Bitcoin Could Be a “Buy the Dip” Opportunity at $80,000, Says Bravos Research

Bitcoin’s parabolic price rally may face a correction, with $80,000 emerging as a key support level, according to a new report from investment research firm Bravos Research. The firm’s latest Macro Report, titled “Is the 2025 Bitcoin crash starting?” warns that Bitcoin’s bullish momentum could falter amid stock market weakness and ETF outflows.

BTC Price at Risk of Rebalancing

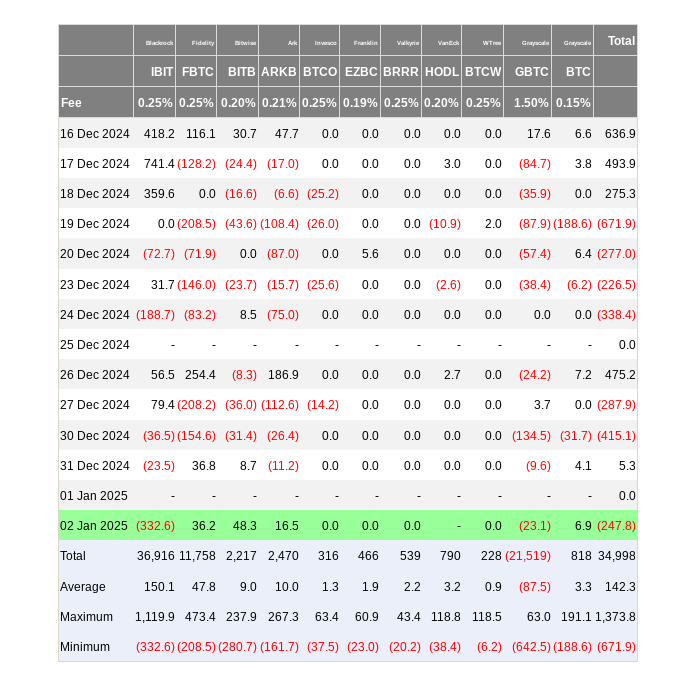

Bitcoin’s current price action, hovering just below the $100,000 mark, is under pressure from several macroeconomic and market factors. Bravos Research highlighted the record outflows from BlackRock’s iShares Bitcoin Trust (IBIT), sluggish stock performance, and a hawkish Federal Reserve as headwinds for the cryptocurrency.

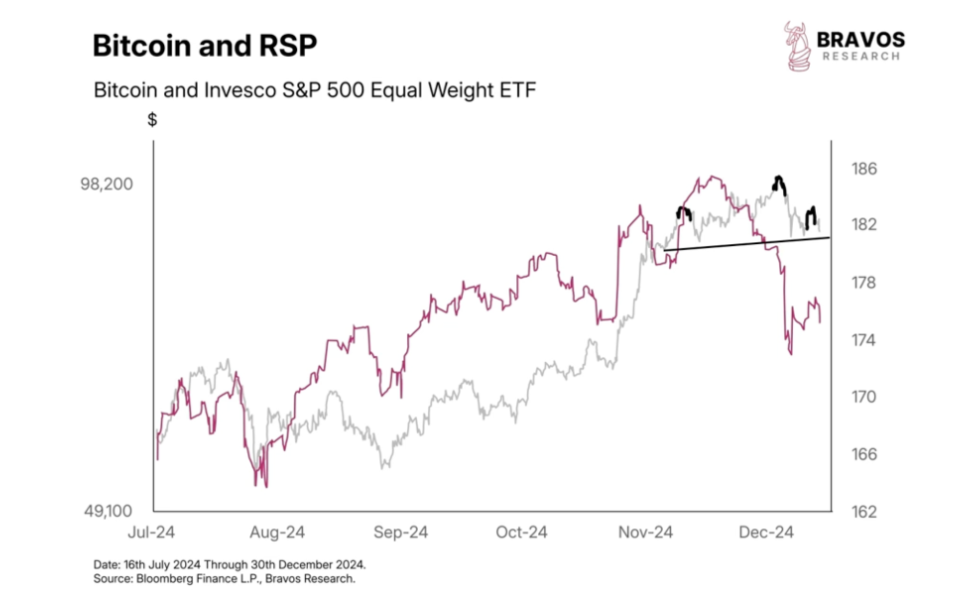

The report suggested that Bitcoin’s price might “catch down” to the weakened stock market, reversing the trend observed in September 2024, when Bitcoin rallied to catch up with stock market strength.

“If Bitcoin corrects, we’d look to buy the dip around $80,000 for the next leg higher,” Bravos wrote.

ETF Flows: A Double-Edged Sword

The report also examined the impact of Bitcoin ETFs on the market. While ETFs have continued to accumulate Bitcoin at a rate of approximately 3,000 BTC daily, their influence on price has been inconsistent.

For instance, even as ETFs added to their holdings in March 2024, Bitcoin’s price dropped by 30%, showcasing the limited direct correlation between ETF inflows and BTC price action.

“Bitcoin ETFs currently own 1.15 million Bitcoin, and still accumulating about 3,000 BTC daily. At this pace, Bitcoin could surge another 50% in 50 days,” the report noted. “However, even a slight slowdown in ETF buying could trigger a decline.”

Market Dynamics: $80,000 a Critical Level

A correction to $80,000 aligns with growing consensus among analysts that the level could act as a buying opportunity for long-term investors. Bravos noted that despite short-term volatility, Bitcoin remains “undeniably in the parabolic stage”, with further upside likely after any pullback.

Broader Implications

Bitcoin’s trajectory remains tied to macroeconomic factors, including:

- Stock market trends, with Bitcoin increasingly correlated to equities.

- ETF activity, which continues to grow as institutional adoption rises.

- Federal Reserve policies, as interest rate adjustments impact risk-on assets like Bitcoin.

What’s Next for Bitcoin?

Bravos Research suggests caution in the near term, advising investors to watch for a potential correction to $80,000, which could present a strategic entry point. With Bitcoin ETFs still accumulating and broader market factors in flux, 2025 promises to be a pivotal year for the cryptocurrency.

As always, investors should perform their own research and remain vigilant about market risks. Bitcoin’s volatility continues to offer both opportunities and challenges for traders and long-term holders alike.

Share This