Bitcoin’s Bull Signal Returns: Key Macro Index Points to $100K Breakout

Macro Chain Index Flashes First ‘Buy’ Since 2022 Bottom, Signaling New Bitcoin Surge

A critical macroeconomic indicator that predicted Bitcoin’s 2022 bottom has just flashed its first ‘buy signal’ in nearly three years, setting the stage for what could be a major rally past $100,000.

The signal, issued by the Macro Chain Index (MCI), comes amid rising trader optimism, growing open interest in futures markets, and sustained positive funding rates—all of which are building a strong case for Bitcoin’s next big move.

RSI Crossover Historically Signals Explosive Rallies

The MCI combines on-chain data and macroeconomic indicators to assess long-term value trends in Bitcoin. In April 2025, its RSI (Relative Strength Index) crossed above the 52-week moving average—a bullish move seen in 2015, 2019, and 2022, each time preceding 500%+ price surges.

“Our Macro Chain Index fired a long signal—the first since 2022,” said Alpha Extract, creator of the MCI. “The fundamentals align, and the market structure is following. This is a significant call.”

If history repeats, this RSI crossover could mark the beginning of a new bull run, with Bitcoin already rebounding from a local low of $74,450 to around $95,650—a nearly 29% climb in just a few weeks.

Bitcoin Price Rebound Strengthens Amid Futures Momentum

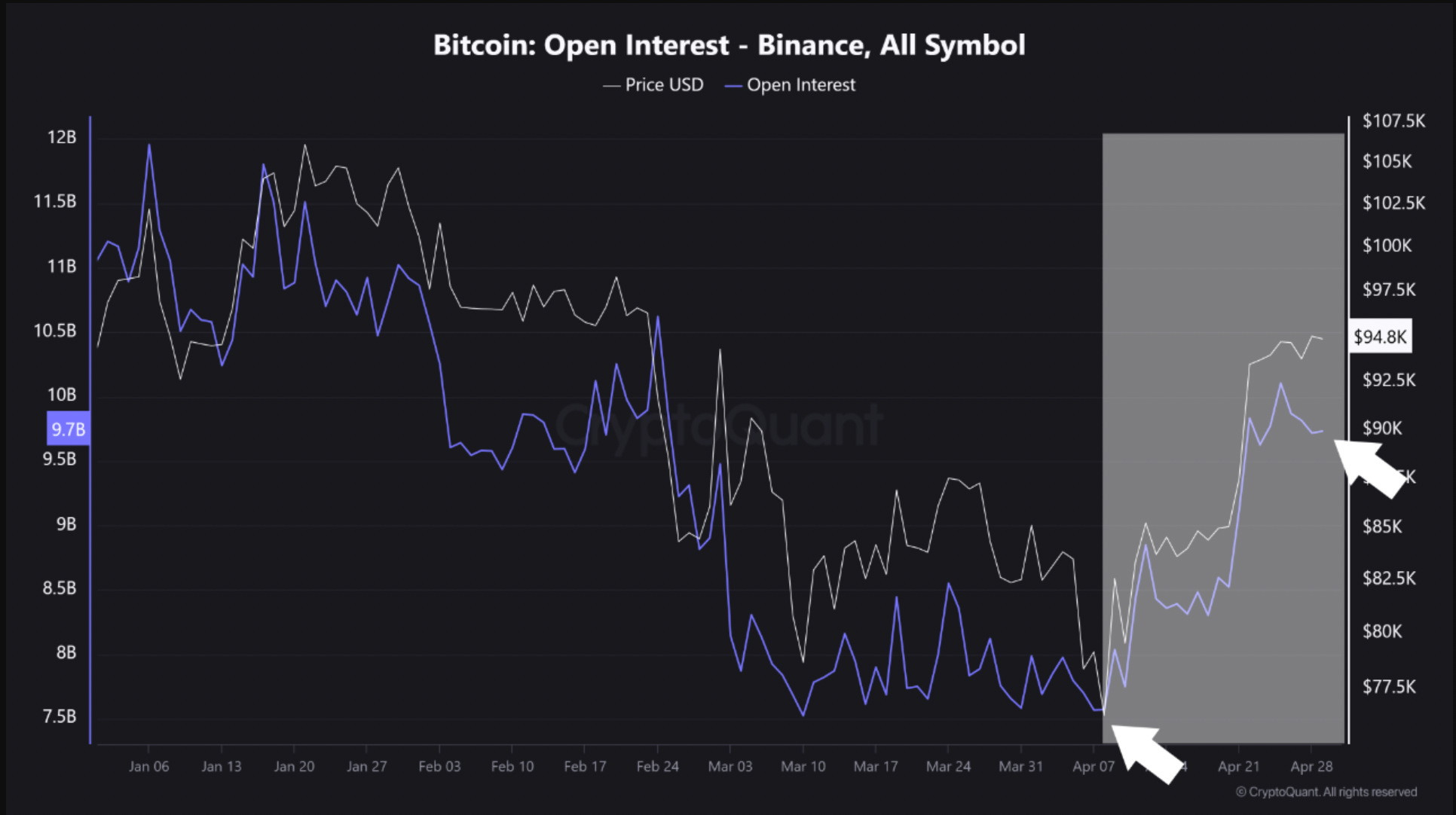

The renewed optimism isn’t limited to charts. Open interest in Bitcoin futures on Binance rose by $2.2 billion in April alone, recovering from a 36.9% drop earlier this year during a market-wide pullback sparked by global trade tensions under U.S. President Donald Trump.

-

Open interest rose 29.3%, from $7.5 billion to $9.7 billion in just three weeks.

-

Funding rates remain positive, a clear indicator that long-position traders are leading the market.

This alignment of rising price, increased leverage, and confident long positions suggests traders are positioning for continued gains—possibly breaking through the critical $100,000 psychological barrier in the near term.

“Bitcoin appears to be decoupling from the bearish stock market,” analysts noted, underscoring the asset’s growing independence as a macro hedge.

The Road to $100K?

As of late April 2025, Bitcoin is showing strong resilience and upward momentum despite earlier volatility. With on-chain metrics flashing green, a macro buy signal confirmed, and market participants showing renewed confidence, the stage may be set for Bitcoin’s historic run toward six figures.