BTC Exchange Inflows and Miner Outflows Drop — Can Bitcoin Reclaim $100K?

Bitcoin (BTC) faces a pivotal moment as exchange inflows and miner outflows drop significantly, signaling reduced selling pressure. Following an all-time high of $108,000 on December 17, 2024, BTC has since declined by over 10%, trading at approximately $98,474.

Reduced Exchange Inflows: A Bullish Signal?

Data from CryptoQuant shows that BTC exchange inflows — the total amount of Bitcoin transferred to exchanges — have steadily decreased since peaking at 98,748 BTC on November 25, 2024. December saw daily inflows ranging from 11,000 to 79,000 BTC, reflecting reduced activity compared to earlier months.

The decline in exchange inflows suggests lower selling pressure, as fewer BTC transfers to exchanges typically indicate reduced intent to sell by holders.

Miner Outflows Show a Similar Trend

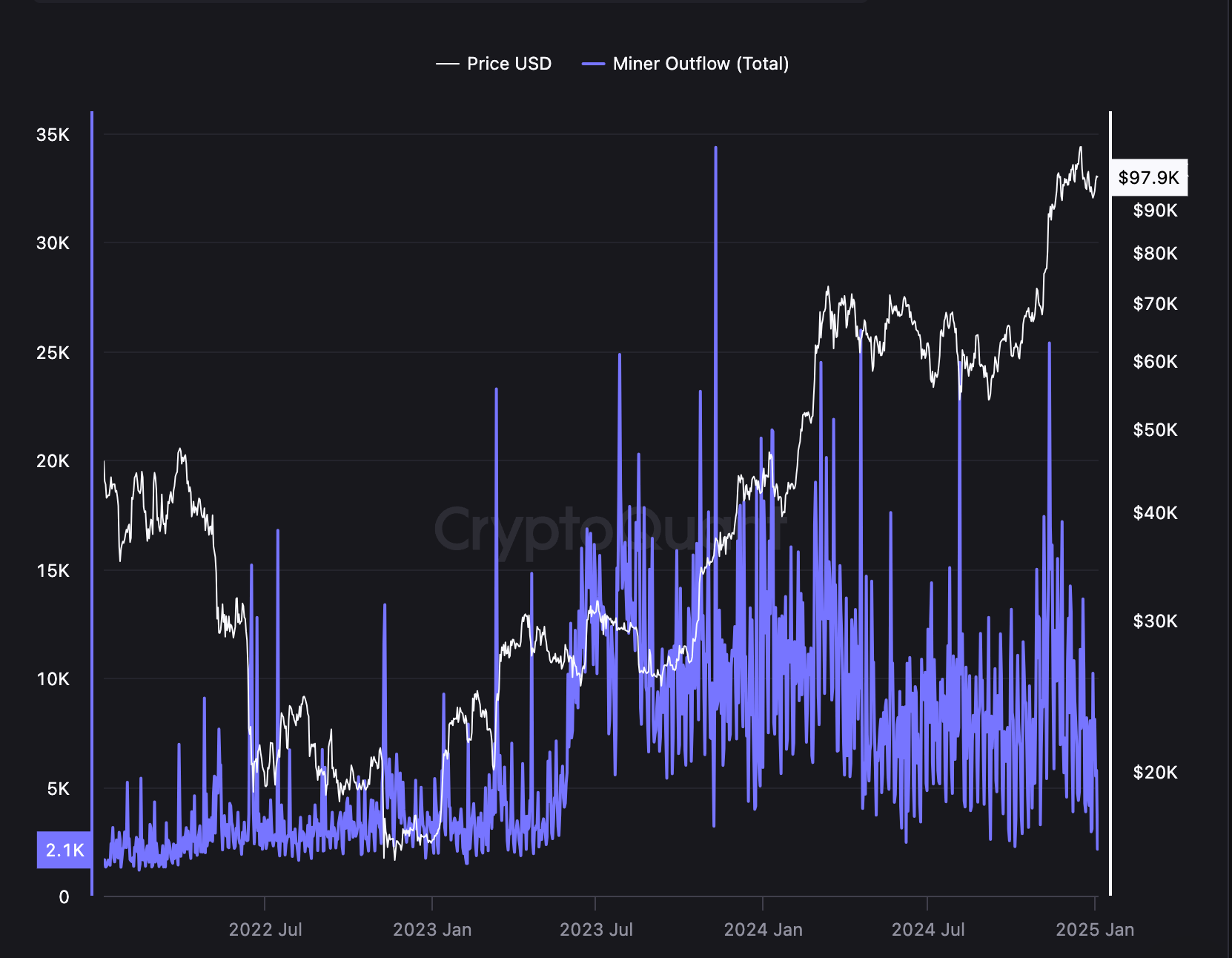

Bitcoin miner outflows, or the amount of BTC miners send to exchanges, have also dropped significantly. After spiking at 25,367 BTC on November 11, 2024, when Bitcoin hit $88,000, miner outflows have decreased steadily.

Recent data highlights the following daily miner outflows:

- January 1, 2025: 5,489 BTC.

- January 2, 2025: 5,748 BTC.

- January 3, 2025: 2,133 BTC.

This reduction indicates that miners, who often sell BTC to cover operational costs, are under less pressure to liquidate holdings, which could support Bitcoin’s price stability.

Miner outflow July 2022 to January 2025. Source: CryptoQuant

Trading Volume and ETF Inflows Key to BTC’s January Rally

Bitcoin analysts remain cautiously optimistic about BTC’s trajectory in January. Bitfinex analysts project Bitcoin will trade between $95,000 and $110,000, but emphasize the need for increased daily trading volume to drive a significant breakout.

Market analyst Axel Adler noted:

“The market structure remains bullish, with no clear signs of being overheated. However, for a strong impulse, we lack sufficient trading volume. Therefore, we are waiting for the market to recover from the holiday season.”

ETF Inflows Signal Institutional Interest

Encouragingly, Bitcoin ETF inflows rebounded on January 3, 2025, with $900 million in new investments, reversing several days of outflows. This resurgence in ETF activity indicates renewed interest from institutional investors, a key driver for Bitcoin’s long-term growth.

What’s Next for Bitcoin?

While reduced exchange inflows and miner outflows signal a bullish foundation, Bitcoin must overcome key resistance levels to reclaim the $100,000 mark. Increased trading volume and sustained institutional interest will be pivotal in driving BTC’s next upward momentum.

As the market shakes off the holiday season and trading activity intensifies, Bitcoin could be poised for another significant rally in the first quarter of 2025.

Stay updated with Cointelegraph for the latest insights into Bitcoin’s price action and market trends.

Share This