Top Crypto Adopters in 2025: Institutions, Retail, and Low-Income Countries

The cryptocurrency industry is on the brink of another transformative year in 2025, driven by increased regulatory clarity and growing mainstream adoption. With Bitcoin (BTC) hitting an all-time high of $108,300 in December 2024, optimism is surging for another record-breaking year.

As institutions, retail investors, and low-income countries embrace digital assets, the industry is set to witness unprecedented growth and new milestones.

Regulatory Clarity Poised to Break Adoption Records

The crypto landscape saw major regulatory developments in 2024, paving the way for increased adoption:

Europe: The Markets in Crypto-Assets Regulation (MiCA), the first comprehensive regulatory framework for crypto, took effect on December 30, 2024, providing clear guidelines for service providers.

Asia: Singapore solidified its status as a crypto hub, doubling digital asset licenses issued in 2024. The country is leading innovation despite its small population with 1,600 blockchain patents, 2,433 crypto-related jobs, and 81 exchanges.

According to Jonathan Levin, CEO of Chainalysis, these developments will:

“Enhance industry trust, market integrity, and consumer protection, making the sector more attractive to retail and institutional investors.”

With an estimated 560 million crypto holders globally as of mid-2024, experts predict these numbers could triple in the next two years, spurred by greater regulatory clarity and market confidence.

Institutions Drive Growth Through ETFs and Bitcoin Reserves

Institutional adoption is accelerating, bolstered by the success of U.S. Bitcoin ETFs, which reached $110 billion in assets less than a year after their launch. Analysts forecast Bitcoin’s price to hit $200,000 during the 2025 cycle, driven by institutional demand.

Key developments include:

Bitcoin ETFs making BTC investments accessible to traditional financial institutions.

The Bitcoin Act, proposed by U.S. Senator Cynthia Lummis, which advocates creating a strategic Bitcoin reserve for the United States.

With Donald Trump’s presidential victory and a Republican-majority Senate, support for Bitcoin-friendly legislation is gaining momentum. According to Adam Back, co-founder of Blockstream:

“If the Bitcoin Act is passed, BTC could eventually surpass $1 million.”

Low-Income Countries Lead the Crypto Adoption Wave

While institutional adoption garners attention, low- and middle-income countries are driving real-world use cases for cryptocurrencies:

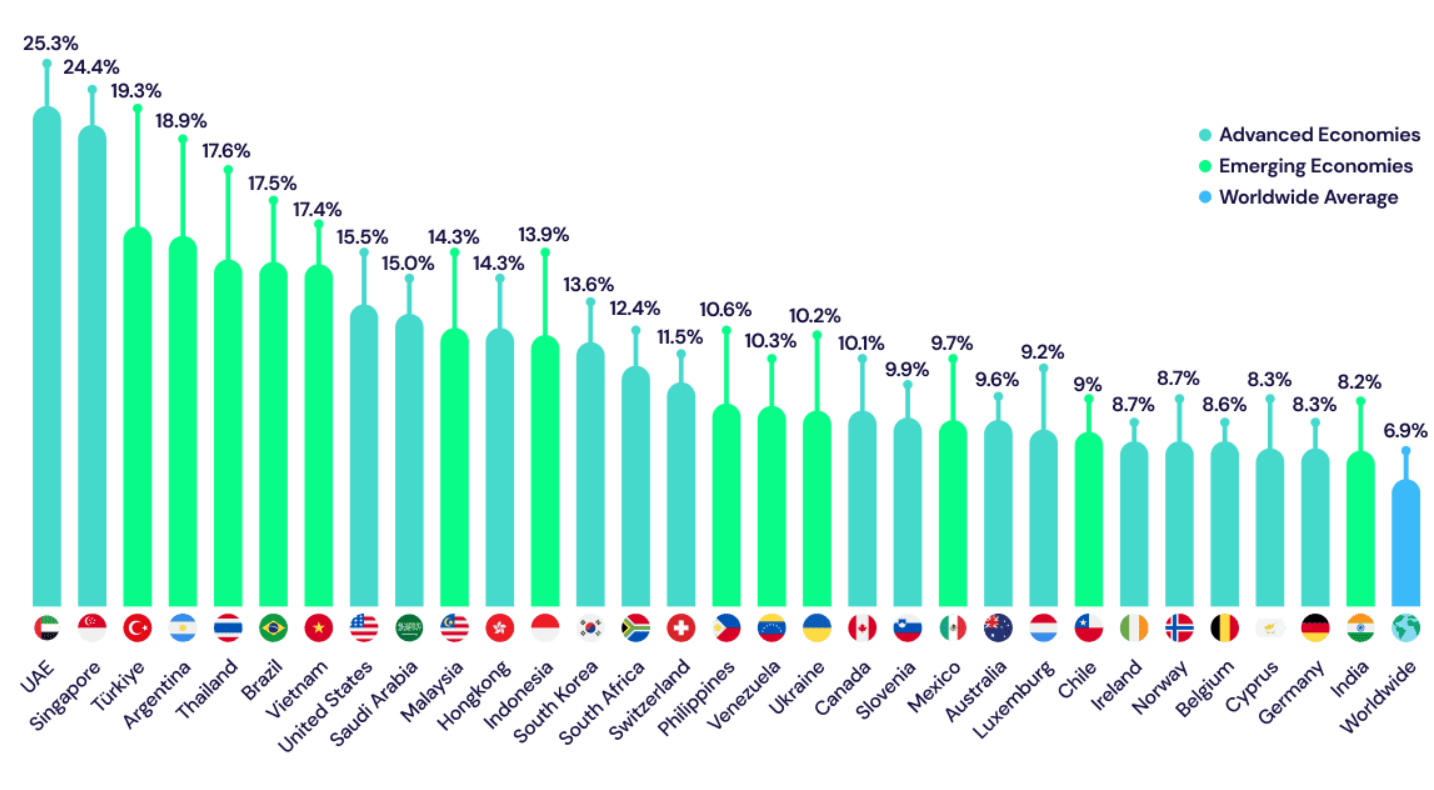

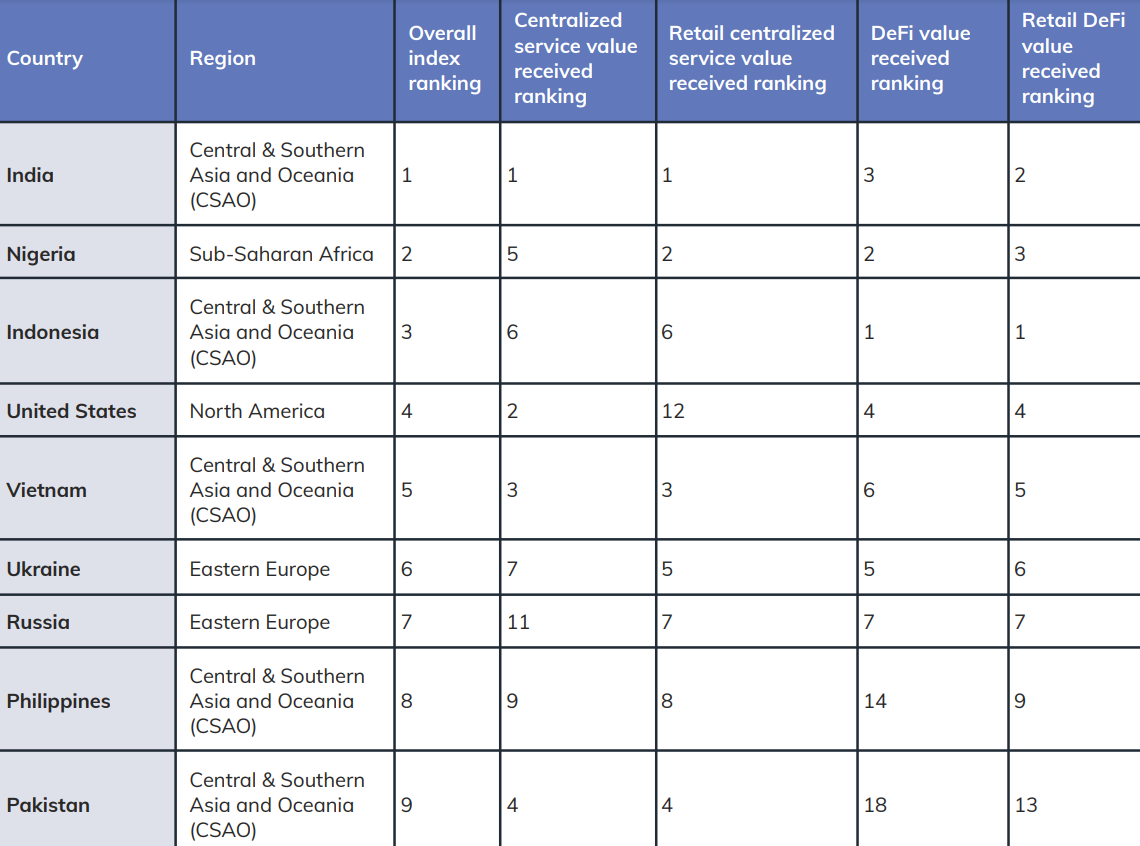

India, Nigeria, and Indonesia topped the 2024 Global Crypto Adoption Index, with India ranked first for its robust crypto activity.

In Latin America, El Salvador continues to be a trailblazer, generating over $31 million in Bitcoin profits since adopting BTC as legal tender in 2021.

Although El Salvador faced criticism during Bitcoin’s downturn in 2022, its decision to embrace BTC highlights the growing role of cryptocurrency in global finance. According to blockchain expert Anndy Lian:

“As more nations explore Bitcoin reserves, we could see a shift toward decentralized and digital approaches to economic stability.”

In sub-Saharan Africa, Latin America, and Eastern Europe, the use of stablecoins and DeFi platforms surged in 2024, further demonstrating crypto’s potential to address economic challenges in low-income regions.

Crypto and Gold: Competing as Reserve Assets

Bitcoin’s rise as a potential reserve asset alongside gold is becoming more evident. Over the past year:

Bitcoin rose 131% in value.

Gold experienced a more modest 30% increase.

As global financial systems evolve, Bitcoin’s decentralized nature and accessibility position it as a viable alternative to traditional reserves.

The Path Ahead: 2025 Optimism

With Bitcoin regaining $100,000 on January 6, 2025, optimism remains high for another bullish year. Donald Trump’s January 20 inauguration is anticipated to bring further regulatory clarity, acting as a potential catalyst for crypto prices.

Whether through institutional investment, retail adoption, or low-income countries embracing crypto for economic solutions, 2025 is shaping up to be a pivotal year for digital assets.

Share This