What is Current Inflation Rate in South Africa?

Inflation is a term used to describe the general increase in prices of goods and services over time. When inflation occurs, the purchasing power of money decreases because you can buy less with the same amount of money. In other words, the value of money decreases over time.

Let’s say you have $10, and currently, you can buy five apples with that money. However, if inflation occurs, the prices of apples may increase, and you might be able to buy only three apples with the same $10.

Inflation can happen for various reasons. One common cause is when there is too much money circulating in the economy compared to the supply of goods and services available. This excess money leads to increased demand, and as a result, sellers can raise their prices.

When inflation is moderate, it can be seen as a normal part of a growing economy. However, high inflation can have negative effects, such as eroding people’s savings and making it harder for them to afford essential goods and services.

Central banks and governments often try to manage inflation by implementing monetary policies and controlling the money supply. They aim to strike a balance to maintain stable prices and ensure the economy functions smoothly.

What Is the Current Inflation Rate in South Africa 2023?

In January 2023, the annual consumer price inflation stood at 6.9%, showing a decrease from the 7.2% recorded in December 2022. Check current inflation rates at South African Reserve Bank (SARB), the country’s official statistical agency (Statistics South Africa), or reputable financial news websites. https://www.resbank.co.za/en/home

What Is the Inflation Rate in Uk?

The average annual consumer price inflation for 2022, which compares the average Consumer Price Index (CPI) for all urban areas in 2022 with that of 2021, was 6.9%.

What Is the Prime Rate in South Africa?

As of May 2023, the prime lending rate in South Africa is 11.75%. It has seen several changes in recent months, including an increase of 0.25% in November 2021, another 0.25% in January 2022, a larger increase of 0.75% in September 2022, an additional 0.25% in January 2023, and a further increase of 50 basis points in March 2023.

What Is the Highest Inflation Rate in South Africa?

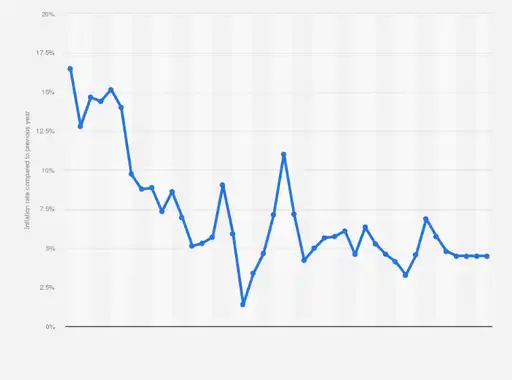

The inflation rate in South Africa has averaged 8.71 percent from 1968 until 2023. It reached its highest level of 20.70 percent in January 1986 and recorded its lowest level of 0.20 percent in January 2004. These figures reflect the historical fluctuations in inflation over the years, indicating periods of high inflation and periods of relatively low inflation in South Africa.

Why Is Inflation in South Africa High?

The ongoing electricity crisis in South Africa has resulted in prolonged and unprecedented power outages, creating significant financial burdens throughout the food value chains. As a consequence, the increased cost of production incurred by food producers is ultimately transferred to consumers, leading to a rise in food price inflation.

What Is the Highest Inflation Rate Ever in South Africa?

Over the period from 1960 to 2022, the average annual inflation rate in South Africa was 7.9%. Throughout this timeframe, prices experienced a cumulative increase of 10,396.72%. For instance, an item that cost 100 rands in 1960 would have a price of 10,496.72 rands at the start of 2023, reflecting the impact of inflation over the years.

In April 2023, the year-over-year inflation rate was 7.1%. This indicates that, compared to April of the previous year, prices had risen by an average of 7.1% during that period.

What Is the Current Economic Growth Rate in South Africa?

The South African economy achieved its second consecutive year of growth, with a 2.0% expansion between 2021 and 2022. During this period, the economy grew from R4.50 trillion to R4.60 trillion.

Is South Africa Suffering from Inflation?

In April 2023, the headline inflation rate stood at 6.8%. Notably, the poorest households faced the highest inflation rate during the 12 months leading up to April, with the cost of living for households in the lowest income bracket (decile 1) rising by 11.3% (Figure 1).

What Is the Expected Inflation Rate in South Africa in 2024?

| Characteristic | Inflation rate compared to previous year |

|---|---|

| 2024* | 4.8% |

| 2023* | 5.75% |

| 2022 | 6.87% |

| 2021 | 4.56% |

What Will South Africa’s Inflation Be in 2025?

With core goods and food higher in the near term, headline inflation for 2023 is revised up to 6.2% (from 6.0%). Headline inflation for 2024 also increases to 5.1%, before moderating to 4.5% in 2025 on the back of easing food and fuel inflation. Risks to the inflation outlook are assessed to the upside.

What Is the Inflation Rate in the Uk in 2023?

Many economies have observed a peak in inflation rates during late 2022, followed by a decline in the annual inflation rate in 2023. In April 2023, the United Kingdom experienced an annual inflation rate of 8.7%, which was higher than that of most comparable economies such as the Eurozone (7.0%), France (6.9%), and the United States (3.8%). However, the UK’s inflation rate was on par with that of Italy, which also recorded an inflation rate of 8.7% in April 2023.

Why Are South African Interest Rates so High?

Governor Lesetja Kganyago stated that the decision was made with the objective of bolstering confidence in achieving sustainable control over inflation in the long run. South Africa’s monetary policymakers initiated a series of interest rate hikes starting in November 2021, culminating in the most significant increase in a decade—a 0.75 percentage point hike—in July.

What Is the Long-Term Inflation Forecast for South Africa?

As of the latest data in 2028, the inflation rate in South Africa stands at 4.5 percent. To provide a basis for comparison, the average inflation rate across 184 countries globally in 2028 is 3.72 percent.

Will Inflation Rise in South Africa?

As per the South African Reserve Bank’s monetary policy review, it is projected that headline inflation will re-enter the target range during the third quarter of 2023. However, it is anticipated that inflation will only reach the midpoint of the target range by 2025.

Is South Africa in a Recession in 2023?

According to data released by the national statistics agency on Tuesday, South Africa experienced slight growth in the first quarter of 2023, effectively avoiding the threat of a recession.

Will Food Prices Go down in 2023 South Africa?

Experts have provided a positive outlook for South Africans in 2023, as they anticipate a drop in food prices. This forecast brings a sigh of relief for South Africans, signaling a potential reduction in prices this year.

What Are the 5 Causes of Inflation?

- Demand-Pull Inflation: This occurs when demand for goods and services surpasses the available supply. When consumers have more money to spend, they increase their purchasing power, leading to higher demand. As demand outpaces supply, sellers can raise prices, contributing to inflation.

- Cost-Push Inflation: This type of inflation is driven by increased production costs. When the costs of labor, raw materials, or other inputs rise, businesses often pass these higher costs onto consumers by raising prices. This can lead to a general increase in prices across the economy.

- Monetary Inflation: Also known as “too much money chasing too few goods,” monetary inflation happens when there is an excessive increase in the money supply. If the amount of money in circulation grows faster than the production of goods and services, it can lead to inflationary pressures.

- Imported Inflation: When a country heavily relies on imports, changes in the exchange rate can impact the prices of imported goods. If the local currency depreciates against other currencies, the cost of imported goods rises, which can contribute to inflation.

- Expectations and Psychology: Inflation expectations play a role in shaping actual inflation. If people anticipate higher prices in the future, they may adjust their behavior accordingly. For example, workers may demand higher wages to keep up with expected inflation, leading to a wage-price spiral and further inflation.

Who Benefits from Inflation?

Stockholders can find some protection from inflation as the same factors that drive up the prices of goods also increase the value of companies. When prices rise, the value of assets held by companies, such as inventory, property, and equipment, tends to increase as well. This can positively impact the value of stocks and provide a buffer against inflation.

In response to inflation, companies have the ability to raise prices for their goods and services. This allows them to safeguard their profitability by passing on increased costs to consumers. However, certain industries, such as retail and restaurants, often operate with thinner profit margins. In such cases, it may be more challenging for these businesses to offset rising costs through price increases, potentially affecting their profitability during inflationary periods.

How does the South African CPI measure inflation?

The Consumer Price Index (CPI) is an index that measures the average change in prices of goods and services over time. The CPI is calculated through a basket of goods and services. The basket includes items such as food, clothing, transport, shelter, medical care and education. These are all the things that people need to survive. The prices for these items are collected every month from a sample of retail outlets in different areas across South Africa. Prices for each item are recorded in a table with columns for the item and its price on a date.

What are the key inflationary drivers in South Africa?

South Africa has been experiencing an inflation rate of 6.4% for the past year. This is mainly because of the following factors:

– The depreciation of the rand against major currencies, has caused a rise in the prices of imported goods.

– The increase in VAT from 14% to 15%.

– The imposition of a drought levy on certain agricultural products and electricity tariffs

Share This