Bitcoin Consolidates Amid Market Shifts: Quantile Regression Predicts $1 Million by 2030

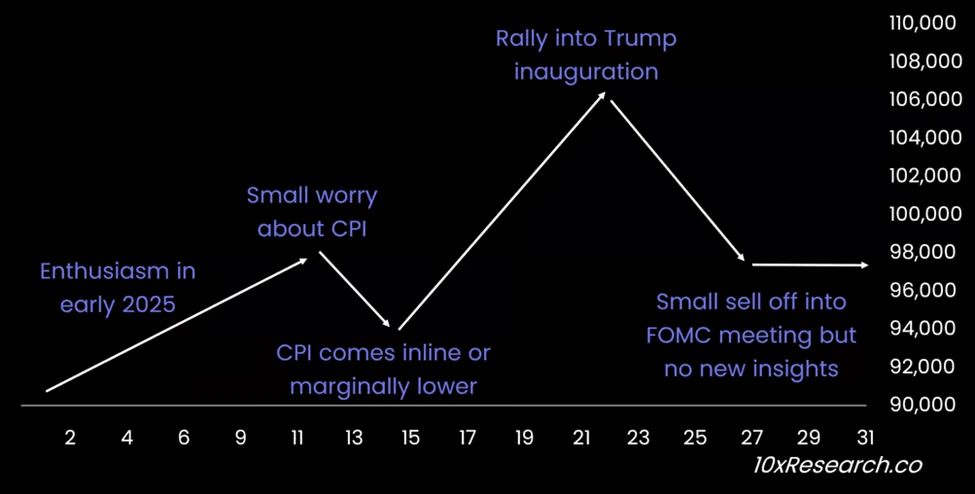

Bitcoin remains in the spotlight as market conditions evolve, presenting both opportunities and challenges for investors. Key economic events in January 2025, including CPI data, the U.S. presidential inauguration, and the Federal Reserve’s FOMC meeting, could significantly influence Bitcoin’s price trajectory.

Early 2025: Key Drivers of Market Volatility

Market analysts predict heightened volatility stemming from the following events:

January 15 CPI Data: A favorable inflation report could fuel optimism, leading to a short-term rally.

January 20 Inauguration of President Trump: Political shifts may spur speculative activity, though the sustainability of any rally remains uncertain.

January 29 FOMC Meeting: Investors anticipate Federal Reserve decisions that could cool market sentiment, potentially causing retracement.

These developments underscore the need for traders to employ tactical positioning rather than relying on a singular directional trend.

Bitcoin’s Market Dominance and Altcoin Challenges

In 2024, Bitcoin’s market dominance surged from 50% to 60%, creating headwinds for altcoins. Despite brief dips to 53%, Bitcoin consolidated at 55% by year-end, maintaining a stronghold over the cryptocurrency market.

Institutional Insights and Projections

Institutional investors increasingly rely on robust research to refine strategies. Reports highlight:

- On-chain data analysis.

- Funding rates and liquidity flow insights.

- Backtested strategies for bullish and bearish conditions.

Short-term forecasts remain divided. John Glover, CIO of Ledn, predicts a dip to $89,000 before rebounding to $125,000 by Q1 2025. Long-term projections are optimistic, with some analysts forecasting Bitcoin reaching $160,000 to $180,000 by late 2025.

Quantile Regression Analysis: A Path to $1 Million

The Bitcoin Quantile Model employs advanced statistical analysis, projecting a potential price of $1 million by the early 2030s. By analyzing various outcomes, the model predicts an upper limit of $947,000 during the 2031–2032 transition. This optimistic trajectory is supported by robust institutional interest and expanding global adoption.

Investor Sentiment and Market Confidence

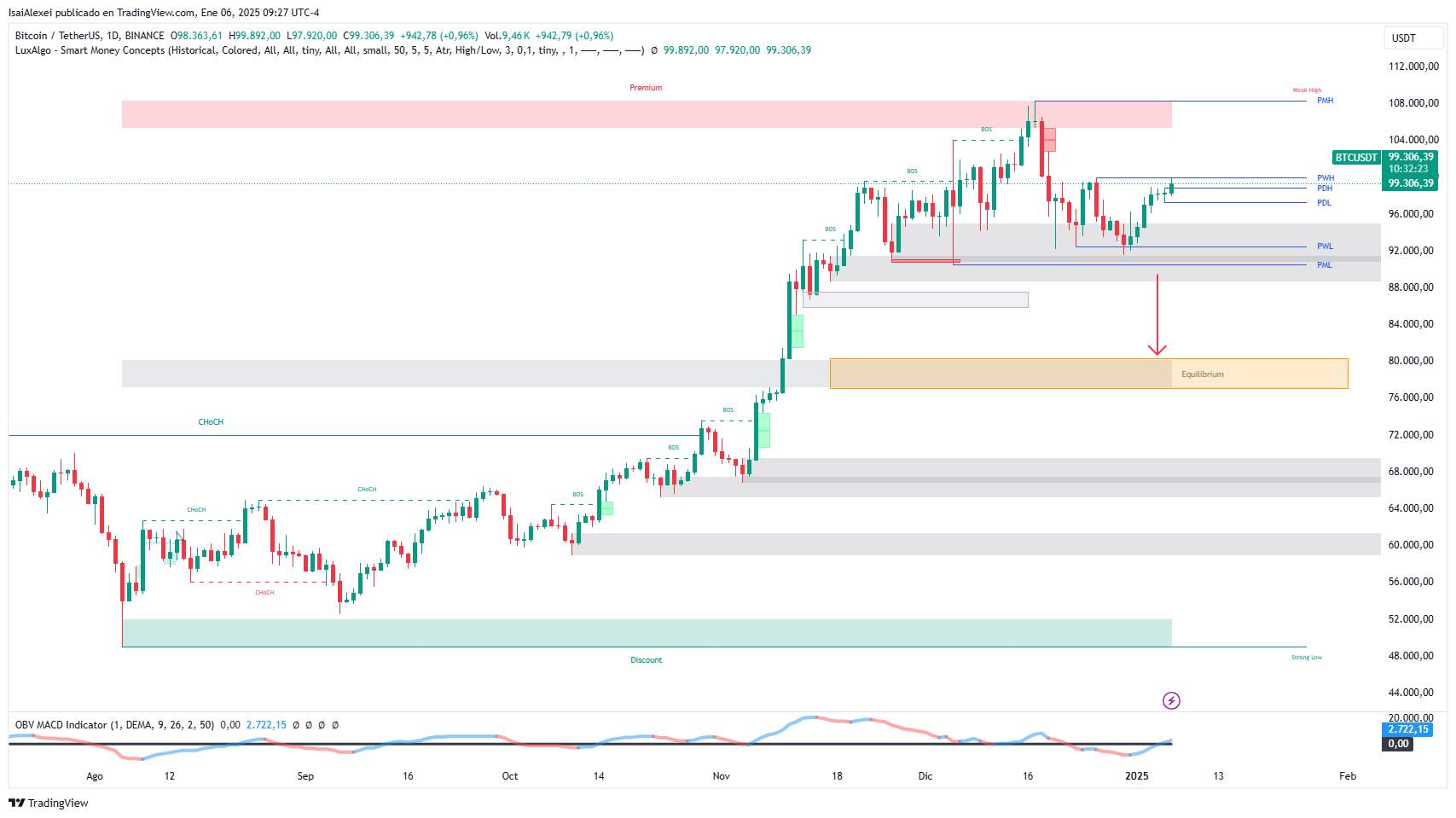

Investor psychology continues to influence short-term trends. The Crypto Fear & Greed Index recently entered the “Extreme Greed” zone, signaling heightened market enthusiasm. Bitcoin currently trades at $99,254, approaching the critical $100,000 resistance level. Analysts suggest a breakout could push prices to the $105,000–$110,000 range.

Institutional Demand Drives Adoption

ETF inflows and increasing national adoption bolster Bitcoin’s status as “digital gold.” Nations like Switzerland and Argentina are exploring its integration into financial reserves, reinforcing Bitcoin’s position as a key asset in global markets.

As the cryptocurrency consolidates near historic highs, traders and investors must remain vigilant, navigating market volatility with a strategic approach. Whether Bitcoin’s long-term potential reaches the forecasted heights, its resilience amid evolving conditions is undeniable.

- Potential Decline in Bitcoin Rally Anticipated Before January FOMC Meeting

- Bitcoin Rally Boosted by Trump Inauguration Could Lose Steam by Month-End, Analyst Warns

- Strong Employment Data Sparks Volatility in Cryptocurrency Markets

- Bitcoin Whales Accumulate Amid Post-Inauguration Price Correction

- Donald Trump’s January 20th Inauguration: Will Bitcoin Face a “Sell the News” Moment?…

- World Liberty Financial Increases Crypto Holdings as Trump Takes Office

- Michael Saylor Teases New Bitcoin Purchase as MicroStrategy's Holdings Reach 447,470 BTC

- 21 Altcoins with Major Token Unlocks This Week: Day-by-Day, Hour-by-Hour Breakdown

- CryptoQuant CEO Highlights Key Drivers of Bitcoin Demand in 2025

- Robert Kiyosaki Predicts Bitcoin to Skyrocket Between $175K and $350K by 2025

- Bitcoin Needs Trading Volume Surge to Break $105K in January

- How Macroeconomic Events Influence Bitcoin Prices

- Bitcoin Price to Hit $1.5 Million by 2035, Predicts Analyst Behind 2024 Rally Forecast

- Bitcoin Hits $110K, But Traders Stay Cautious—What’s Holding Them Back?

- Bitcoin Could Be a “Buy the Dip” Opportunity at $80,000, Says Bravos Research

- Bitcoin and Ethereum Options Worth $3 Billion Expire Amid Crypto Market Frenzy

- What Drives Bitcoin Demand in 2025? CryptoQuant CEO Breaks It Down

- Why Is XRP Surging? Price Hits $3.38 Amid Spot ETF Hype and Regulatory Optimism

- Will Bitcoin’s Momentum Spark an Altcoin Rally?

- KULR Technology Predicts $200K Bitcoin Price After Buying the $97K Dip