Bitcoin Targets $120K in January Amid Record Binance Stablecoin Reserves

Bitcoin (BTC) is setting up for a potential rally to $120,000 in January 2025, with analysts forecasting a surge fueled by record stablecoin reserves on Binance.

Key Predictions:

January Rally: Following a 10% correction from its $108,300 all-time high on Dec. 17, Bitcoin may see a breakout driven by increased optimism and the January effect, which often leads to renewed investments. Ryan Lee, chief analyst at Biget Research, predicts BTC could hit $120,000 before a possible correction from profit-taking.

Factors Driving the Rally: Lee cites several factors, including inflows from Bitcoin exchange-traded funds (ETFs), the performance of the US stock market, and FTX repayments scheduled for Jan. 3 as key drivers of Bitcoin’s price movement.

Local Price Top: Based on Bitcoin’s correlation with the global liquidity index, BTC may peak above $110,000 before experiencing a correction.

Record Binance Stablecoin Reserves:

$45 Billion in Reserves: Bitcoin’s potential rally is supported by nearly $45 billion in stablecoin reserves waiting to be deployed on Binance. These reserves reached an all-time high of $44.5 billion on Dec. 31, nearing the previous record of $45.8 billion on Dec. 11.

Stablecoin Impact: Stablecoins are the main gateway for investors moving from fiat to crypto, and increasing inflows to exchanges like Binance signal growing buying pressure. On Dec. 11, Bitcoin surged 4.7% in a day, driven by these reserves.

Resistance Levels and Market Outlook:

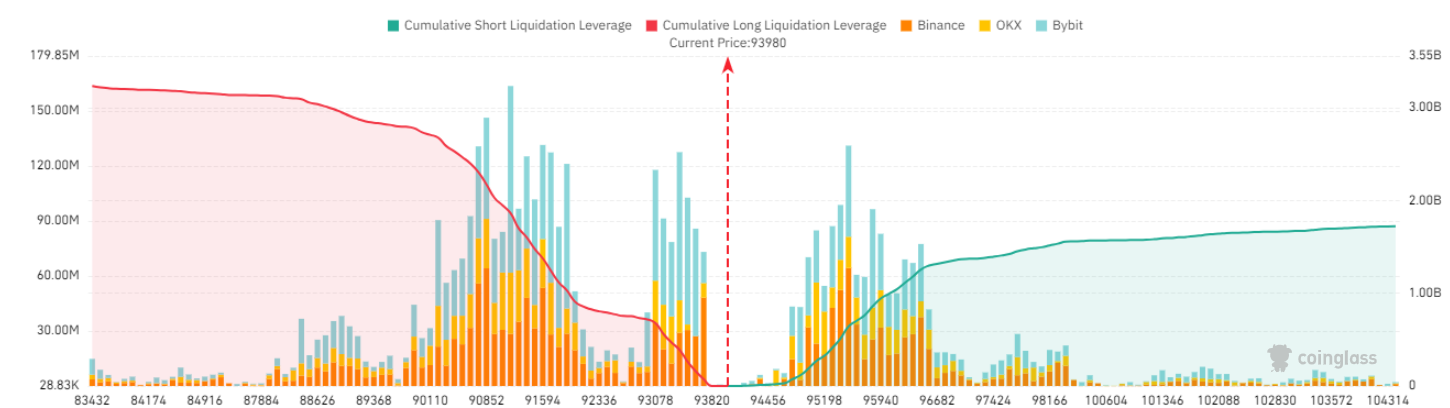

Key Resistance: Bitcoin needs to break through significant resistance levels at $95,000 and $96,400. A move above $96,400 could trigger liquidations of $1.24 billion in leveraged short positions across crypto exchanges.

Optimistic 2025 Outlook: Analysts remain optimistic about Bitcoin’s future, with some predicting a rise to $160,000 in 2025, driven by improving US financial policy and continued institutional adoption.

As Bitcoin targets $120,000 in January, the combination of growing stablecoin reserves and market optimism sets the stage for a strong start to the new year. However, investors should monitor resistance levels and potential market corrections.

- Bitcoin Rally Boosted by Trump Inauguration Could Lose Steam by Month-End, Analyst Warns

- Potential Decline in Bitcoin Rally Anticipated Before January FOMC Meeting

- Bitcoin Price to Hit $1.5 Million by 2035, Predicts Analyst Behind 2024 Rally Forecast

- BTC Exchange Inflows and Miner Outflows Drop — Can Bitcoin Reclaim $100K?

- KULR Technology Predicts $200K Bitcoin Price After Buying the $97K Dip

- Bitcoin Needs Trading Volume Surge to Break $105K in January

- Bitcoin Whales Accumulate Amid Post-Inauguration Price Correction

- Donald Trump’s January 20th Inauguration: Will Bitcoin Face a “Sell the News” Moment?…

- Filecoin Poised for a 3,000% Pump: Analyst Sets $190.95 Target This Altseason

- Bitcoin Faces Price Correction as Whales Drive Selling Pressure

- Bitcoin Price Could Hit $249K by 2025: Market Inflows and Halving Cycles Set Stage for…

- How High Can Bitcoin Go? Analysts Eye $120,000 and Beyond

- $30 MANA and $15 RENDER ATH Targets Expected This Altseason, Analysts Say

- Bernstein Sets Bold $200,000 Bitcoin Price Target for 2025

- Why Is XRP Surging? Price Hits $3.38 Amid Spot ETF Hype and Regulatory Optimism

- XRP Surges 16% Amid Speculation of SEC Shakeup and ETF Approval

- Michael Saylor Teases New Bitcoin Purchase as MicroStrategy's Holdings Reach 447,470 BTC

- Bitcoin Could Be a “Buy the Dip” Opportunity at $80,000, Says Bravos Research

- Bitcoin Investors Withdraw $333M from BlackRock IBIT ETF in Record Outflow

- Franklin Templeton Predicts Global Expansion of Bitcoin Reserves in 2025