Bitcoin Eyes Massive Upside as Global Bond Markets Show Stress

Investors Turn to Bitcoin as U.S. and Japanese Bond Yields Reach Critical Levels

As bond markets in the United States and Japan flash signs of deepening stress, Bitcoin is staging an unexpected rally, gaining ground even as traditional safe-haven assets falter. The move suggests a profound realignment in investor sentiment—one that positions Bitcoin not as a speculative risk, but as a legitimate alternative in a crumbling global financial order.

Soaring Debt, Rising Yields: A Brewing Crisis

Yields on long-dated U.S. Treasury bonds are surging—a red flag for a financial system built on cheap debt. On May 22, the 30-year U.S. Treasury yield hit 5.15%, its highest since October 2023 and levels unseen since 2007. The 10-year yield stands at 4.48%, while the 5-year and 2-year yields clock in at 4% and 3.92%, respectively.

The implications are severe. As U.S. debt crosses $36.8 trillion, the cost of servicing it is projected to reach $952 billion by 2025—a staggering burden for the world’s largest economy.

U.S. bond yields – 30Y, 10Y, 5Y, and 2Y. Source: TradingView

Traditionally, bond markets serve as the backbone of the financial system, offering a low-risk haven for capital. But today, they’re signaling instability, not safety.

Investors Rethink the “Safe Haven” Narrative

Investor confidence in U.S. Treasurys is deteriorating. The once rock-solid belief that government bonds are immune to political meddling or economic turbulence is eroding. The loss of the U.S. government’s last AAA credit rating only confirms the growing unease.

Meanwhile, the Federal Reserve’s refusal to cut rates or initiate quantitative easing (QE) amid inflation fears limits its options. With little room to maneuver, and rising geopolitical pressure on Fed Chair Jerome Powell, attempts at yield control could only backfire.

Japan Adds to the Pressure

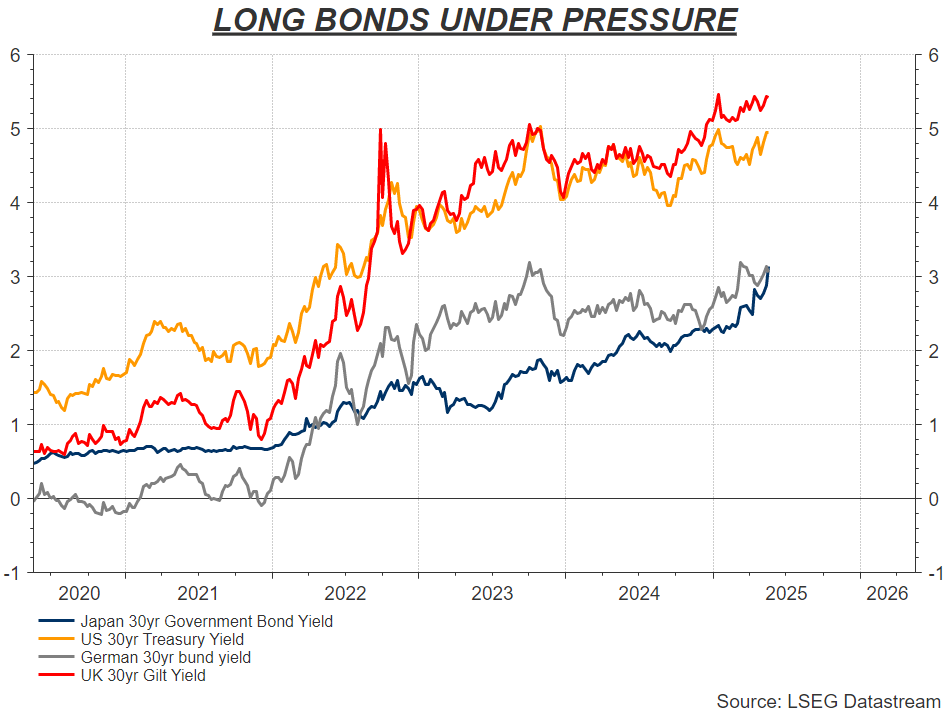

Japan, the largest foreign holder of U.S. Treasurys with $1.13 trillion in holdings, is now showing signs of exiting the carry trade. Its 30-year bond yield hit 3.1%, the highest ever recorded, while the 20-year yield reached 2.53%—levels last seen in 1999.

30-year government bonds. Source: LSEG Datastream

Prime Minister Shigeru Ishiba recently warned that Japan’s fiscal condition is “worse than Greece”, highlighting the country’s staggering 260% debt-to-GDP ratio. As Japanese pension and insurance funds reevaluate their exposure, U.S. debt markets may soon lose another critical buyer.

Bitcoin Emerges as an Unexpected Refuge

Contrary to conventional wisdom, Bitcoin is thriving in this macroeconomic chaos. Typically seen as a risk-on asset, Bitcoin now appears to benefit from rising global uncertainty. As old paradigms falter, Bitcoin’s appeal as both a high-growth investment and a store of value is growing stronger.

Institutional shifts support this view. In early May, 38% of institutional investors were underweight U.S. equities, the lowest level since May 2023, according to BofA’s Fund Manager Survey.

Meanwhile, Bitcoin ETF inflows continue to rise, with assets under management now surpassing $104 billion, according to CoinGlass—a record high. These numbers indicate that capital is not just flowing into Bitcoin—it is doing so with conviction.

Bitcoin’s Dual Narrative: Safe Haven and Growth Engine

In a world where old financial frameworks are breaking down, Bitcoin is no longer bound by its early label as just a high-risk gamble. Instead, it embodies two powerful identities: a growth vehicle and a hedge against systemic collapse.

With a market cap still far below gold’s $22 trillion and the U.S. monetary base’s $5.5 trillion, Bitcoin may still be undervalued in the context of its emerging role in global finance.

This article is for informational purposes only and does not constitute financial advice. Always conduct your own due diligence before making investment decisions.

Share This