Bitcoin Price Analysis Flashes Red: Experts Warn of Looming ‘Bearish Phase’

A new on-chain metric suggests that Bitcoin (BTC) could be headed toward a bearish phase, even as many traders remain hopeful for continued upside. According to insights from CryptoQuant, the cryptocurrency is flowing out of derivatives exchanges and into spot exchanges, potentially signaling reduced appetite for risk among larger holders.

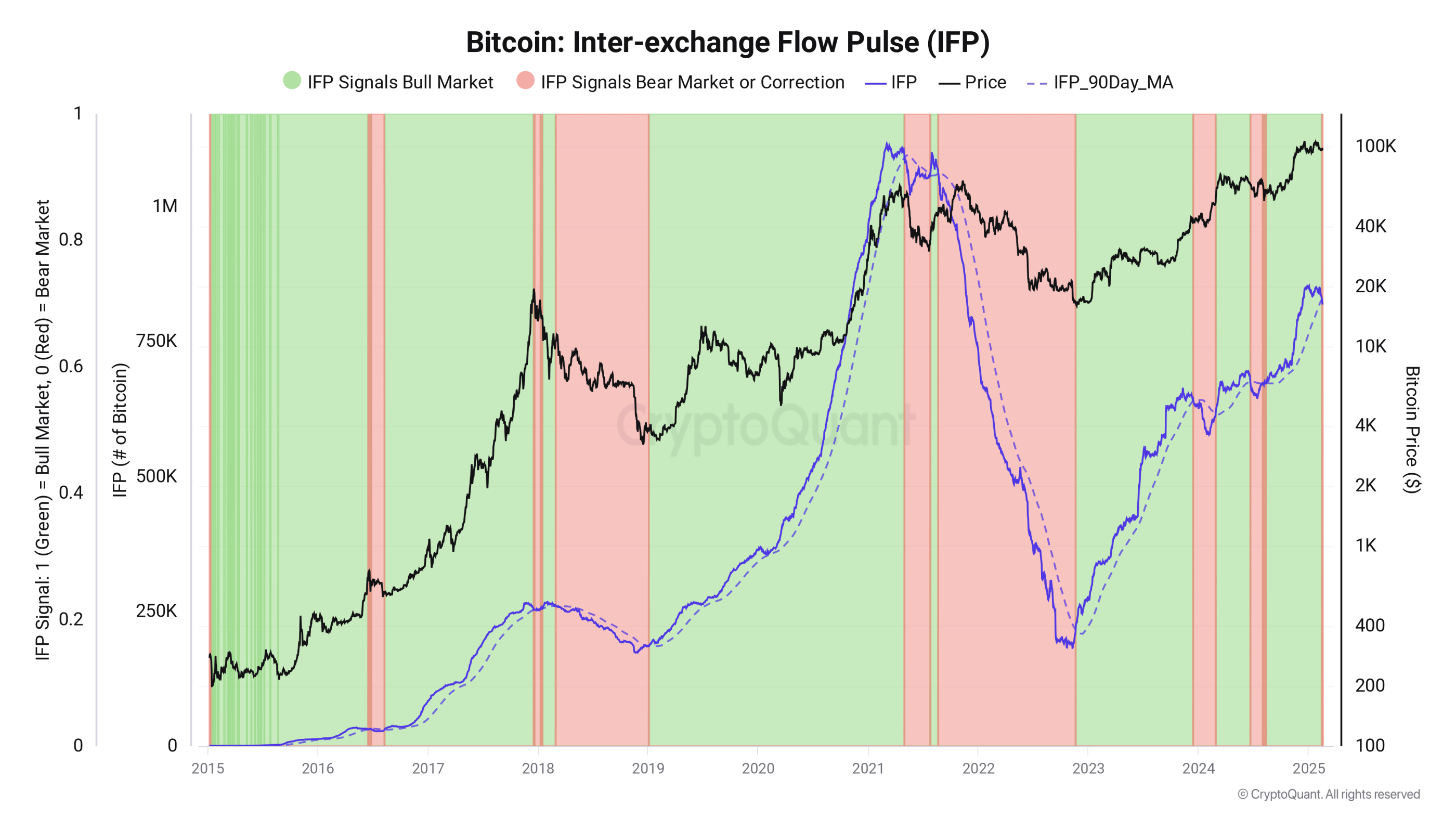

Inter-Exchange Flow Pulse Turns Bearish

A key indicator known as the Inter-Exchange Flow Pulse (IFP) has flipped negative, which in the past has often preceded Bitcoin price downturns. Research by CryptoQuant contributor J. A. Maartunn outlines why this trend is concerning:

“When a significant amount of Bitcoin is transferred to derivative exchanges, the indicator signals a bullish period. This is because traders are moving coins to open long positions. However, when BTC starts to flow out of derivatives and into spot exchanges, it can mark the beginning of a bearish period, often triggered by whales closing long positions and reducing overall exposure.”

The chart accompanying these findings shows the IFP diving downward, traditionally an early indicator of BTC price weakness. According to Maartunn, “Today, the indicator has turned bearish, suggesting a decline in market risk appetite and potentially marking the start of a bearish phase.”

Historically, the IFP peaked in March 2021, just one month before Bitcoin briefly topped $58,000. Notably, in January of this year—when BTC hit a record of $109,000 on the same metric—IFP was still far below its all-time highs. Past cycles indicate that BTC price peaks often align with new IFP highs, potentially signaling that the market is not yet at a major top.

Bullish Outlook Still in Play?

Despite the warning signs from IFP, many analysts remain upbeat about the broader trajectory of Bitcoin. According to various forecasts, the current BTC rally may still have legs, contingent on macroeconomic conditions and global liquidity.

However, recent inflation reports have emboldened the Federal Reserve to maintain a tighter monetary policy, which could delay more favorable conditions for risk assets like cryptocurrencies. Even so, many market-watchers are looking for strong buying support—especially from larger BTC whales—to help identify the next reliable price floor.

In the near term, all eyes are on spot exchange inflows and how major investors choose to navigate these potentially volatile waters. Whether the IFP signal heralds a short-lived dip or the start of a more extended corrective phase remains to be seen, but traders and enthusiasts are keeping close tabs on this critical Bitcoin price metric.

Share This