KULR Technology Predicts $200K Bitcoin Price After Buying the $97K Dip

KULR Technology Group, a New York Stock Exchange-listed firm, has made bold predictions of Bitcoin (BTC) reaching a peak of $200,000 during the 2025 market cycle. The company recently invested $21 million in Bitcoin at an average price of $97,391.

Strategic Bitcoin Purchase Signals Confidence

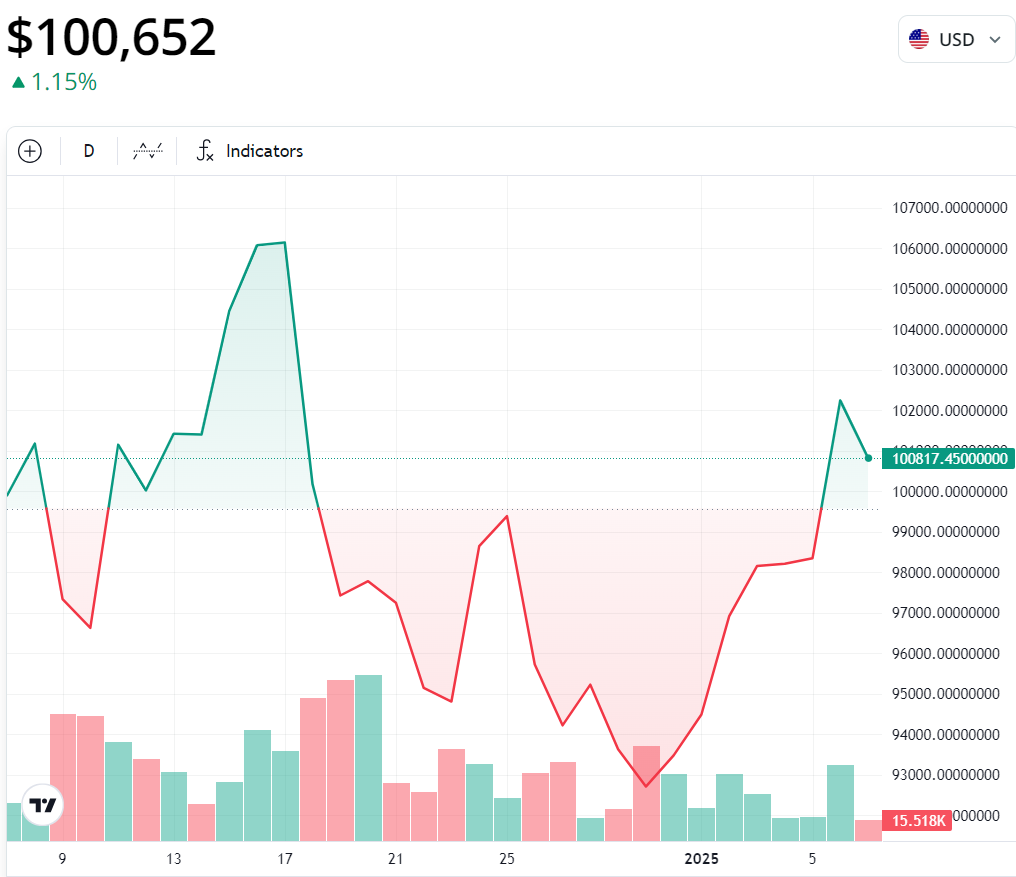

On January 6, KULR Technology Group announced the acquisition of 217.18 BTC, valued at approximately $21 million, as part of its newly launched Bitcoin treasury strategy. The purchase occurred hours before Bitcoin reclaimed the $100,000 milestone, marking a significant vote of confidence in the cryptocurrency.

Michael Mo, CEO of KULR Technology, expressed optimism for Bitcoin’s future, stating:

“The biggest catalyst is the adoption of a strategic BTC reserve by nations and states. The US, Germany, Switzerland, and others are currently exploring this.”

Bitcoin’s Road to $200K

KULR predicts Bitcoin could double its current price and achieve a $200,000 peak in 2025, driven by factors such as global adoption and increasing institutional interest. According to Mo, the creation of strategic Bitcoin reserves by countries could propel the cryptocurrency to unprecedented levels.

The US Bitcoin Act, championed by Senator Cynthia Lummis, aims to establish a strategic Bitcoin reserve. If passed, this legislation could accelerate Bitcoin’s rise, with some experts, including Adam Back, CEO of Blockstream, predicting a potential price of $1 million for the asset.

However, to reach $200,000, Bitcoin’s market capitalization would need to increase by an additional $2 trillion, surpassing Apple’s $3.7 trillion market cap to become the world’s second-largest asset.

Crypto Regulations and Fed Policy to Shape Bitcoin’s Path

According to a report by Binance Research, Bitcoin’s rally to its all-time high of $108,300 was fueled by expectations of improved crypto regulations and monetary policy shifts. However, the Federal Reserve’s decision to scale back planned 2025 interest rate cuts triggered a sharp correction, briefly pulling Bitcoin below $100,000.

Binance’s analysis noted:

“The rally faltered in late December when the Federal Reserve reduced its planned 2025 rate cuts from four to two, despite a modest 0.25% cut during the month, wiping over $0.5 trillion from the cryptocurrency market capitalization.”

The CME Group’s FedWatch Tool suggests a 90.9% likelihood of holding current rates steady, further influencing Bitcoin’s trajectory in the near term.

Institutional Adoption Gains Momentum

As 2025 begins, signs of increasing institutional interest in Bitcoin are emerging. The Czech National Bank recently announced plans to explore Bitcoin as part of its foreign exchange reserve diversification strategy. Such moves reflect growing confidence in Bitcoin’s potential as a reserve asset.

Looking Ahead

Bitcoin’s climb to $200,000 hinges on several factors, including regulatory developments, Federal Reserve policy, and institutional adoption. As nations and corporations increasingly embrace Bitcoin, its role as a global asset continues to solidify.

KULR’s strategic investment and optimistic outlook underscore the growing importance of Bitcoin in both financial and geopolitical arenas.

Share This