Ripple vs SEC: Court Approves 60-Day Pause as Settlement Talks Advance

Ripple and SEC Seek Resolution After Years of Legal Battles Over XRP

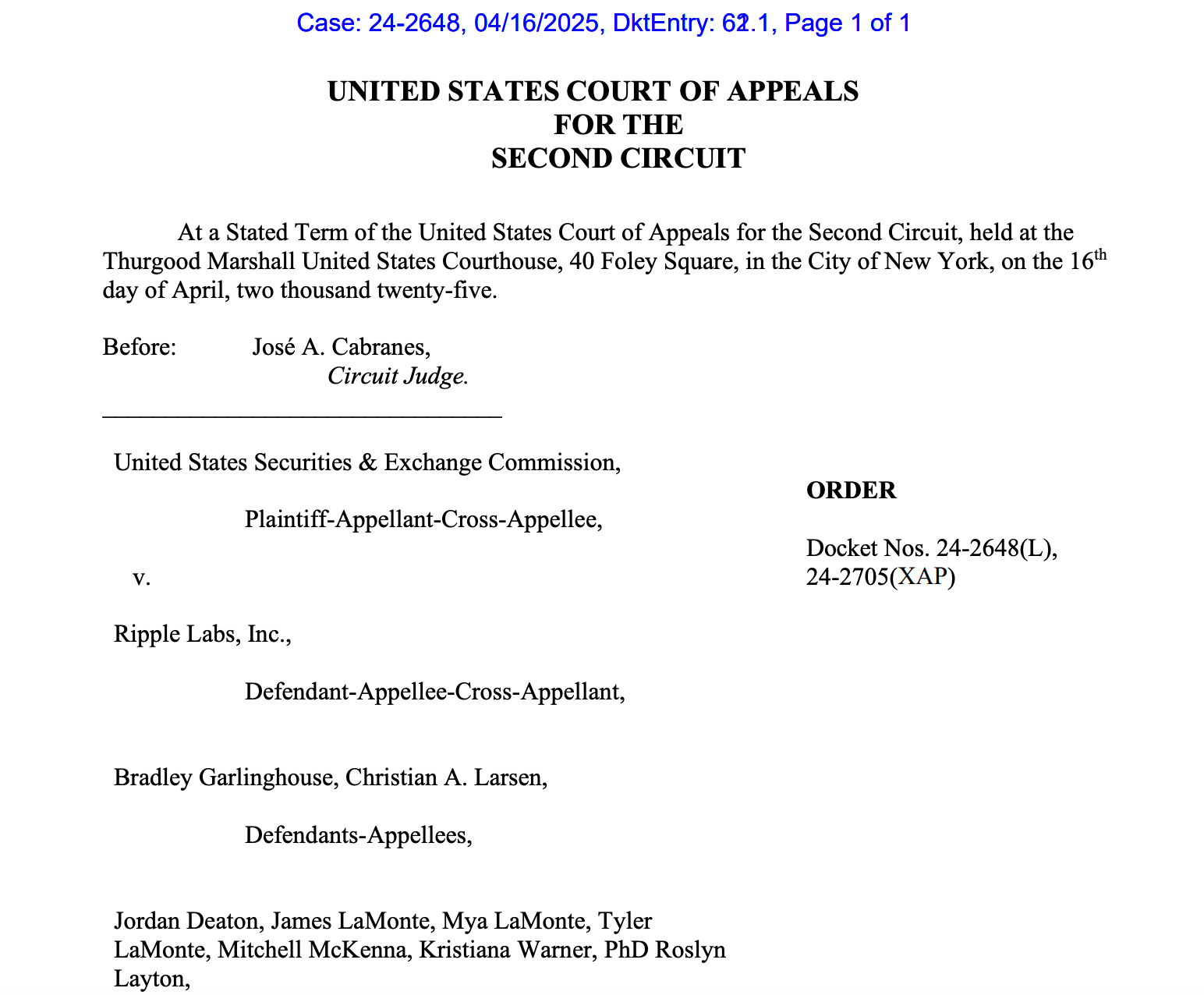

In a long-running legal drama that has shaped the regulatory debate over cryptocurrency in the United States, the U.S. Court of Appeals for the Second Circuit has approved a 60-day pause in the Ripple vs SEC appeals case, signaling a possible path toward settlement.

On April 16, both Ripple Labs and the U.S. Securities and Exchange Commission (SEC) filed a joint motion to hold the appeal in abeyance, a legal term for putting the case on temporary hold. The court granted the request, requiring the SEC to submit a status update by June 15.

This move comes just weeks after Ripple CEO Brad Garlinghouse announced that the SEC would no longer pursue its appeal against the blockchain firm, suggesting a softening of the commission’s previously aggressive stance.

A Winding Legal Battle Approaches the Finish Line

The dispute dates back to December 2020, when the SEC sued Ripple, alleging the company had sold XRP tokens as unregistered securities. In August 2024, a federal court partially ruled in favor of the SEC, ordering Ripple to pay $125 million in penalties. Both sides filed appeals — and now, both seem eager to walk away from the fight.

Ripple’s legal chief, Stuart Alderoty, previously announced the firm would drop its cross-appeal and expect a $75 million refund, citing progress in negotiations.

However, despite signals of agreement, the case still carries legal entanglements. Ripple’s partial victory did not fully resolve the status of XRP in the eyes of U.S. regulators, keeping the broader crypto community on edge.

Political Shift at the SEC Alters Enforcement Strategy

The momentum toward a settlement has been influenced by major political changes at the SEC. Following a shift in presidential leadership, former SEC Chair Gary Gensler was replaced by acting chair Mark Uyeda, who began pulling back from high-profile enforcement actions against crypto firms.

Ripple, once seen as a prime example of regulatory overreach, has suddenly found itself in a more favorable climate. Reports suggest that Ripple pledged $5 million in XRP to Trump’s inauguration fund, while Garlinghouse and Alderoty appeared at events aligned with the current administration — fueling speculation of a more lenient regulatory approach under new SEC leadership.

“The final exclamation mark that XRP is not a security,” said attorney John Deaton in reaction to the SEC dropping its case.

New Chair, New Direction: What’s Next for Crypto Regulation?

The SEC’s direction could shift again soon. On April 9, the U.S. Senate confirmed Paul Atkins as the new SEC Chair. A known skeptic of strict crypto regulation, Atkins faces intense scrutiny over his financial ties to blockchain firms.

His disclosure statements reveal millions in crypto-related assets, including stakes in Securitize, Pontoro, and Patomak Global Partners. Lawmakers have raised concerns about potential conflicts of interest as Atkins prepares to steer the agency’s future.

Whether these ties will soften the SEC’s regulatory grip or spark further controversy remains to be seen.

Conclusion: A Case That Shaped Crypto’s Legal Future Nears Endgame

The pause granted by the appeals court represents more than just a procedural delay — it could be a turning point in one of the most influential crypto lawsuits in U.S. history. As Ripple and the SEC edge closer to a final agreement, the case could set a precedent for how digital assets are treated under U.S. law.

For investors, developers, and policymakers alike, the coming weeks could clarify whether XRP — and similar tokens — will finally be free from the cloud of regulatory uncertainty.

Share This