Crypto Market Faces Bearish Wave, but Coinbase Predicts Strong Q3 Rebound

📉 Current Crypto Downturn May Signal Opportunity Ahead, Says Coinbase

April 17, 2025 — In its latest monthly market report, Coinbase reveals that the cryptocurrency market is currently grappling with strong bearish pressures, yet the exchange sees hope for recovery by Q3 2025. Despite shrinking valuations and reduced venture capital activity, key indicators suggest a rapid turnaround may be on the horizon.

📊 Altcoin Market Suffers Major Losses

According to Coinbase’s April 15 institutional investor outlook, the altcoin market cap has plunged 41%, sliding from a $1.6 trillion peak in December 2024 to $950 billion by mid-April. The worst was seen on April 9, when the figure dipped to $906.9 billion, before recovering slightly to $976.9 billion.

David Duong, Coinbase’s Head of Research, notes that this slump reflects what could be the beginning of a new “crypto winter.” He attributes the downturn to macroeconomic uncertainty, particularly global tariffs and fiscal tightening, which are discouraging new investments.

“Several converging signals may be pointing to the start of a new ‘crypto winter,'” Duong said. “Extreme negative sentiment has set in.”

💰 VC Funding Plummets, Slowing Growth

Coinbase reports that venture capital funding for crypto projects has dropped by 50%–60% from its highs in 2021–2022. The decline in funding, particularly for altcoin projects, is creating a drag on innovation and onboarding of new users into the ecosystem.

Duong links this funding freeze to ongoing global economic headwinds, stating:

“Traditional risk assets are facing sustained headwinds, leading to a paralysis in investment decisions across the board.”

📈 Metrics Signal a Possible Q3 Comeback

Despite the gloom, Coinbase remains cautiously optimistic, forecasting that sentiment may reset quickly once the broader market stabilizes.

“We remain constructive for the second half of 2025,” Duong emphasized.

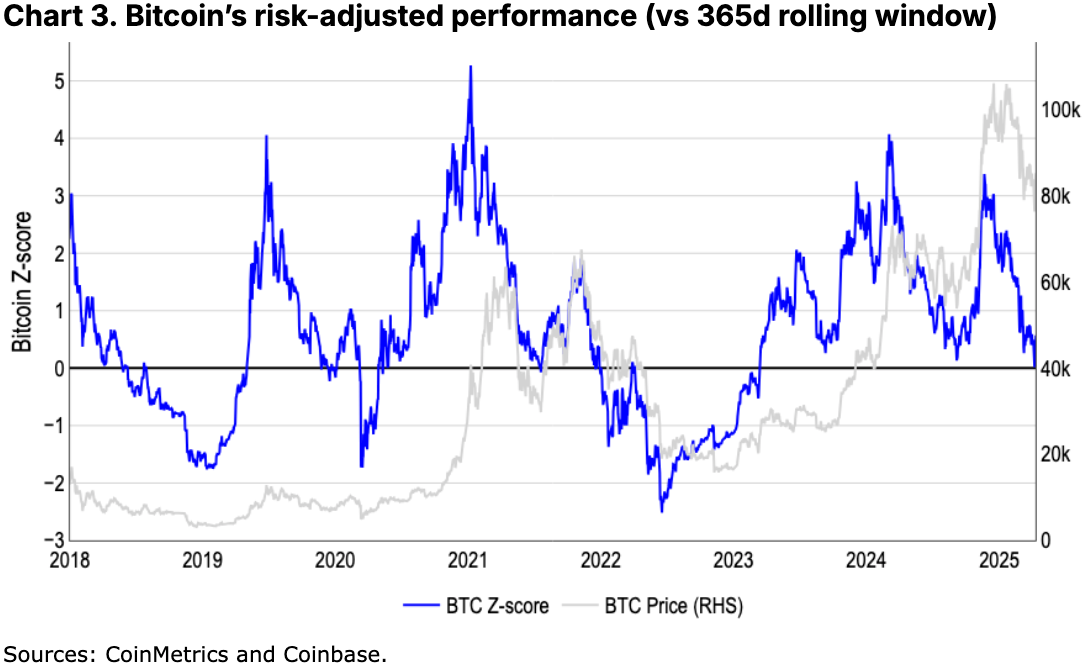

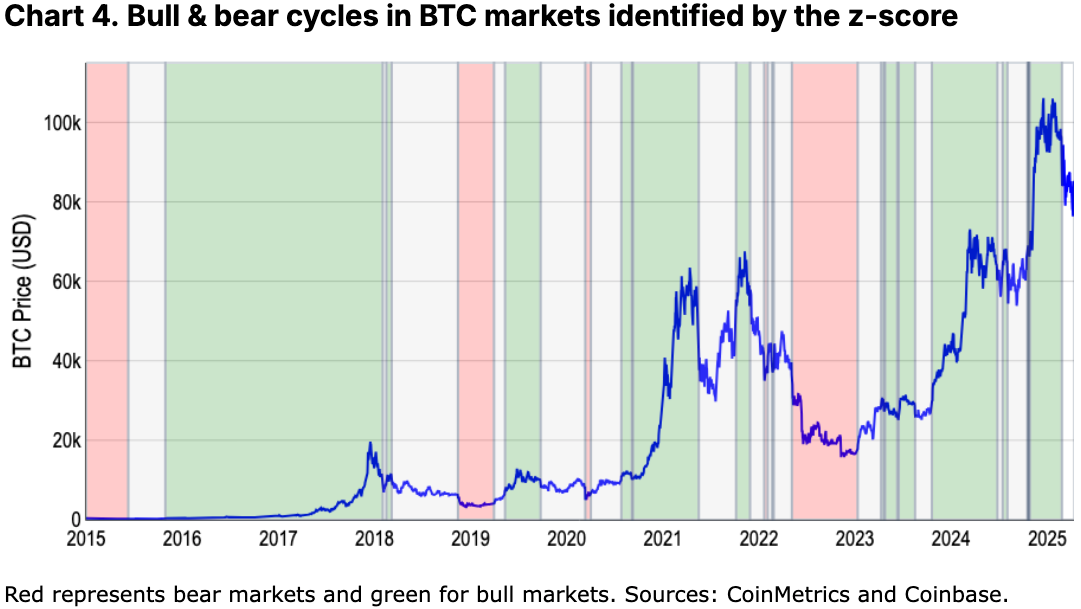

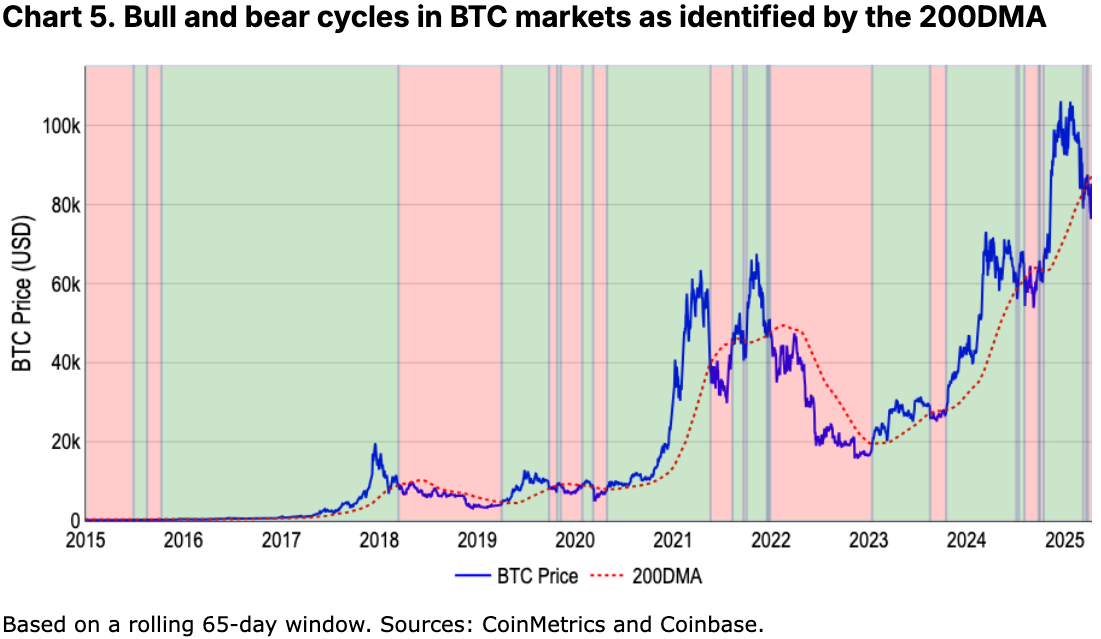

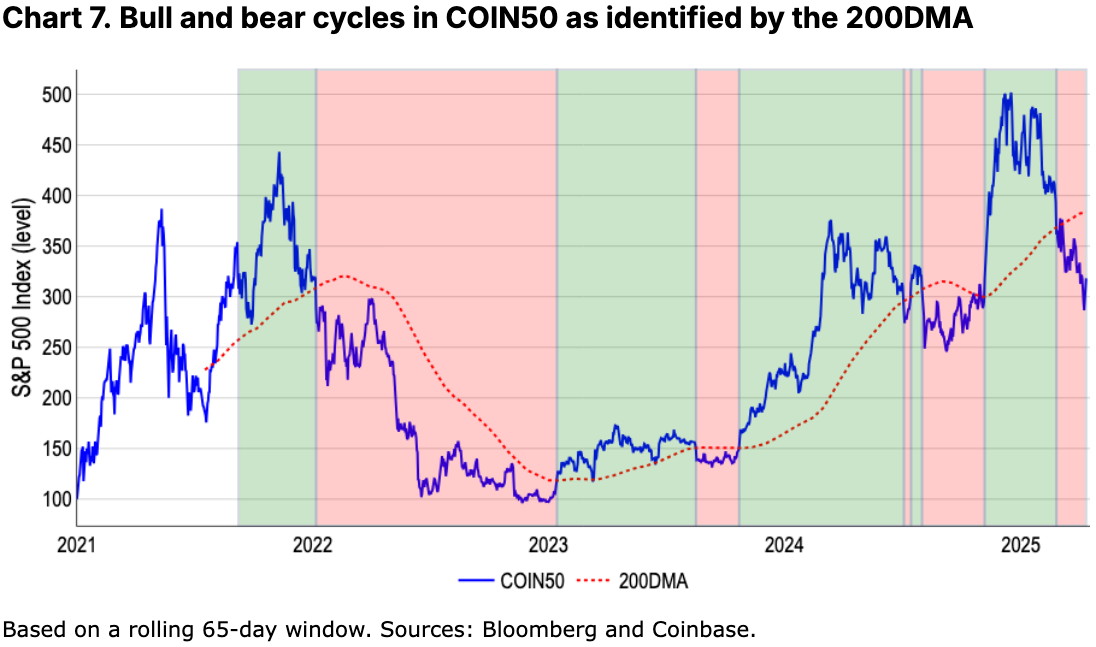

Coinbase uses a combination of technical metrics to track market cycles, including:

-

200-day moving averages

-

Risk-adjusted performance

-

Bitcoin Z-scores, which compare market value to realized value to detect overbought or oversold conditions.

The data suggests that while the bull market likely ended in late February, the market has moved into a neutral phase, rather than a deepening collapse.

🔍 Why Bitcoin Is No Longer the Market’s Sole Barometer

Interestingly, Coinbase’s research suggests that Bitcoin is no longer a reliable indicator of overall market trends. As crypto expands into new sectors like DeFi, AI agents, and DePIN (Decentralized Physical Infrastructure Networks), altcoins are increasingly moving independently of Bitcoin.

“As Bitcoin’s role as a ‘store of value’ continues to grow, we believe a broader view is needed to evaluate the health of the crypto market,” Duong wrote.

📉 Are We Officially in a Bear Market?

Coinbase’s 200-day moving average model shows Bitcoin entered bear market territory in late March. When applied to the Coin50 index, which tracks the top 50 crypto assets, the model indicates a bear market since February’s end.

Yet some analysts note that Bitcoin’s modest decline, especially compared to traditional financial markets, signals resilience. Wintermute, a market-making firm, observed:

“Bitcoin’s price levels have only returned to their positions during the U.S. election period—showing relative strength.”

🔚 Final Thoughts

Coinbase’s findings paint a complex picture: the crypto market is weathering a difficult season, but the conditions for a Q3 rebound are aligning. The next few weeks will be critical, as institutional and retail sentiment recalibrate.

Share This