Bitcoin Investors Withdraw $333M from BlackRock IBIT ETF in Record Outflow

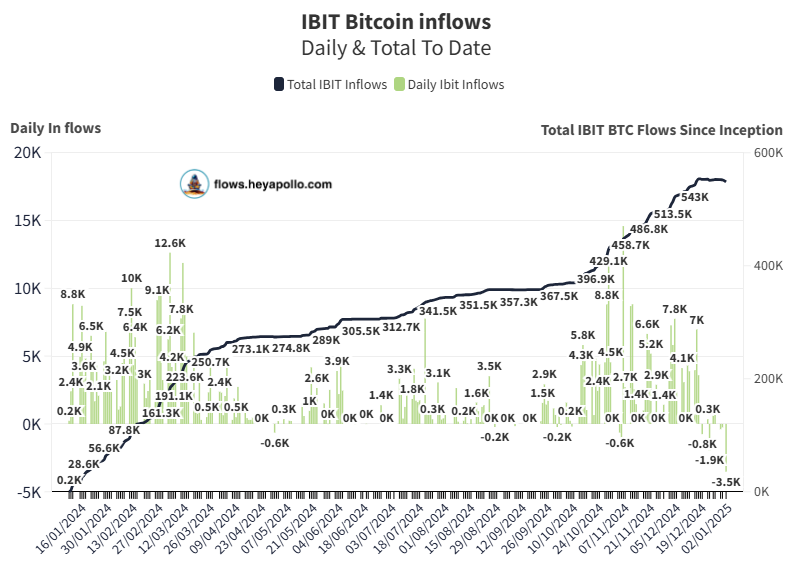

BlackRock’s iShares Bitcoin Trust (IBIT) experienced its largest daily outflow since its launch in January 2024, with investors pulling $332.6 million on January 2, 2025, as U.S. markets reopened after the New Year’s Day holiday. This marked the third consecutive trading day of outflows for the fund, setting yet another record.

Outflows Eclipsing Previous Highs

The latest outflow significantly exceeded the previous record of $188.7 million on December 24, 2024, according to data from Farside Investors. Over the past week, IBIT has experienced cumulative outflows of $392.6 million, raising questions about investor sentiment toward Bitcoin ETFs.

Context: A Leader in Inflows

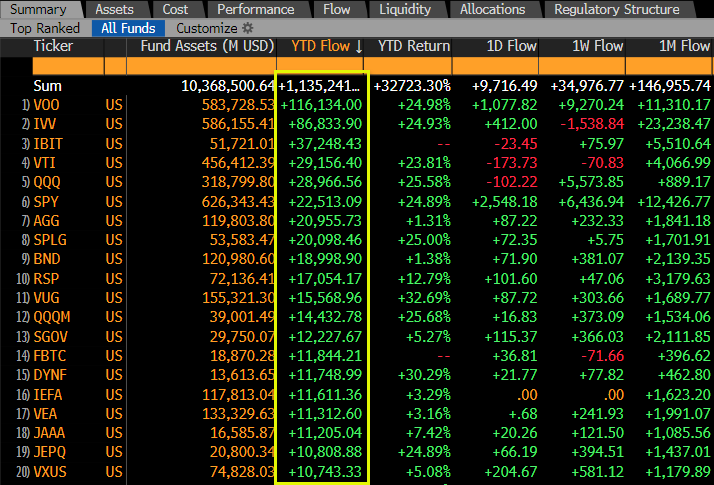

Despite the recent withdrawals, BlackRock’s IBIT remains a major player in the ETF space. In 2024, the fund ranked third among all U.S. ETFs in net inflows, amassing $37.2 billion, according to Bloomberg data shared by senior ETF analyst Eric Balchunas.

The leading ETFs for inflows in 2024 included:

- Vanguard 500 Index Fund: $116 billion

- iShares Core S&P 500 ETF: $89 billion

- BlackRock IBIT: $37.2 billion

Bitcoin pioneer Adam Back noted that Bitcoin ETFs could take the top spot in 2025, driven by increased inflows and rising BTC prices.

Competitors See Inflows

While BlackRock’s IBIT faced significant outflows, other Bitcoin ETFs saw gains on January 2:

- Bitwise Bitcoin ETF: +$48.3 million

- Fidelity Bitcoin ETF: +$36.2 million

- Ark 21Shares Bitcoin ETF: +$16.5 million

- Grayscale Bitcoin Mini Trust: +$6.9 million (though its GBTC fund lost $23.1 million)

Despite these inflows, the net outflow across all Bitcoin ETFs totaled $242 million, largely driven by BlackRock’s withdrawals.

Market Dynamics

The withdrawal trend in IBIT may be an isolated incident or a reaction to broader market conditions. Analysts suggest it could represent profit-taking following Bitcoin’s strong performance in late 2024 or portfolio rebalancing among institutional investors.

BlackRock remains a dominant force, and its influence in the crypto ETF space is unlikely to wane. The fund’s success in 2024 underscores its strong institutional appeal, even as the market faces periodic outflows.

Predictions for 2025

ETF Store president Nate Geraci has outlined bold predictions for crypto ETFs in 2025, including:

- Launch of combined Bitcoin (BTC) and Ether (ETH) ETFs

- Introduction of spot ETH ETF options trading

- Approval of staking-enabled Ether funds

- Possible debut of a spot Solana ETF

Geraci confidently stated, “Actually, these all will happen.”

Looking Ahead

As crypto markets evolve, Bitcoin ETFs are poised to play an increasingly prominent role in mainstream finance. Despite the recent outflows, BlackRock’s IBIT remains a cornerstone of this ecosystem, and upcoming innovations in crypto ETFs may reignite investor interest in 2025. Stay tuned for further developments in this dynamic sector.

Share This