Mantra CEO Addresses OM Token Collapse: Buybacks and Ecosystem Support in Focus

Mantra CEO John Mullin has reassured the crypto community that OM token recovery is his “primary concern,” following a sharp decline in the token’s value. Speaking during an Ask Me Anything (AMA) session hosted by Cointelegraph on April 14, Mullin outlined ongoing efforts to restore the token’s value and support the Mantra ecosystem.

OM Token Decline and Immediate Recovery Focus

At the time of writing, the OM token was trading at $0.73, slightly up from its low of $0.52 recorded on April 13. Mullin highlighted that Mantra’s team and partners are actively exploring potential buybacks and token burns to help stabilize and recover the token’s price. However, he made it clear that these plans are still in their early stages.

“We’re still in the early stages of putting together this plan for potential buyback of tokens,” Mullin stated, emphasizing that OM token recovery is the company’s “preeminent and primary concern right now.”

Denial of Insider Allegations: Setting the Record Straight

In the wake of the token’s collapse, Mullin firmly denied accusations that Mantra investors had engaged in insider dumping of the OM token prior to the crash. Addressing rumors that the Mantra team controls 90% of the token’s supply, Mullin described such claims as “baseless” and pointed to the recent community transparency report that details the token’s distribution.

“We posted a community transparency report last week, and it shows all the different wallets,” Mullin said, noting that the tokenomics are split between the Ethereum side and the mainnet side.

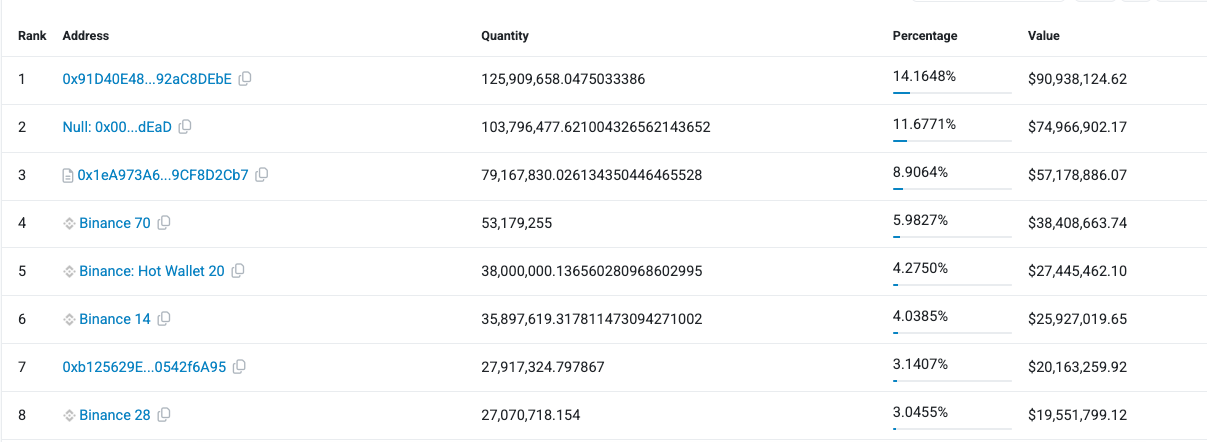

Mullin also pointed out that Binance is the largest holder of OM tokens on exchanges, with OKX currently holding the top wallet, controlling 14% of the circulating supply (approximately 130 million OM tokens).

Mantra Ecosystem Fund (MEF): A Key Part of the Recovery

Alongside the token recovery efforts, Mullin discussed the launch of the Mantra Ecosystem Fund (MEF), a $109-million fund created in collaboration with strategic investors like Laser Digital and Shorooq. Mullin reassured the community that the MEF fund is not solely comprised of OM tokens, but also includes dollar commitments and contributions aimed at supporting the broader Mantra ecosystem.

“We’ll continue to invest and support the ecosystem as part of this recovery plan,” Mullin emphasized, indicating that the fund is designed to provide long-term support for the ecosystem’s recovery.

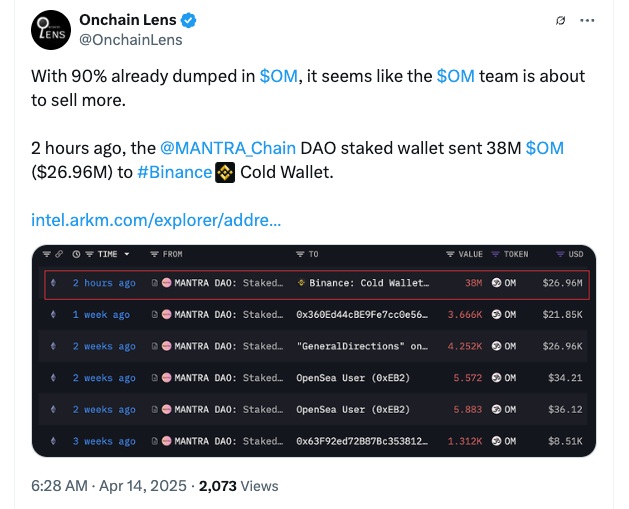

Clarifying the Binance OM Token Transactions

In response to the community’s concerns over certain transactions, Mullin explained that a 38-million OM token transfer to a Binance cold wallet on April 14 was tied to the Binance staking program. He clarified that these tokens were simply returned to Mantra after the staking program ended.

“It was actually Binance,” Mullin said, adding that Binance had been using OM tokens on its exchange as part of a staking program and returned them once the program concluded.

A Cascade of Sell Pressure: Understanding the Post-Crash Sell-Off

Mullin also shed light on the sell-off that followed the token’s collapse, revealing that many of the transactions that triggered community reactions were related to collateral positions on unnamed exchanges. These exchanges, having taken over the collateral, began liquidating positions, causing a cascade of sell pressure.

“So, what happened was basically the positions were taken over by the exchange that took the collateral and started selling, which caused a cascade of sell pressure and forced more liquidations,” Mullin explained.

He reiterated that Mantra is committed to addressing the situation transparently and working towards restoring the community’s trust.

“We’re not running from anything,” Mullin said, calling the situation “very unfortunate.”

What’s Next for Mantra’s Recovery Plans?

Despite the challenges, Mantra remains focused on the recovery of the OM token and the broader ecosystem. As the company explores buybacks, token burns, and strategic investments through the MEF fund, the roadmap for OM token revival will likely unfold in the coming months.

Share This