Bitcoin Drops Below $108K as Hopes for Early Fed Rate Cuts Fade

Lack of economic catalysts and cautious Fed sentiment send BTC lower, with crypto volatility at a standstill.

Wall Street Open Sends Bitcoin Into Retreat

Bitcoin’s price dipped below $108,000 on May 28 as the broader market pulled back amid growing skepticism over U.S. Federal Reserve rate cuts before September. The move, which aligns with a broader risk-off sentiment across financial markets, saw BTC/USD slide toward fresh multiday lows.

According to Cointelegraph Markets Pro and TradingView, BTC came under pressure shortly after Wall Street opened, continuing a downward trend that has persisted through May.

The key driver? Investor sentiment shifting against early rate cuts, a tailwind that had previously buoyed crypto prices.

Odds of a Fed Rate Cut Before September Keep Falling

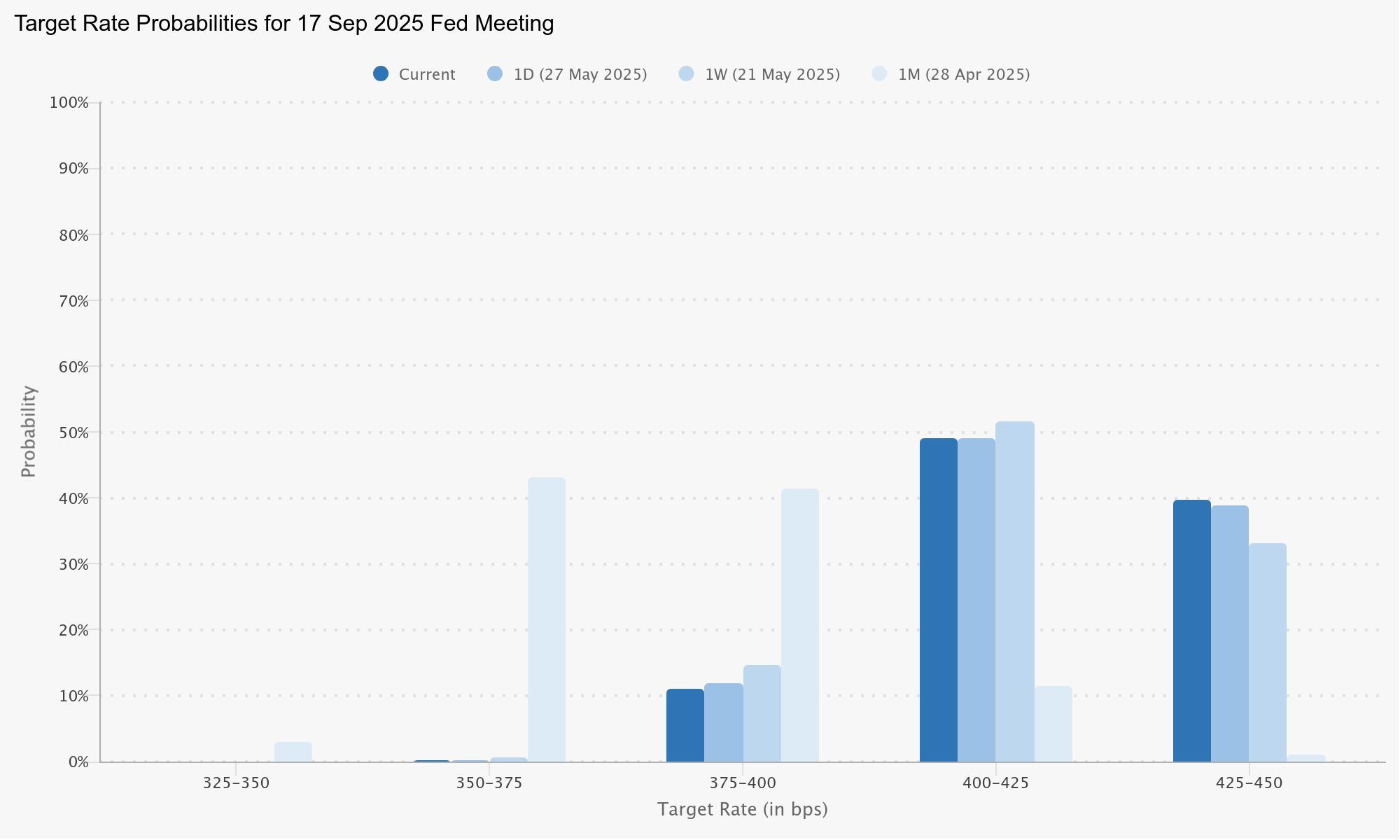

The CME Group’s FedWatch Tool indicated waning expectations for a rate cut before the September FOMC meeting. Market sentiment is adjusting to a new baseline: fewer rate cuts in 2024 and potentially just two cuts in 2025, down from four projected earlier this year.

This repricing of expectations is weighing heavily on risk assets, particularly crypto and tech stocks.

“Markets increasingly see fewer Fed rate cuts this year, with the first only coming in September.”

At the same time, alternative forecasting platforms such as Kalshi echoed similar pessimism, pointing to a reduced outlook for monetary easing.

Labor Market Weakness: A Potential Wild Card

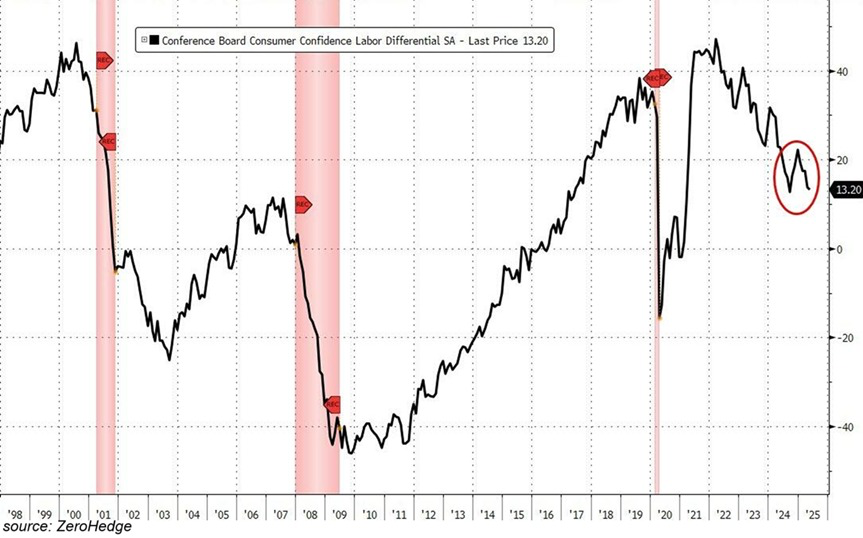

Despite the gloom, not all is lost. In a fresh post to its followers, The Kobeissi Letter flagged a worrying trend in the U.S. labor market: consumer sentiment around job availability is plunging.

“This indicator clearly suggests a further increase in the unemployment rate in the coming months,” the analysis noted, highlighting that declining job optimism is a historic precursor to rising unemployment.

A sharp deterioration in the job market could prompt the Fed to accelerate its rate-cut timeline, potentially offering relief to crypto bulls.

Liquidity Thin, Volatility Missing

Despite the labor market warning signs, Bitcoin continues to lack a clear volatility trigger. The recent dip saw BTC slice through bid liquidity, a phenomenon that trader TheKingfisher warned could open the door to further downside.

“A massive wall of short liquidations sits above $108,900,” he noted, citing data from CoinGlass, “with notable concentration around $109,000–$109,200, creating an imbalance biased toward short liquidations.”

Without fresh catalysts, BTC remains trapped in a narrow range since its all-time high of $112,000, unable to generate sustained momentum in either direction.

Crypto Awaits Its Next Macro Catalyst

In its latest bulletin, QCP Capital underscored the market’s lack of energy:

“Volatility across most asset classes continues to drift lower… Markets appear increasingly inured to negative developments,” it told subscribers.

Even with geopolitical tension and economic risks in the headlines, investors are becoming numb to data releases and macro news. That’s keeping Bitcoin and other risk assets rangebound and reactive rather than proactive.

Until a major shift—be it in economic data, Federal Reserve policy, or an unexpected geopolitical event—crypto markets may continue to drift.

Share This