Crypto VCs Set Their Sights on Stablecoins, RWA Tokenization, and AI in 2025

With the crypto market poised for significant growth, venture capitalists (VCs) are zeroing in on opportunities in stablecoins, real-world asset (RWA) tokenization, artificial intelligence (AI), and infrastructure projects, according to Deng Chao, CEO of HashKey Capital.

Key Drivers of Crypto VC Investment in 2025

Political and Regulatory Tailwinds

- The re-election of Donald Trump and expectations of friendlier U.S. crypto regulations are providing a supportive macroeconomic environment for investment.

- Stimulative U.S. policies are seen as a catalyst for attracting more VC capital into crypto.

“As we enter into a supportive macro environment… these macro tailwinds are set to drive more VC investments heading into 2025,” said Chao.

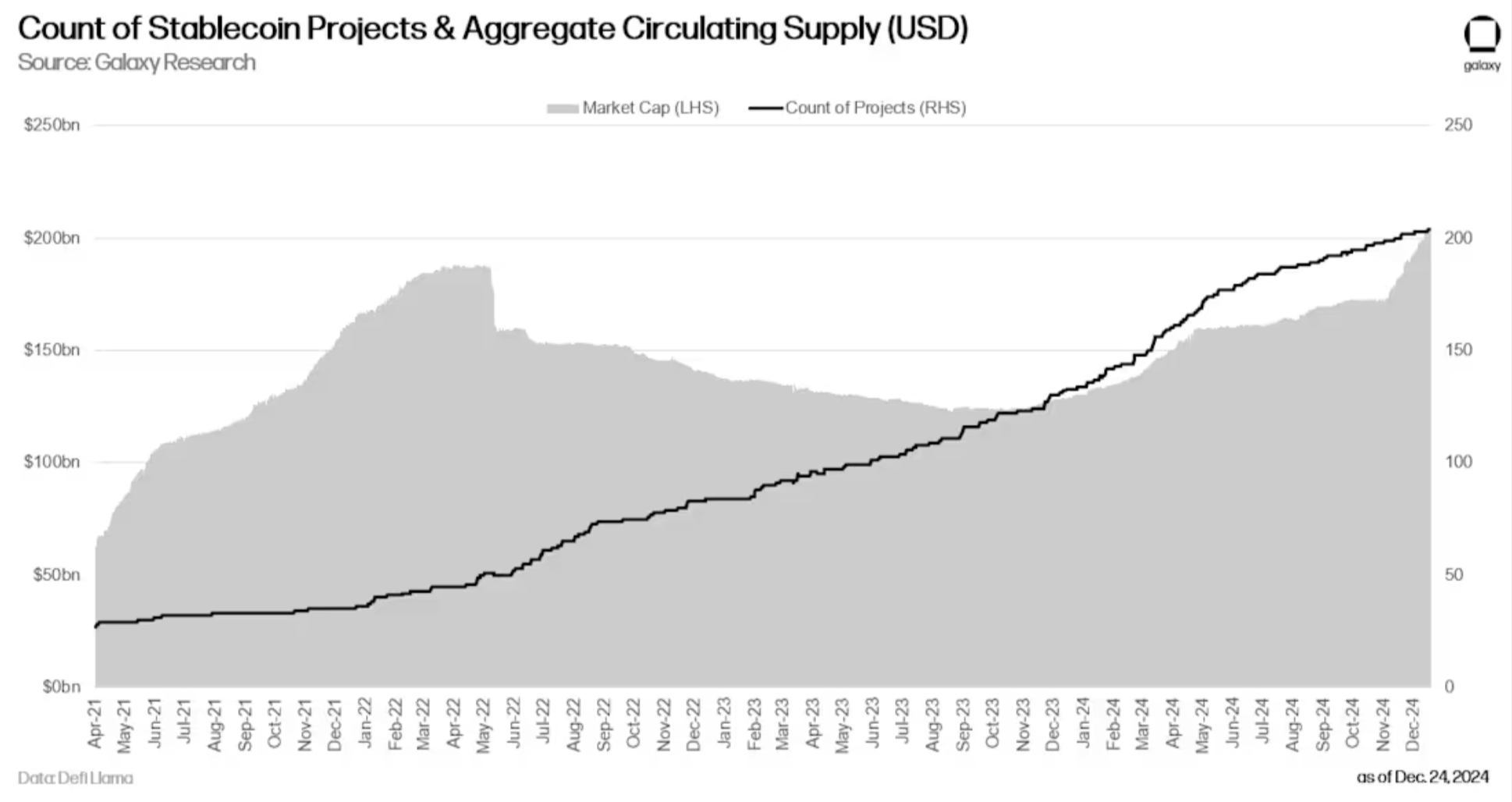

Stablecoins as Proven Use Cases

Stablecoins have emerged as the strongest proven crypto use case in 2024, especially in emerging markets:

- Adoption in Developing Economies: Dollar-pegged stablecoins serve as a store of value for individuals in countries with depreciating currencies or strict capital controls.

- Banking the Unbanked: With 1.4 billion people lacking banking services (per World Bank estimates), stablecoins offer a solution via crypto wallets and smartphones, bypassing traditional banking infrastructure.

Real-World Asset (RWA) Tokenization

The tokenization of real-world assets is another area drawing strong VC interest:

- Sector Potential: The RWA tokenization sector, encompassing tokenized securities, bonds, collectibles, and stablecoins, is projected to reach $30 trillion by 2030.

- Efficiency Gains: Blockchain-based RWA tokenization offers cheaper transaction fees, faster settlement times, and greater accessibility.

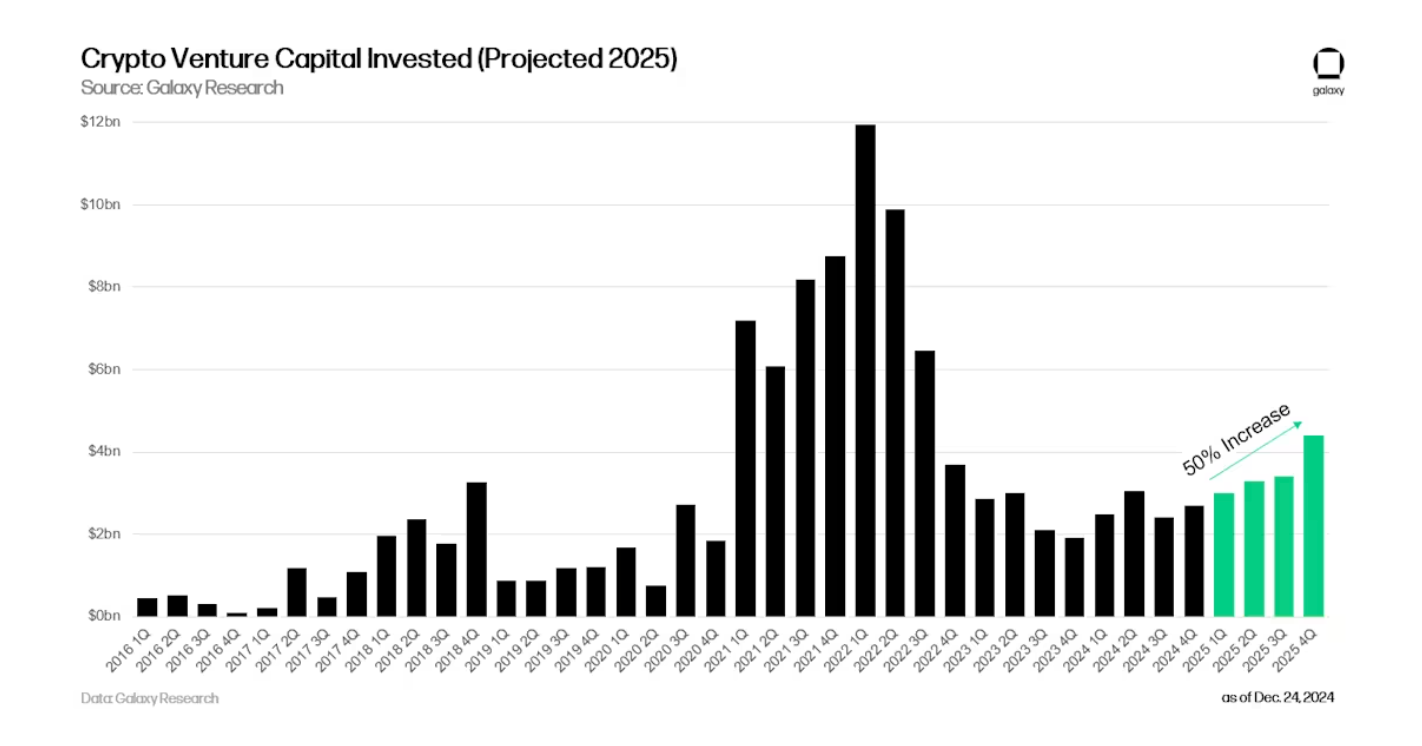

Projected VC Growth in 2025

Investment Trends

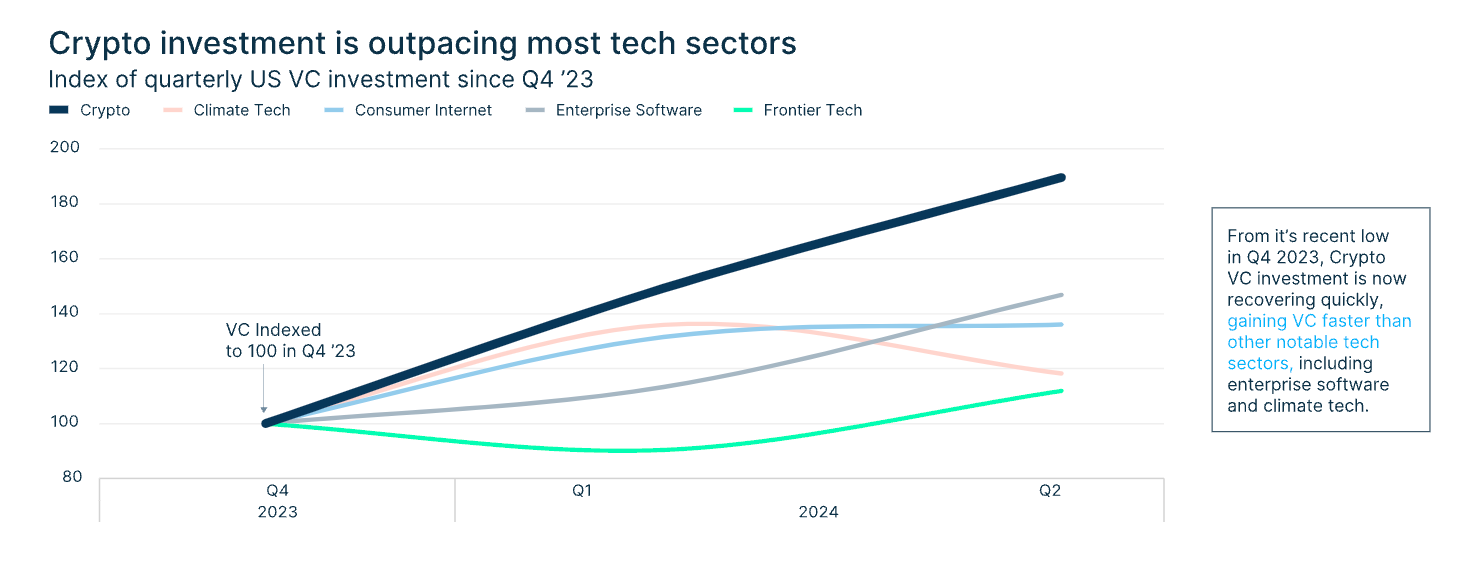

- 2024 Recap: Crypto companies raised approximately $13.6 billion in 2024, up from $10.1 billion in 2023.

- 2025 Outlook: VC investments are expected to grow 50% year-over-year, reaching $18 billion, according to PitchBook and Galaxy Digital.

Challenges

While VC funding is set to increase, it will likely fall short of the 2021-2022 peak, which saw record-breaking investment during the bull market.

The Role of Emerging Technologies

Artificial Intelligence

AI is becoming a focal point for VCs seeking to capitalize on its potential to enhance blockchain scalability, efficiency, and user experience.

Infrastructure Investments

Investors are also prioritizing foundational blockchain projects that enable secure, scalable, and user-friendly platforms.

A Promising Year Ahead

The stablecoin boom, growing demand for RWA tokenization, and advancements in blockchain infrastructure and AI position crypto as a key area for VC investment in 2025. While the market may not return to the peaks of the 2021 bull run, the trajectory indicates significant growth and maturation of the industry.

With political support, emerging use cases, and expanding markets, 2025 is shaping up to be a pivotal year for crypto VC investment.

Share This