US Bitcoin ETFs Now Drive Billions in Daily Trading, Rivaling Major Exchanges

United States spot Bitcoin exchange-traded funds (ETFs) have rapidly become a dominant force in crypto markets, accounting for billions in daily trading volumes and reshaping institutional access to digital assets.

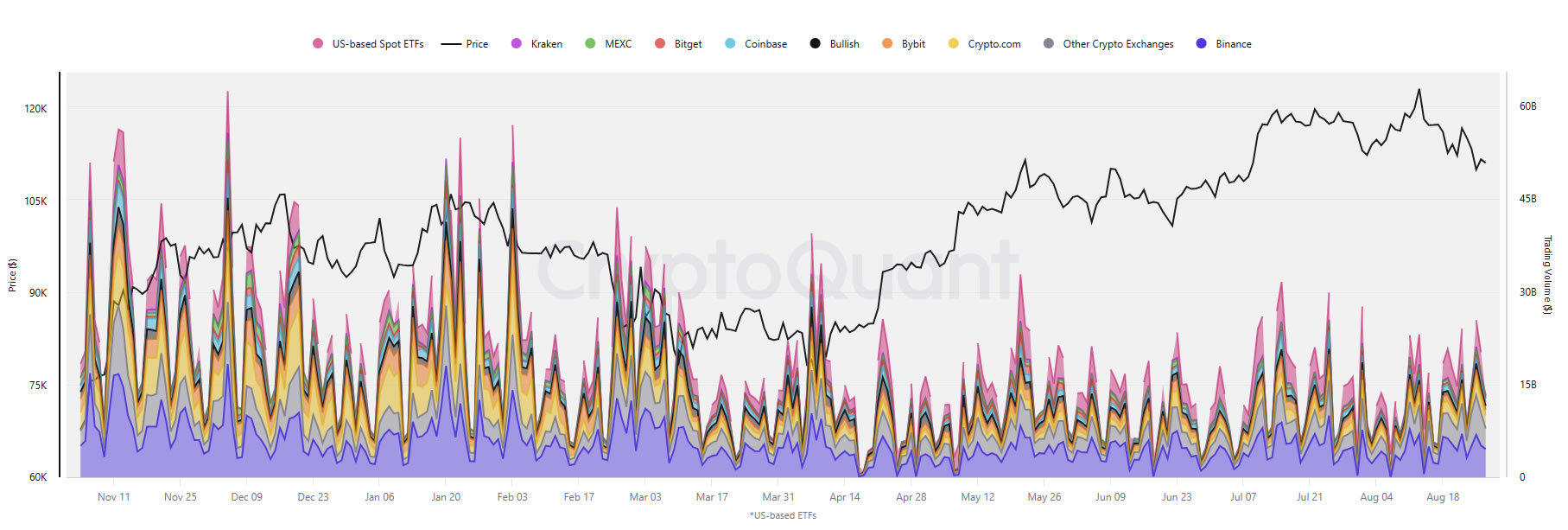

ETFs Command Billions in Daily Bitcoin Trades

According to blockchain analytics firm CryptoQuant, U.S.-based spot Bitcoin ETFs now generate between $5 billion and $10 billion in trading volume on active days, often rivaling — and in some cases surpassing — the activity of traditional crypto exchanges.

“Bitcoin spot trading volumes through US-based ETFs have become a significant source of investor exposure to Bitcoin,” said Julio Moreno, head of research at CryptoQuant.

This surge underscores growing institutional participation in crypto markets, where ETFs have provided a regulated and accessible gateway for large investors.

Binance Still Leads, But ETFs Gain Ground

Despite the rapid rise of ETFs, Binance remains the world’s largest crypto exchange. Bitcoin spot volumes have climbed as high as $18 billion, while Ether volumes peaked at $11 billion on top trading days.

Currently, the 11 U.S. spot Bitcoin funds record $2.77 billion in daily trading volume, representing 67% of Binance’s daily spot Bitcoin activity of $4.1 billion, according to CoinGlass and CoinGecko.

Binance’s overall daily trading volume across all crypto pairs remains significantly higher, at around $22 billion.

“US spot Bitcoin ETFs have emerged as a dominant force in crypto markets and demonstrate their pivotal role in price discovery and institutional adoption,” said Nick Ruck, director at LVRG Research.

Ethereum ETFs Lag Behind in Institutional Adoption

While Bitcoin ETFs dominate, Ethereum shows a slower pace of adoption. Moreno noted that ETH spot trading is still largely concentrated on Binance and Crypto.com, while ETFs account for just 4% of daily Ether trading activity.

This suggests limited institutional engagement with Ethereum compared to Bitcoin.

ETF Flows Show Shift from Bitcoin to Ether

Recent ETF flows, however, reveal a changing trend. Over the past four trading days, Bitcoin spot ETFs drew in $571.6 million, with BlackRock’s iShares Bitcoin Trust (IBIT) capturing nearly 40% of inflows at $223.3 million.

In contrast, spot Ether ETFs recorded $1.24 billion in inflows over the same period — more than double that of Bitcoin funds.

Ether ETFs have now seen over $4 billion in inflows this month alone, representing 30% of total inflows since their launch 13 months ago. Notably, Ether funds have not recorded a single net outflow day since August 20.

“Current flow dynamics show ETFs are not just supplementing but actively reshaping spot market liquidity,” said Ruck. “These products now represent a significant percentage of Bitcoin’s total supply, cementing ETFs as a fundamental gateway for traditional capital.”

Market Sentiment Cools Amid Bitcoin Price Dip

Meanwhile, Bitcoin has slipped 2.5% this week, trading around $111,600 at the time of writing, as market sentiment cooled despite ETF growth.

The Bigger Picture

The rise of Bitcoin ETFs marks a turning point in how traditional capital enters crypto markets. With billions in daily trading volume and increasing influence over liquidity and price discovery, ETFs are no longer just a supplementary product — they are shaping the future of institutional crypto adoption.

Share This