Nexo Returns to the U.S. Market as Trump Jr. Highlights Crypto’s Future Amid New SEC Leadership

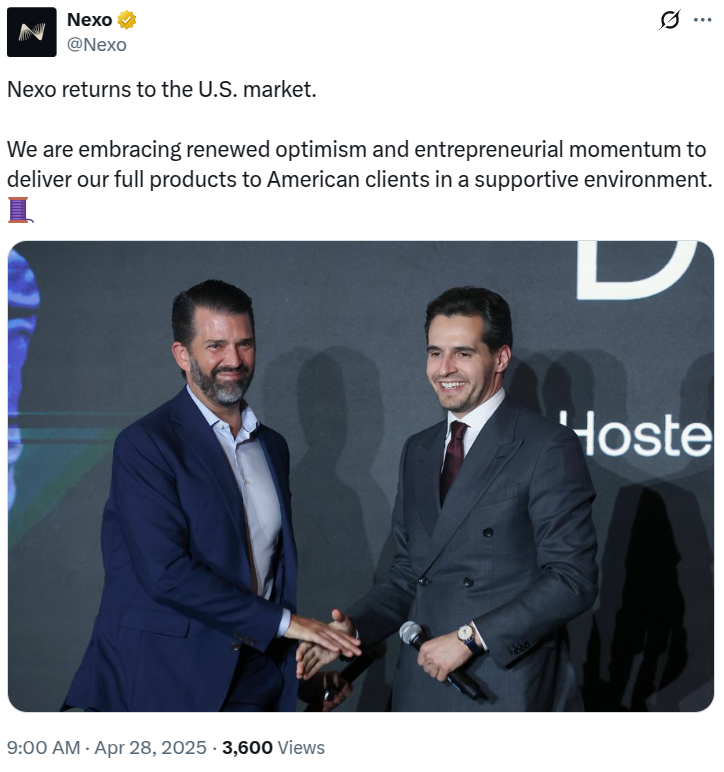

In a significant move for the cryptocurrency space, Nexo, a prominent cryptocurrency services platform, has announced its reentry into the U.S. market after navigating a series of regulatory challenges. The announcement, made on April 28, was marked by an exclusive event that featured Donald Trump Jr., who expressed strong support for the crypto industry’s future and the need for a proactive regulatory framework.

Nexo’s Comeback to the U.S. Market

After leaving the U.S. in late 2022 due to regulatory uncertainty, Nexo is ready to return, buoyed by a shift in the regulatory environment. At the event, Trump Jr. emphasized that cryptocurrency is the future of finance, and he sees crypto’s potential as a catalyst for transforming the financial sector. “We see the opportunity for the financial sector and want to ensure we bring that back to the U.S.,” Trump Jr. noted.

Trump Jr. further underscored the importance of a supportive regulatory environment, stating that “the key to everything crypto is going to be the regulatory framework.”

The SEC’s Changing Stance on Crypto Regulation

This shift in regulatory sentiment coincides with the recent appointment of Paul Atkins as the new chair of the U.S. Securities and Exchange Commission (SEC). Once considered a significant roadblock to the crypto industry, the SEC’s change in leadership is seen by many as a turning point. Paul Atkins’ appointment has generated optimism, with Michael Saylor, CEO of Strategy (formerly MicroStrategy), commenting, “SEC Chairman Paul Atkins will be good for Bitcoin.”

James Gernetzke, CFO of Exodus, a leading crypto wallet provider, echoed similar sentiments, stating, “The promise of being able to engage with a regulator on a reasonable basis is going to be very helpful.”

The new leadership at the SEC signals a potentially friendlier regulatory environment for the cryptocurrency industry, which has struggled with ambiguity around the status of certain crypto products, including Nexo’s interest-earning product.

Nexo’s Legal Challenges and Settlement with the SEC

Nexo’s return to the U.S. follows a period of legal battles and regulatory challenges. In early 2023, the company reached a $45 million settlement with the SEC due to its failure to register its interest-earning product as a security. This product allowed customers to earn compounding yields on certain cryptocurrencies, but it faced scrutiny from regulators who argued that it constituted an unqualified security.

Additionally, the California Department of Financial Protection and Innovation issued a desist and refrain order against Nexo’s interest-earning product, further complicating the company’s U.S. operations.

In the wake of these regulatory hurdles, Nexo shut down its interest-earning product for U.S.-based customers, marking a major shift in the company’s strategy.

The Road Ahead for Nexo in the U.S.

Despite these setbacks, Nexo is optimistic about its return to the U.S. market, particularly with the evolving regulatory landscape under Paul Atkins’ leadership. While the company declined to comment further on its plans, industry observers are hopeful that a more collaborative approach between crypto companies and regulators could pave the way for a more robust and transparent regulatory framework.

As Nexo reenters the U.S. market, it will face the challenge of rebuilding trust and navigating the shifting regulatory terrain. However, with the backing of key figures like Trump Jr. and the SEC’s evolving stance, the company’s prospects for success are looking brighter.

Share This