Bitcoin Miners Refuse to Sell Despite Record Highs and Falling Revenue

Satoshi-era miners offload only 150 BTC in 2025 as institutional-style hodling dominates the market.

Veteran Miners Break With Tradition as BTC Approaches All-Time Highs

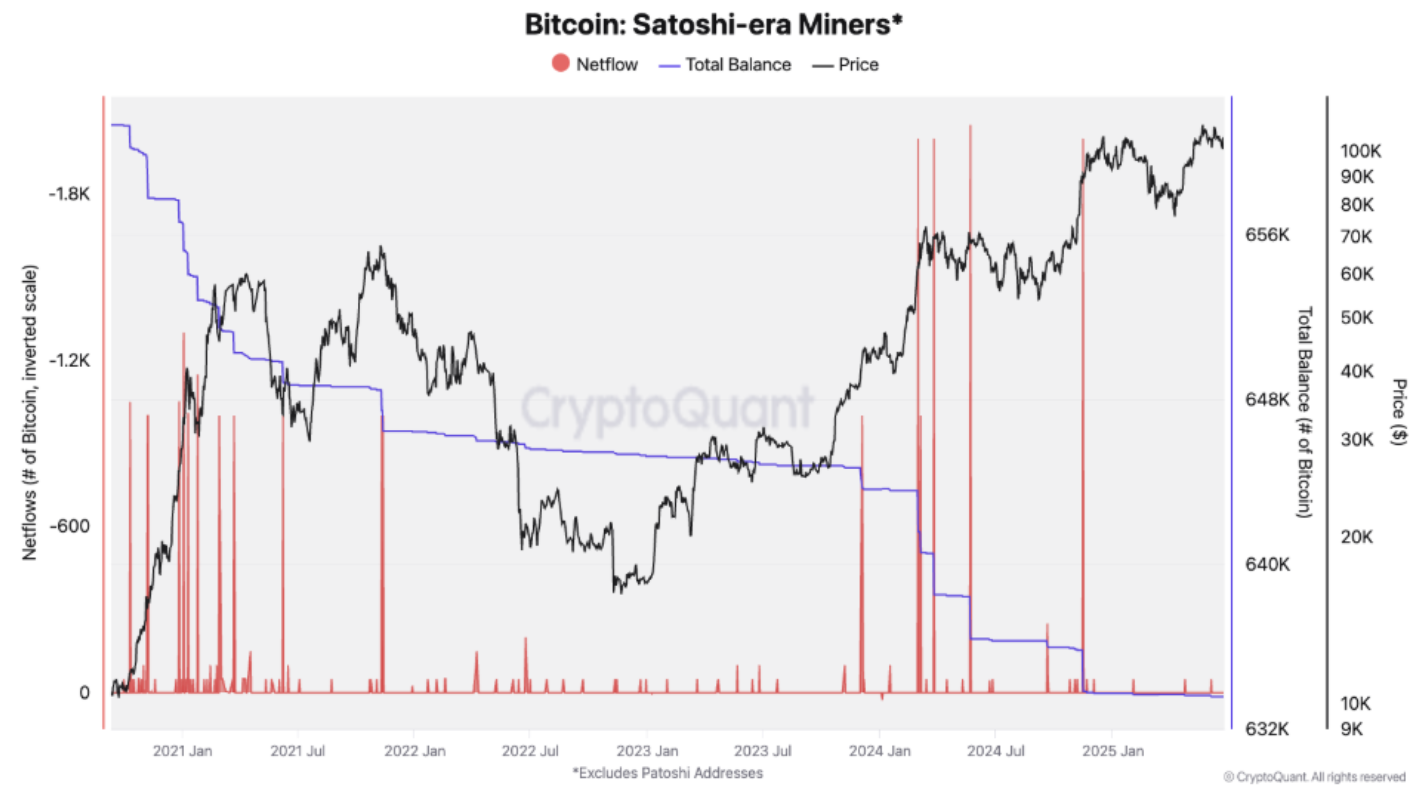

Bitcoin miners are bucking historical trends in 2025. Despite prices hovering near record highs, long-term miners—particularly those from the Satoshi era—have largely refrained from taking profits.

New data from CryptoQuant shows that these early participants have sold just 150 BTC so far this year, compared to nearly 10,000 BTC offloaded in 2024. The move signals a growing trend of long-term conviction among the sector’s most seasoned players.

Miner Profits Fall, But Selling Stays Low

This contrarian behavior comes amid deteriorating economic conditions for miners. As of June 22, daily Bitcoin mining revenue had dropped to $34 million, the lowest since April 20, according to CryptoQuant’s latest Weekly Report.

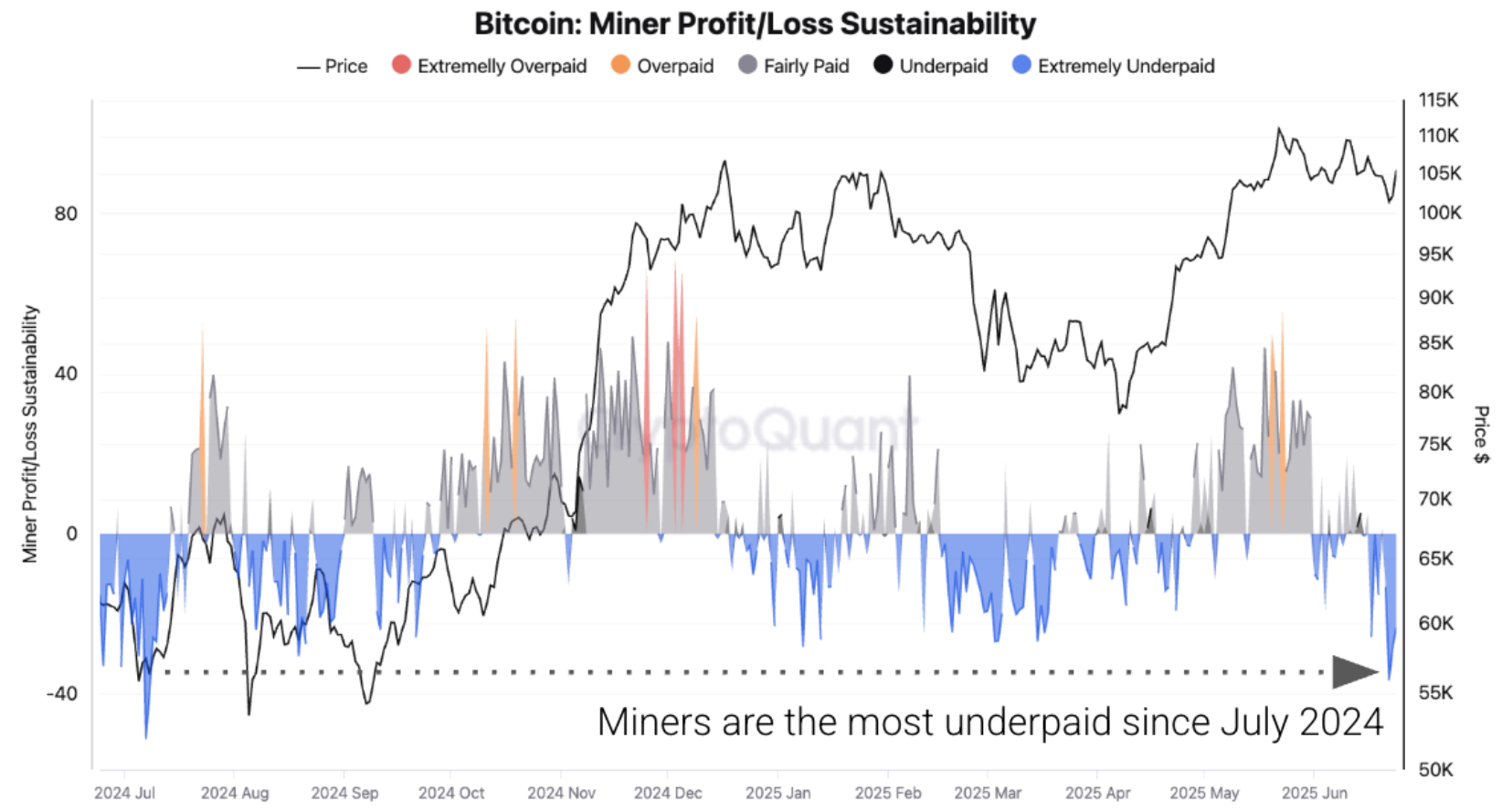

“Bitcoin miners are the most underpaid they have been in the last year,” the report notes, citing declining transaction fees and the recent price pullback as key factors.

Meanwhile, the Bitcoin network hashrate—a key measure of computational activity—has declined 3.5% over the past 10 days, marking the steepest drop since the July 2024 post-halving adjustment, which slashed miner rewards by 50%.

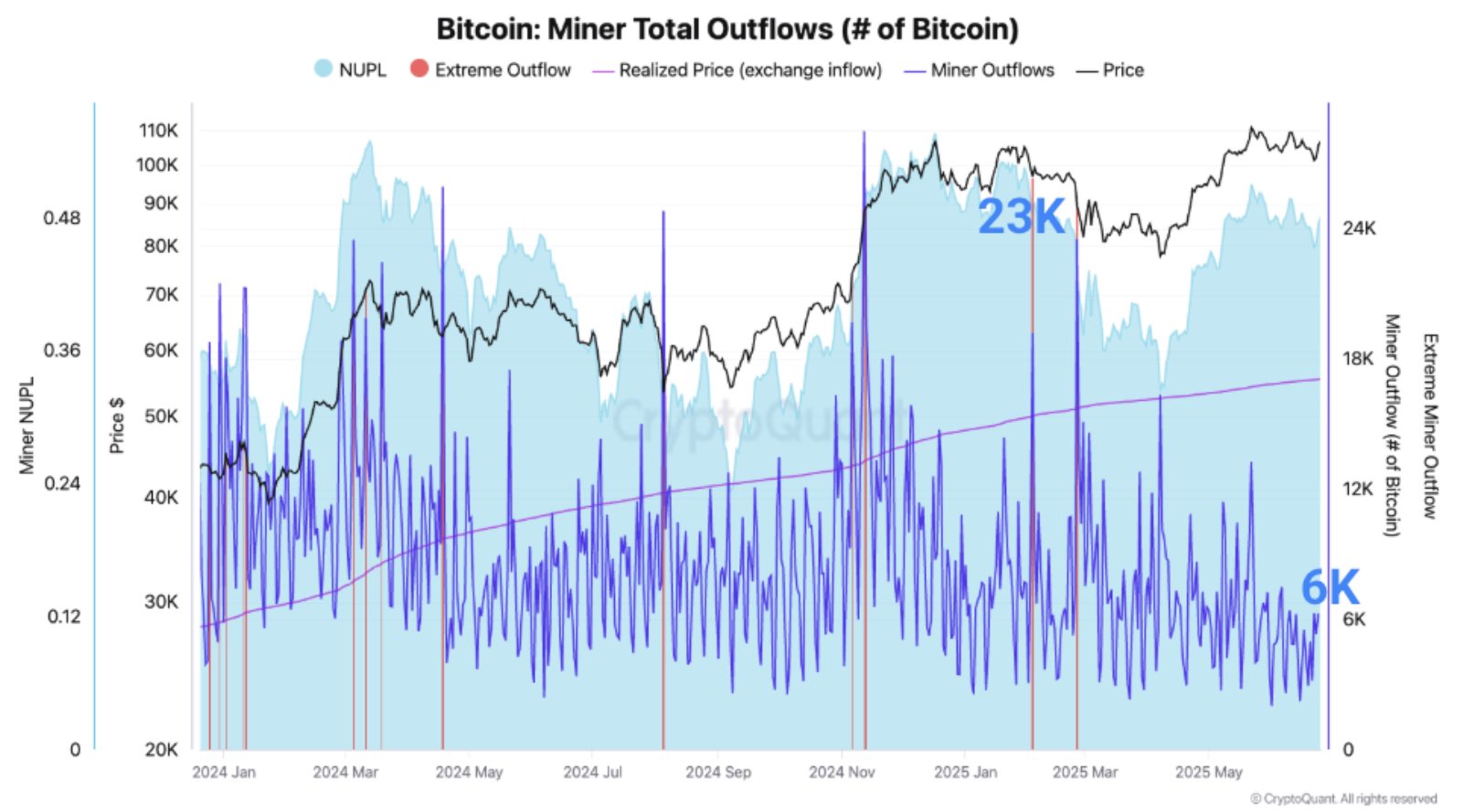

Yet, despite these headwinds, miner outflows have dropped sharply. Daily BTC transfers from miners to exchanges have fallen from a peak of 23,000 BTC in February to just 6,000 BTC today, with no signs of major profit-taking since.

Mid-Tier Miners Add to Reserves

Miners holding between 100 and 1,000 BTC have added 4,000 BTC to their collective holdings since April, bringing their total to 65,000 BTC—the highest level since November 2024. This shift coincides with a local market bottom and reinforces a “buy-the-dip” mentality.

“The sector’s overall 48% operating margin may be encouraging miners to hold,” the report added.

Satoshi-Era Addresses Remain Largely Dormant

The most telling sign of this new market behavior comes from miners believed to have been active since Bitcoin’s earliest days—commonly referred to as Satoshi-era miners. Traditionally known for cashing out during bullish runs, they have instead opted to keep distribution to a minimum in 2025.

“Only 150 BTC sold this year vs. 10,000 BTC last year,” CryptoQuant stated. “This is a fundamental shift in how early adopters are managing their holdings.”

This unexpected restraint suggests a longer-term view even among those who’ve held Bitcoin for over a decade—raising questions about whether another market top is truly near.

Share This