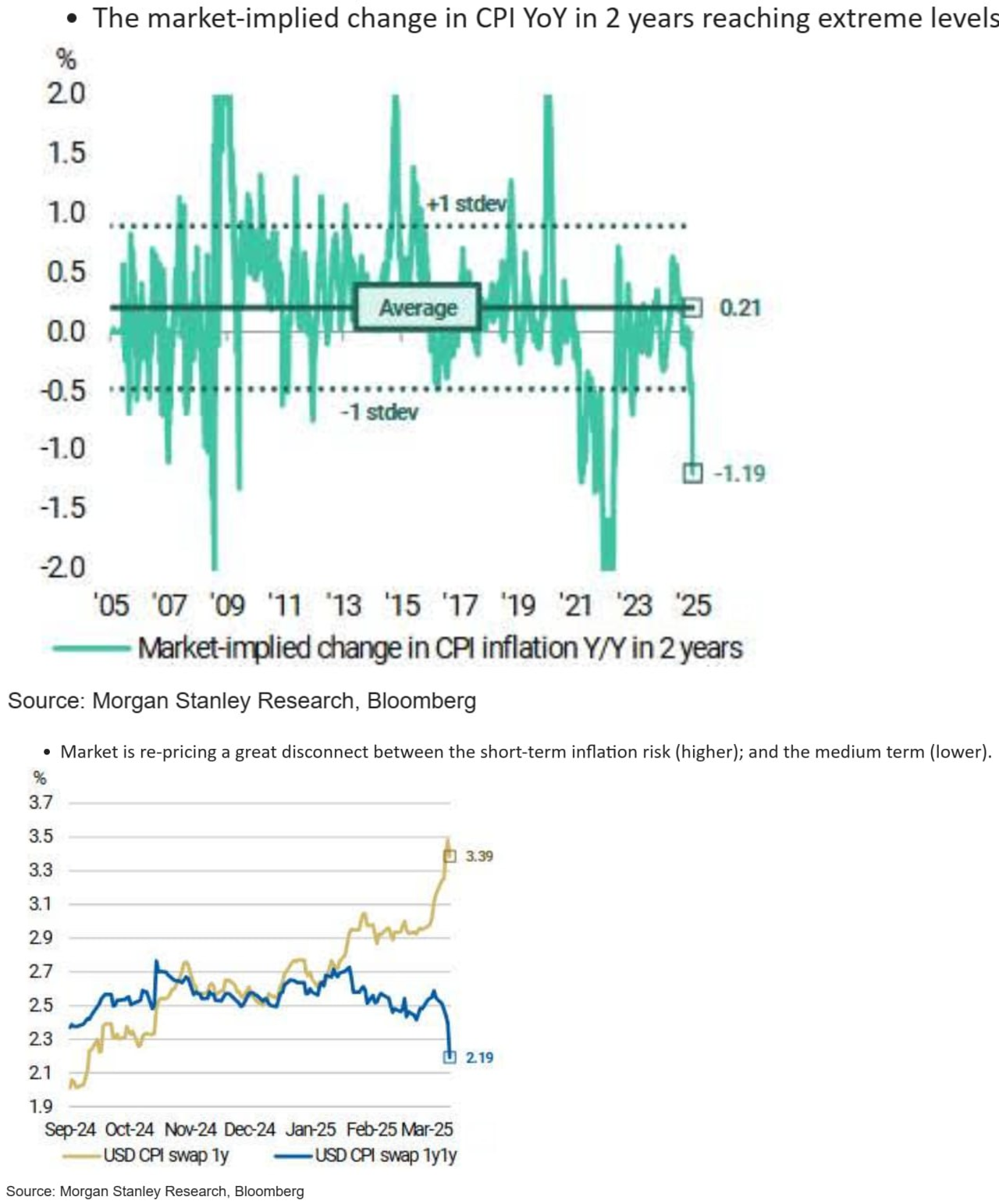

Tapiero cites weakening manufacturing expectations and falling forward market inflation indicators as signals that liquidity will soon flood back into markets — a key catalyst for Bitcoin’s next major leg up.

“Liquidity spigot coming as real rates too restrictive given fiscal tightening,” Tapiero asserts.

Speculators Back in the Black — But Risks Remain

Short-term Bitcoin holders (STHs) — those who bought within the past six months — are once again profitable. Onchain analytics platform CryptoQuant shows their realized price hovering around $92,000, making this level critical.

“If this bull run is to continue, Bitcoin must stay above the STH-Realized Price,” explains CryptoMe from CryptoQuant.

Historically, staying above the STH cost basis has been essential for sustaining bull markets.

However, recent STH coin movements suggest that volatility could spike again, underscoring the fragile balance at play.

Is Greed Setting a Local Top?

Despite a brief dip back to neutral sentiment, recent readings from the Crypto Fear & Greed Index show that “extreme greed” almost took hold last week.

Analytics firm Santiment warns that this rising crowd optimism — measured by bullish social media chatter — could signal a local top if FOMO overtakes rational market behavior.

“The crowd’s greed vs. fear is likely to determine whether Bitcoin forms a local top or breaks out further,” Santiment notes.

As traders hold their breath, one thing is clear: the next moves will be pivotal.