MicroStrategy Nears S&P 500 Spot as Bitcoin Holds Key Price Level

Michael Saylor’s firm could become the second crypto-linked company in the index — but it all hinges on Bitcoin staying above $95,240.

Analyst: “91% Chance” for Strategy’s Entry by Quarter’s End

Financial analyst Jeff Walton believes MicroStrategy (MSTR) — trading under the ticker Strategy — stands a 91% chance of securing a place in the S&P 500 by the end of Q2 2025. But there’s one condition: Bitcoin must not drop more than 10% below its current level before June 30.

Speaking in a video released Tuesday, Walton pegged the crucial BTC support at $95,240, explaining that any dip below this mark would disqualify the company from meeting the S&P’s eligibility requirement of positive cumulative earnings over the past four quarters.

“If Bitcoin falls below $95,240, the Q2 numbers won’t offset the previous three quarters of losses,” Walton said.

As of publication, Bitcoin trades at $106,200, giving Strategy a buffer — for now.

Bitcoin Price Is Driving MicroStrategy’s Accounting Shift

MicroStrategy currently holds 592,345 BTC, making it the largest Bitcoin-holding public company. As of Jan. 1, it adopted the ASU 2023-08 accounting standard, which requires crypto assets to be marked to fair market value at each reporting period, directly impacting net income.

This makes Bitcoin’s end-of-quarter price critically important.

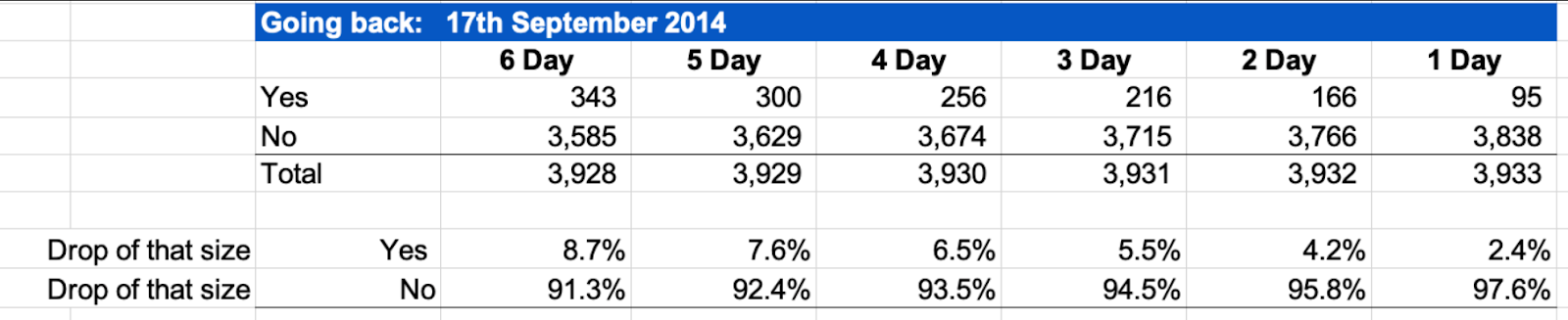

“Going back to September 17, 2014, there have been 3,928 six-day periods,” Walton explained. “In just 343 of those, Bitcoin dropped more than 10% — that’s 8.7%. The rest, 91%, stayed within range.”

Probability Increases as Time Runs Out

As the Q2 deadline (June 30) nears, the statistical odds increase in MicroStrategy’s favor. Walton detailed the decreasing likelihood of a 10% drop as days pass:

-

5 days remaining: 92.4% chance

-

4 days remaining: 93.4% chance

-

3 days remaining: 94.5% chance

-

2 days remaining: 95.8% chance

-

1 day remaining: 97.6% chance

Despite recent market turbulence — including a brief drop below $100K on June 23 due to tensions between Iran and Israel — Bitcoin has bounced back.

Coinbase and Strategy Lead Crypto’s March into Major Indexes

If MicroStrategy makes it, it will become the second crypto-related company in the S&P 500 this year, following Coinbase’s inclusion in May.

Meryem Habibi, Chief Revenue Officer at Bitpace, commented on the shift:

“It cements the legitimacy of an entire asset class.”

Strategy already joined the Nasdaq-100 in December 2024, a key benchmark for the top tech and growth firms.

Share This