US Investors Are Returning to Bitcoin: Two Key Indicators Confirm Shift

After a turbulent end to 2024 for Bitcoin, on-chain data now signals a resurgence in interest from US investors, with two critical metrics—the ETF inflow surge and the Coinbase Premium Index recovery—highlighting their renewed enthusiasm.

ETFs Demand Makes a Comeback

The last FOMC meeting of 2024 created uncertainty as Federal Reserve Chair Jerome Powell signaled that interest rate cuts might not occur in 2025 due to rising inflation. This caution prompted US investors to pull funds from riskier assets like Bitcoin (BTC), resulting in a staggering $1.5 billion withdrawn from US-based Bitcoin exchange-traded funds (ETFs) over four trading days.

Notably, even BlackRock’s IBIT, the world’s largest Bitcoin ETF, saw record-breaking outflows during this period. However, the trend shifted dramatically on Friday, January 3, with total ETF net inflows soaring to $908.1 million, marking the best day since November 21, according to FarSide data.

Top performers included:

- Fidelity’s FBTC: Leading with $357 million in net inflows.

- BlackRock’s IBIT: Securing $253.1 million.

- Ark Invest’s ARKB: Attracting $222.6 million.

This surge in demand underscores a shift in investor sentiment, signaling confidence in Bitcoin’s long-term potential despite macroeconomic headwinds.

Coinbase Premium Index Signals Institutional Confidence

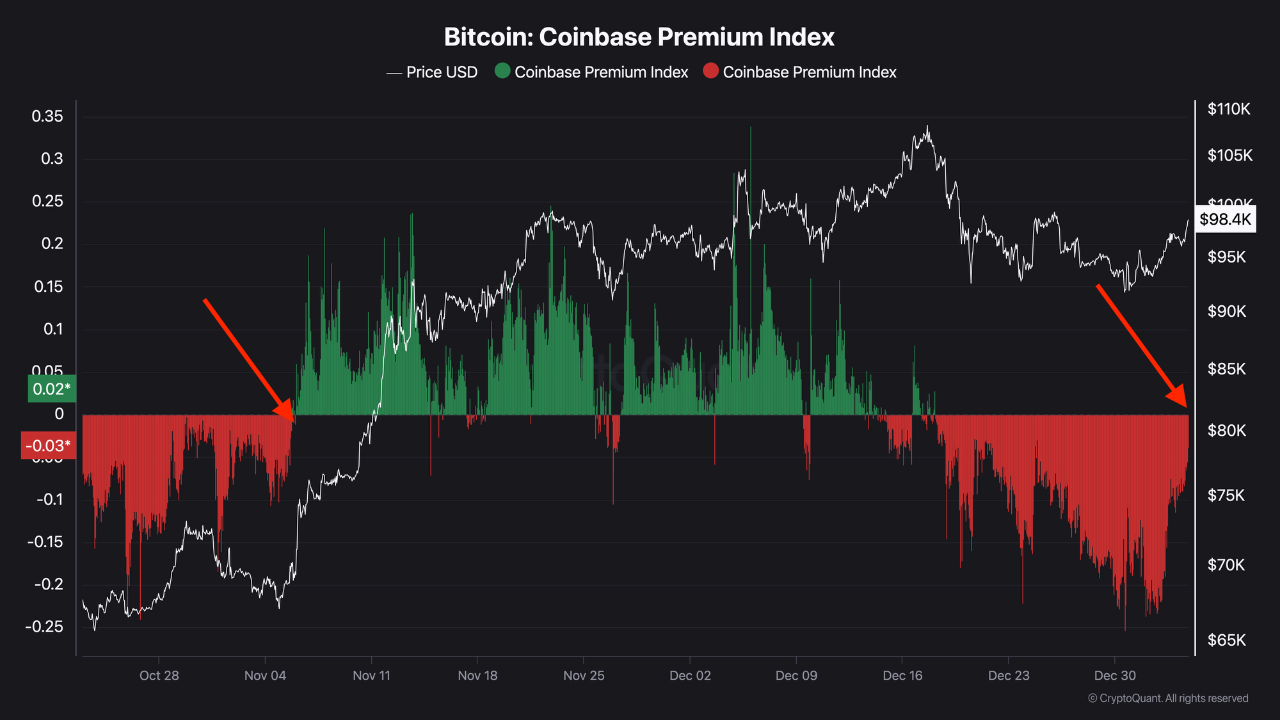

Another crucial metric, the Coinbase Premium Index, measures the price difference of Bitcoin on Coinbase (US-focused) versus Binance (international-focused). A positive index indicates heavy accumulation by US-based investors.

Following the December FOMC meeting, the index plunged to yearly lows, reflecting widespread ETF outflows and waning confidence. However, CryptoQuant data now shows that the index has recovered to neutral territory, indicating that “sentiment by US and institutional investors is back.”

This recovery aligns with the ETF inflow rebound and highlights a renewed interest in Bitcoin accumulation by institutional and retail investors alike.

What’s Next for Bitcoin in 2025?

As US investors return to Bitcoin, these two indicators—ETF demand and Coinbase Premium Index trends—suggest a potential for positive momentum in 2025. With institutional interest revitalized and regulatory uncertainties less pronounced, Bitcoin appears poised to reclaim its position as a favored asset.

This article is for informational purposes only and does not constitute financial advice.

Share This